There was once a time where investing money was something only the wealthy could do. With brokerage fees, large start-up costs, and high risk, it would almost impossible for the common person to invest their spare cash. And with the fall in savings account interest rates to virtually zero a few years ago, options became even more limited for those of us hoping to grow our wealth. Today, it’s easier than ever to get started in the stock market. There’s a wide variety of investment apps designed to help your average Joe and Jane invest their extra cash. Depending on how involved you want to get, you can leave all the hard work up to an automated investment service, or get your hands dirty and try and make the really big bucks.

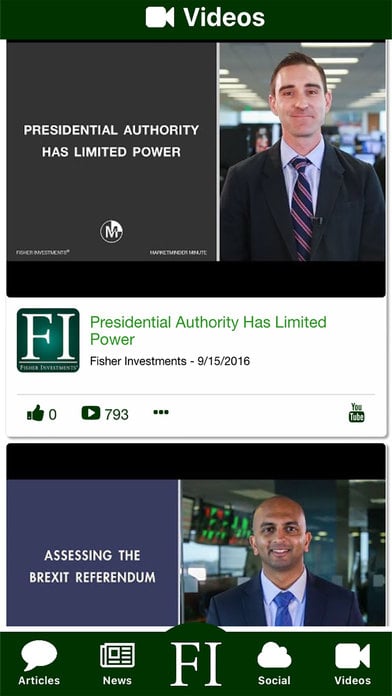

Fisher Investments – Free

If you’re the more hands-on type, Fisher Investments is a great app you can use to augment your market knowledge. Designed to support personal investors, the Fisher Investments app aggregates relevant data from around the web and presents it to you in a easy-to-read package.

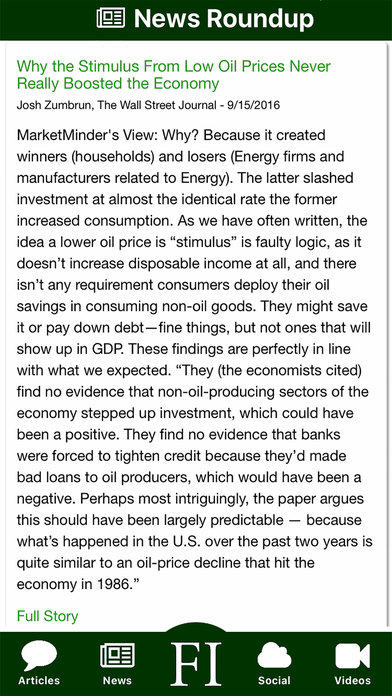

The core of the app is the news section. This section of the app contains posts from venerable sources like the Financial Times and the Wall Street Journal, as well as CNNMoney, Investor’s Business Daily, MarketWatch, and many others. You can view short summaries of each piece within the app, or navigate to the original web page to get the full scoop.

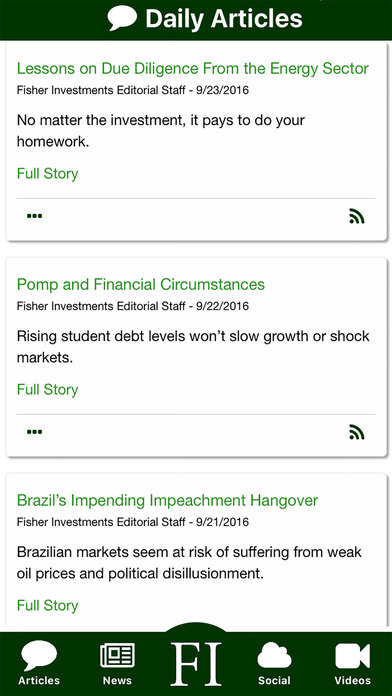

Fisher Investment also makes their own articles available through the app. These posts focus on analyzing market trends and original researching, helping investors make the right decisions. You can also find a section for Fisher’s social media feeds, and a playlist of regularly-updated in-house videos focusing on the affects of world events on the marketplace.

You can also find a section for Fisher’s social media feeds, and a playlist of regularly-updated in-house videos focusing on the affects of world events on the marketplace.

The app is an excellent way to stay on top of market trends, and it should be a solid addition to a solo investors tool belt. You can download the Fisher Investments app on iTunes.

Acorns – Free

If you’re more of a hands-off type of investor, Acorns might be appealing to you. This app actually handles investing money on your behalf, so you don’t have to get too involved.

Even with that help, it’s hard to save money. That’s why Acorn includes a feature called Round-ups. The app will automatically “round up” any purchase that you make with that card to the nearest dollar, and then transfer the different between the purchase and the dollar amount to your Acorn account. For example, if you spend $1.84 on a cup of coffee, an additional $0.16 will be deposited into your Acorn account. You just need to link your debit or credit card to the app, and you’re off to the races. Of course, you can also set up a recurring monthly contribution with the same account.

You can set a variety of investment profiles, ranging from highly conservative to highly risky, to match your risk tolerance and long-term goals. The app will give you estimated returns based on your monthly contributions, and will help you target a specific financial goal for your future. It’s a modern-day alternative to the change jar, but much more powerful.

If you’re particular interested in the details, you can also dig down into exactly what investment instruments Acorn is holding on your behalf.

Of course, nothing is completely free. Acorns charges a $1/month fee to invest on your behalf. You can download Acorns from the iTunes store.

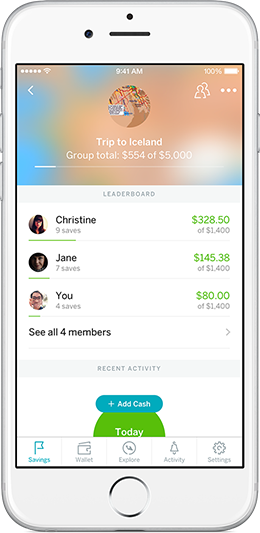

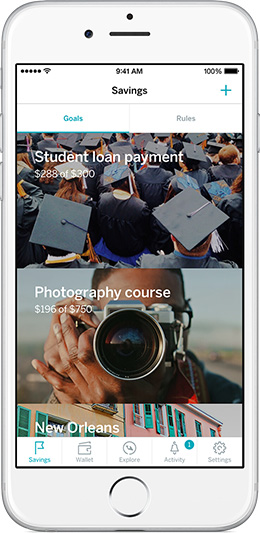

Qapital – Free

Despite the odd (but recognizable!) name, Qapital is another useful financial app. While it does help you invest your money, it’s goal is more about saving than it is about growing wealth. It includes the same sort of round up feature as Acorns, and allows for automated deposits as well.

While the app doesn’t include any investment-specific features, it’s really about saving for specific goals by making saving money automatic. It’s especially useful for activities that more than one person is saving for, like a road trip or a big move. If you set up a shared account with another Qapital user, you can both make deposits into the account simultaneously. This common pot can then be split up or deposited into a single account once you’ve finally reached your goal.

You can also set up a wide variety of other automated withdrawals, called “rules” in Qapital parlance. A favorite is the 52-week rule, which withdraws a steadily-increasing sum of money from your account each week over the course of a full year. Third-party integration with IFTTT allows you to trigger a deposit with an external event, and the built-in Apple Health integration means you can save a few dollars when you hit your step goal for the day.

You can set up a ton of goals at once too. Since you’re probably trying to marshal your money for more than one purpose, this is a welcome feature that not many other finance apps offer. You can download Qapital from the iTunes store.

You might also like:

10 Best Apple Apps To Make Money