Samsung-Apple smartphone battle heats up, as Huawei narrows in

Apple topped the global smartphone market in the fourth quarter of 2016, which saw the "closest ever" gap between the iPhone maker and its Korean competitor, Samsung.

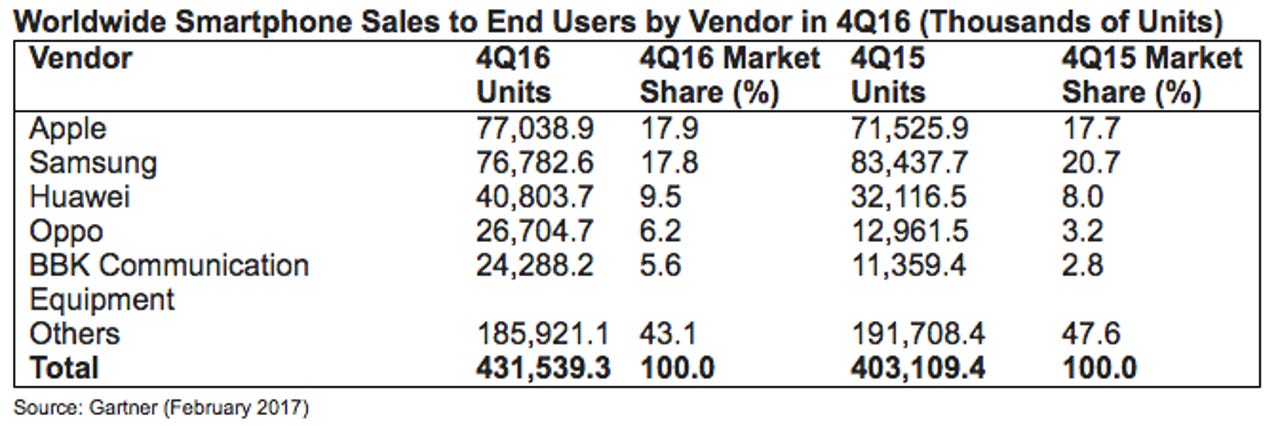

Some 432 million smartphone units were sold worldwide in the quarter, up 7 percent year-on-year, according to the latest market figures from Gartner. This pushed total sales in 2016 to almost 1.5 billion units, up 5 percent from the previous year.

Does the iPhone still matter?

Samsung saw its sales drop 8 percent for the fourth quarter, clocking a second consecutive quarterly dip and pushing its share down by 2.9 percent year-on-year, said Gartner's research director Anshul Gupta.

He noted that the Korean smartphone maker's move to discontinue sales of the Galaxy Note 7 left a gap in its large-screen phone range, dragging down overall sales of its smartphone portfolio.

Samsung also faced increasing competition in the mid-tier and entry-level smartphone segments from Huawei, Oppo, BBK, and Gionee--all of which saw increased sales every quarter last year, Gupta added.

With Samsung's stance weakened, Apple was able to climb ahead to assume pole position in the fourth quarter. This marked the first time in eight quarters that the iPhone maker had led the global market, the Gartner analyst said, but it held a narrow lead of just 256,000 units ahead of Samsung.

Gupta said: "The last time Apple was in the leading position was in the fourth quarter of 2014, when its sales were driven by its first ever large-screen iPhone 6 and 6 Plus. This time it achieved it thanks to strong sales of its flagship phones, the iPhone 7 and iPhone 7 Plus.

"It also benefitted from the weakened demand for Samsung's smartphones in mature markets such as North America and Western Europe, and in some mature markets in Asia such as Australia and South Korea," he said.

Despite of its Note 7 woes and Apple's quarter surge, Samsung still led the global smartphone market in 2016 with a 20.5 percent market share, ahead of Apple's 14.4 percent. Both vendors saw their market shares drop for the year compared to 2015, where Samsung led with 22.5 percent while Apple had 15.9 percent.

Samsung pushed 306.45 million units in 2016, while Apple sold 216.06 million units.

The year proved stellar for China's smartphone vendors, which saw their share climb 7 percent for the fourth quarter--with Huawei, Oppo, and BBK accounting for 21.3 percent of global sales. This was a 7.3 percent climb from the previous year.

Gupta pointed to the "good timing" of Huawei's Mate 9, which was unveiled during the quarter and within a month of Samsung's decision to discontinue the Note 7, propping the smartphone as an alternative. It helped narrow the gap between the Chinese vendor and Samsung to a difference of 36 million units, compared to more than 50 million units in the fourth quarter of 2015.

Huawei shipped 132.82 million units in 2016. He added that Mate 9 with Alexa, expected to ship in the US market in the first quarter of 2017, would help Huawei further reduce the gap with Samsung.

Latest news on Asia

Another Chinese smartphone maker, Oppo, was able to maintain its leading position in its domestic market with its portfolio of "high-performance, front-facing camera, and fast-charging smartphones", Gartner said.

"BBK's focus on quality, design, and strong branding initiatives has positioned it as a strong mobile phone brand in China and India," the research firm said. "BBK continued its hold on the No. 2 position in China and was marginally ahead of Huawei during the fourth quarter of 2016."

It added that BBK saw strong growth in India, where its sales climbed 278 percent in quarter and more than 363 percent in 2016. This helped push its global market position to fifth.

Gartner said major Chinese brands such as Huawei, ZTE, Xiaomi, and Lenovo were expanding into markets outside China, where they would "continue to disrupt the top smartphone players in 2017".

Gupta added: "Samsung needs to successfully launch the next Galaxy flagship phone in order to continue the momentum Galaxy S7 generated, and win back lost customers by launching a new large screen and stylus-equipped smartphone."

For the year, Google's Android grew its lead to account for 82 percent of the total OS market in fourth-quarter 2016. For the year, its market share climbed 3.2 percent to hit 84.8 percent, making it the only mobile platform to see yearly growth.

Gupta said Google's Pixel smartphone and the re-entry of Nokia--via HMD--would drive further competition in the premium and mid-tier market segments, respectively.