Apple stock closed at an all-time high of $133.29 on Monday, but looks can be deceiving.

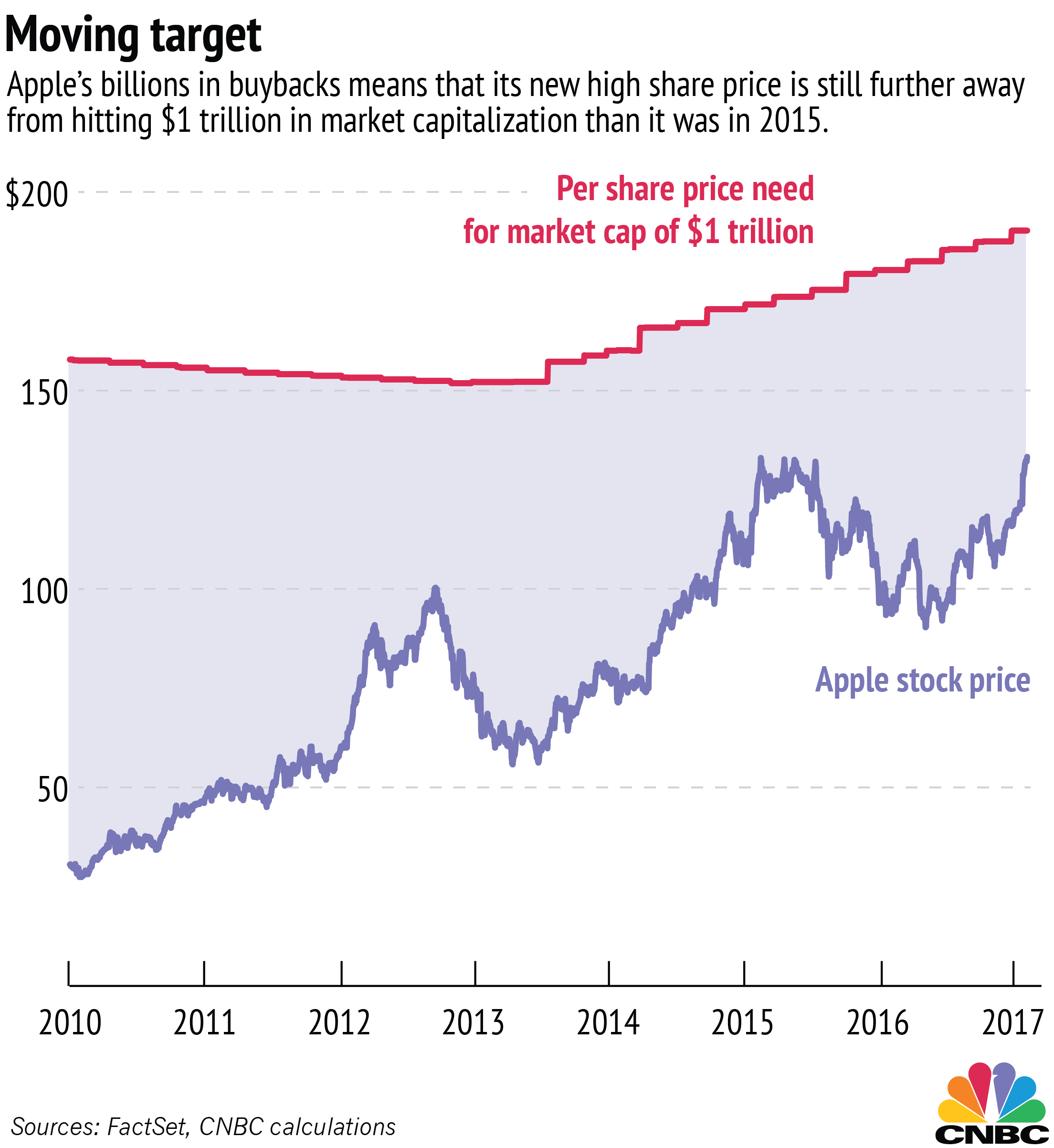

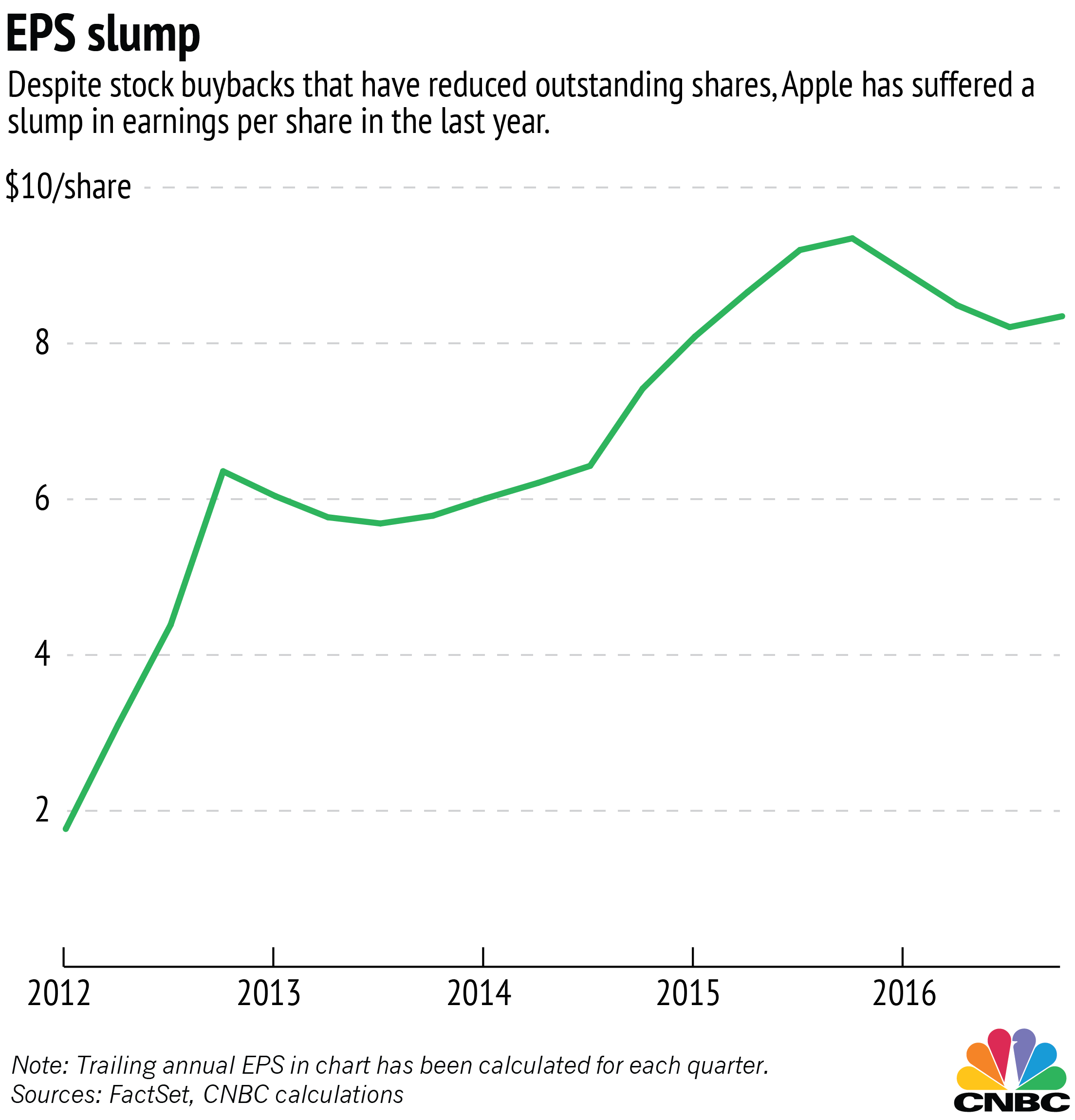

The company's market cap broke $700 billion, but it is still about $70 billion short of where it was the last time Apple's individual share price approached $133 two years ago. And despite the tech giant's high stock price, the actual performance of the company is worse than it was in 2015, with 16 percent lower net income and earnings per share down 9 percent.

In terms of reaching the elusive trillion-dollar market cap, the company is further away now than it was at other points in the last few years.