Oracle beats Q3 earnings expectations

Oracle reported its financial results for the third quarter of 2017 on Wednesday, with earnings that beat market expectations.

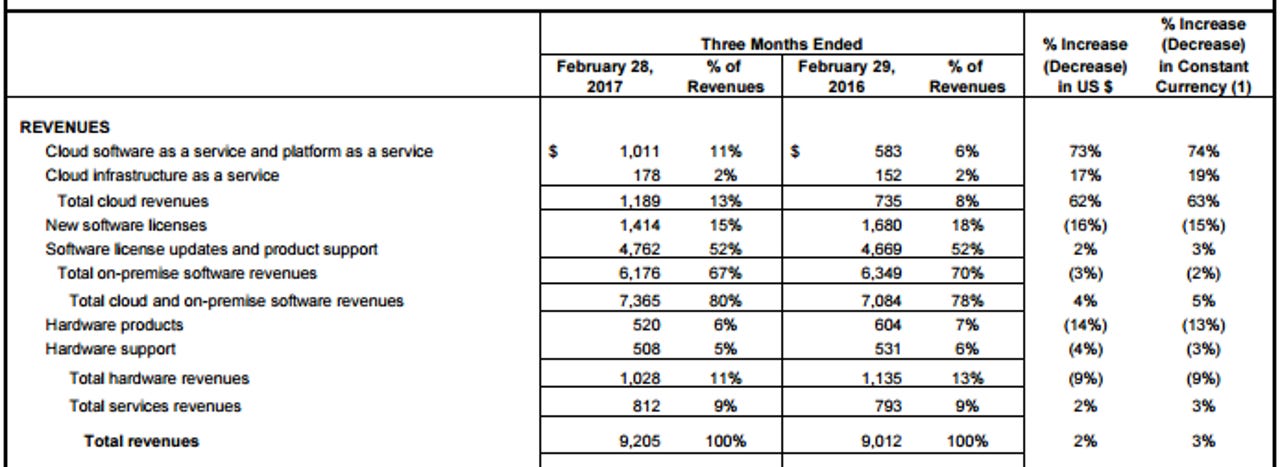

Oracle's non-GAAP earnings came to 69 cents a share on revenue of $9.2 billion. A year earlier, the company reported 64 cents a share on revenue of $9.01 billion.

Wall Street was looking for 62 cents a share on revenue of $9.26 billion.

The Software-as-a-service (SaaS) and Platform-as-a-service (PaaS) business hit $1 billion, up 74 percent in constant currency. Including Infrastructure-as-a-Service (IaaS), total cloud revenues came to $1.2 billion, up 63 percent in constant currency. On an annualized non-GAAP basis, Oracle's total cloud business has reached the $5 billion mark, Oracle CEO Safra Catz said in a statement.

"Our new, large, fast growing, high-margin cloud businesses are driving Oracle's total revenue and earnings up and improving nearly every important non-GAAP business metric you care to inspect," Catz said in a statement.

Revenue from new software licenses hit $1.4 billion, shrinking 15 percent in constant currency. Total on-premise software revenues totaled $6.1 billion, down 2 percent in constant currency.

"Our pivot to the cloud is now clearly in full swing," Catz said on a conference call Wednesday. "Next year, we expect cloud revenue will be larger than new software license revenue."

This marked the first full quarter to include NetSuite's sales and earnings, following Oracle's $9.3 billion acquisition of the cloud ERP company. As Oracle builds up its cloud business, it continues to compare itself to CRM giant Salesforce:

"Over the last year, we sold more new SaaS and PaaS than Salesforce.com, and we're growing more than 3 times faster," Oracle CEO Mark Hurd said in a statement. "If these trends continue, where we are selling more SaaS and PaaS in absolute dollars AND growing dramatically faster, it's just a matter of when we catch and pass Salesforce.com in total cloud revenue."