IBM's five years of falling revenues have left it smaller than Apple, Microsoft and Google

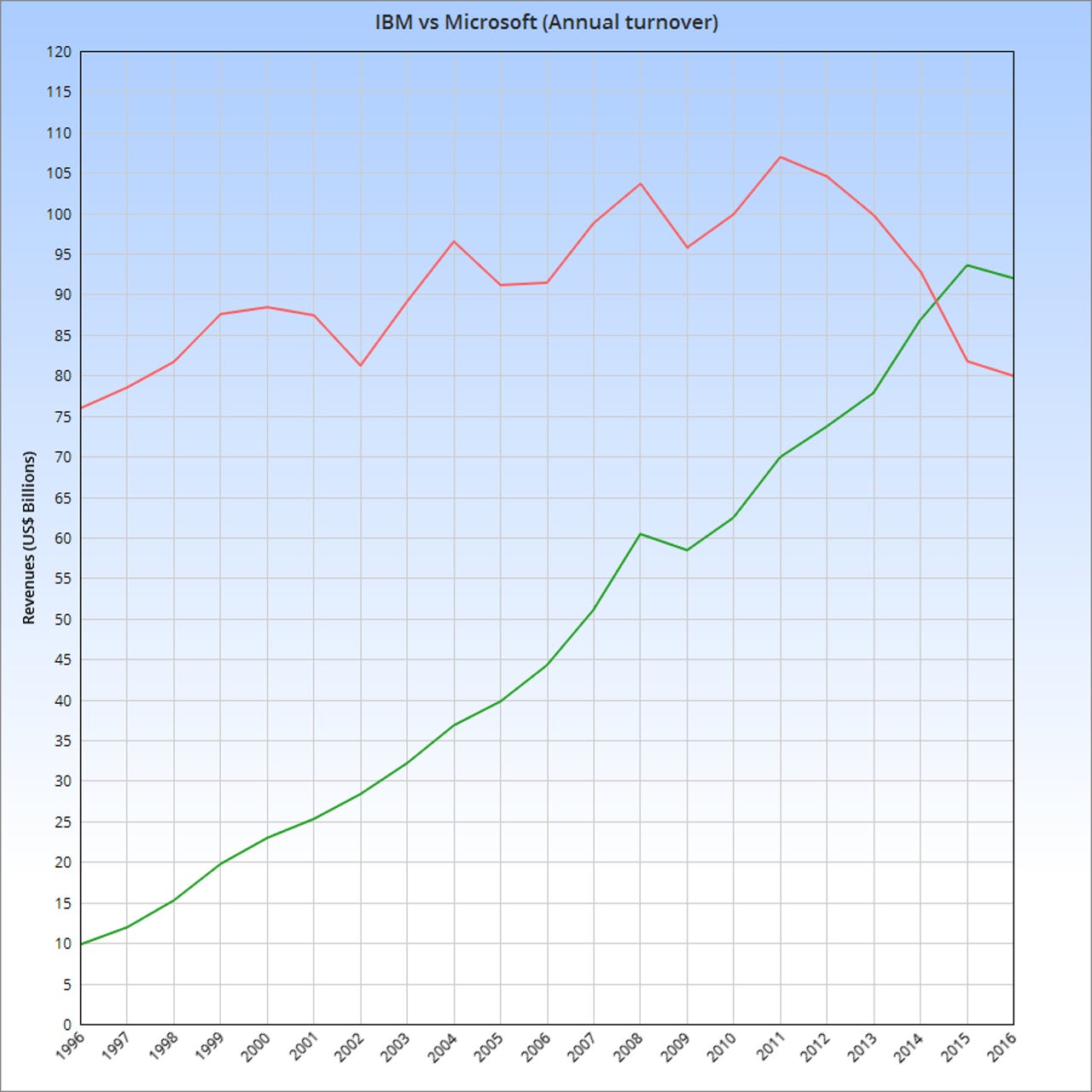

Only 20 years ago, IBM dwarfed Microsoft. However, after its revenues peaked in 2011, IBM has suffered 5 years of decline....

IBM has now recorded 20 consecutive quarters of declining year-on-year revenues, taking it back to a level it hasn't touched for almost 20 years. In its heyday, IBM was roughly twice as big as every other computer company added together. Since then, it has been overtaken by Apple, HP, Microsoft and now Google.

How are the mighty fallen. IBM had annual revenues of $81.67 billion in 1998, when Google first set up shop in Susan Wojcicki's garage. On the latest numbers for fiscal 2016, Google's annual revenues have climbed from zero to $90.27bn while IBM's have declined to $79.92bn. If IBM had matched Google/Alphabet's average growth rate since 2011, its revenues would now be $255bn.

As veteran IBM-watchers will recall, 2011 was "peak IBM", when the company's annual revenues hit $106.9bn. At the time, IBM had just been overtaken by Apple ($108.3bn), but it was still much bigger than Microsoft ($69.9bn) and Google ($37.9bn). Today, it's a very long way behind Apple ($215.6bn), and it looks likely to fall further behind Microsoft ($92.0bn) and Google ($90.3bn).

If you look at compound annual growth rates since 2011, Google's growth rate averages 19 per cent, Apple's almost 15 per cent, and Microsoft's 5.6%. By contrast, IBM's five years of declining revenues give it an average growth rate of -5.7 per cent.

Of course, nobody should expect a dinosaur like IBM to grow as fast as a company with a smash-hit consumer product (Apple) or a hot web-based start-up (Google). But it does seem reasonable to expect it to grow as fast as Microsoft.

Since 2011, Microsoft has been competing against free Linux and free OpenOffice - both pushed heavily by IBM - in a declining PC market. Both Microsoft and IBM get most of their income from business and government IT, where spending is under pressure, and both have been playing catch-up in cloud computing. Both have new, inexperienced CEOs, with Virginia "Ginni" Rometty leading IBM since October 2011 and Satya Nadella replacing Steve Ballmer at Microsoft in February 2014. Nobody would be surprised if both Microsoft and IBM were struggling, but Microsoft has grown while IBM has shrunk. (See Once-tiny Microsoft has overtaken the mighty IBM, posted in January 2015.)

In fact, if IBM had grown by a meagre 5.6% a year - the same rate as Microsoft since 2011 - its current turnover would be $140.6bn instead of $79.9bn. In other words, under Rometty, $60bn worth of annual sales have gone missing.

Taking things even further back makes the comparison look even worse. If IBM had increased its revenues at a very reasonable 5 per cent per year from 1996 onwards, its turnover would have grown from $76.0bn to $201.5bn. And if IBM had grown at the same rate as Microsoft - on average, by 12.29 per cent per year since 1996 - its turnover today would be $771.8bn.

There were times in the 1970s and 1980s when IBM was the world's richest and most powerful company, and it looked unstoppable. Idle calculations based on modest growth rates - at least, modest by technology standards - suggested it could be the first company ever to reach $1 trillion in annual revenues.

Nobody thinks that any more. Today, we're wondering just how far IBM can fall, and how many more years will pass before it stops the rot. But that's a topic for another post....

Note: stated amounts and percentages have been rounded from the actual figures used in the calculations.

IBM's latest financial results have revealed its 20th consecutive quarter of year-on-year revenue declines.