E-Trade cuts trading fees in escalating price war

Add E-Trade to the brokerage firms that are slashing commissions for online stock trades as part of an escalating price war that broke out this week.

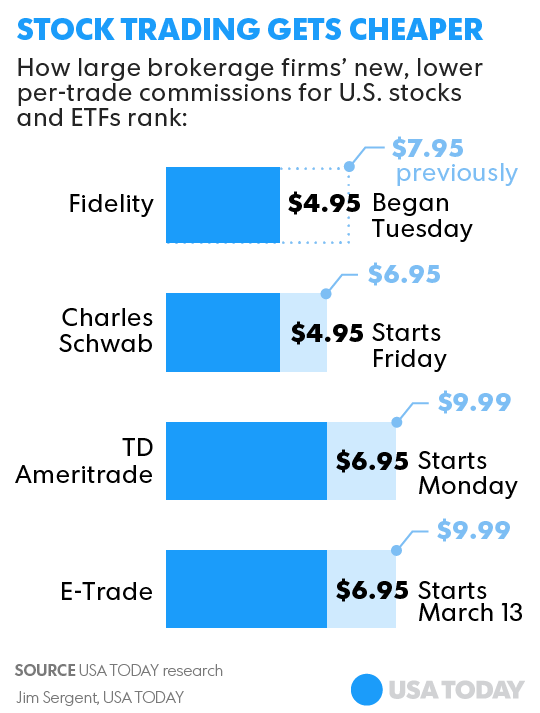

The list of firms competing fiercely for clients and assets includes Fidelity Investments, which kicked off the fight early Tuesday when it cut its commission for stock and ETF trades to $4.95 from $7.95. Charles Schwab countered hours later by matching Fidelity’s lower price, less than four weeks after Schwab had cut its commission to $6.95. In response, TD Ameritrade on Tuesday said it would cut its commission to $6.95 from $9.99. ETFs, or exchange traded funds, are funds that trade like stocks and have surged in popularity in recent years because of low fees and broad diversification.

Fidelity and Schwab cut costs as price war in online stock trading heats up

E-Trade, apparently bowing to pressure from rivals, said on Thursday that it would reduce its trade commissions to $6.95 from $9.99. It also said commission costs for active traders (or those who place 30 or more trades a quarter, down from 150 trades, previously) would be $4.95.

The latest batch of commission haircuts comes amid an industry-wide push to stay competitive by lowering transaction costs and fees, said Arielle O’Shea, investing and retirement specialist at NerdWallet.com, a site that tracks and ranks online brokers.

In the digital age, the online stock trading business — and broader asset management industry — is increasingly cutthroat. Price is now used by financial trading firms as an incentive to keep existing clients and attract new ones, industry analysts have said.

Commissions now imposed by larger players in the industry, such as Fidelity, Schwab and E-Trade, are similar to those of low-cost online brokers, such as TradeKing, which charges $4.95 per trade. Traders also have the option to trade without paying a commission by using the upstart online broker Robinhood.

Low trading costs aren’t the only thing investors should consider when selecting an online broker, said NerdWallet’s O’Shea.

Besides price, an investor also should look at a brokerage firm's trading platform, trade execution, as well as its stock research and investor education offerings, she said. Compare other costs, such as account set-up fees and minimum trade restrictions, as well.

“Commission costs,” O'Shea said, “don’t matter as much if you only trade a few times a year. The more you trade the more you are going to save.”