While Apple's (AAPL -0.31%) second-quarter earnings release after market close on Tuesday is sure to include some useful insights, investors may glean more nuggets about the company during the tech giant's earnings call shortly after its earnings report is posted.

When Apple CEO Tim Cook joins the call on Tuesday, analysts will likely inquire about the company's longer-term growth potential, investments in new product segments, expectations for its services segment, and more. Here are three questions investors should look for Cook to address during the call.

Image source: Apple.

1. Is growth here to stay?

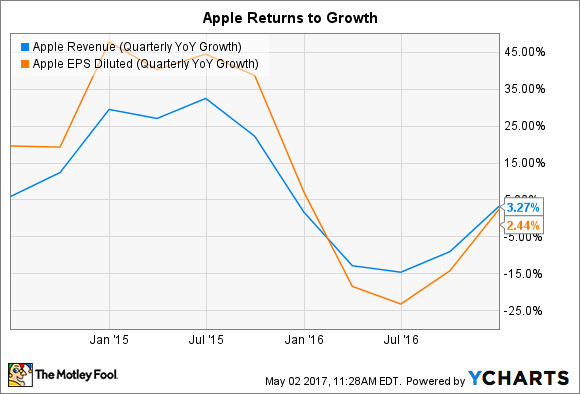

After several quarters in a row of year-over-year declines in revenue and earnings per share (EPS), Apple has recently returned to growth, posting revenue and EPS growth in the low single digits in its first fiscal quarter of 2017.

AAPL Revenue (Quarterly YoY Growth) data by YCharts.

Potentially extending its return to growth, Apple guided for revenue between $51.5 billion and $53.5 billion for its second quarter, up from revenue of $50.6 billion in the year-ago quarter. Given that Apple's guidance range is usually conservative, Apple should continue its recent growth trend in Q2.

But analysts will likely want more insight into whether Cook believes Apple's growth is sustainable, not just for the next quarter but for years to come.

2. Are new product segments on the horizon?

Since Apple's iPhone is no longer delivering consistent double-digit year-over-year growth for Apple, investors in the tech company are looking for a new product to become a meaningful driver in the coming years. With iPad sales declining in recent quarters and Apple Watch still bringing in only a fraction of the tech giant's revenue several years after its introduction, investors may be hoping the company has an entirely new product segment in the works.

If there's any solid indication that Apple is aggressively exploring potential products in new segments, investors can look beyond flaky rumors to the company's soaring research and development expenses. Apple's research and development spending is up 90% in the past three years -- a period in which Apple's revenue has increased only 22%.

AAPL Research and Development Expense (TTM) data by YCharts.

While Cook probably won't share any specific details on future product plans during the call, investors could look for subtle hints about product categories the company could be considering.

3. Can Apple keep up its momentum with services?

Apple's services segment, which accounted for about 9% of Apple's first-quarter revenue, has been a consistently strong growth driver for Apple recently. This trend continued in Apple's first quarter of 2017, with services revenue up 18% year over year, outpacing 5% and 7% revenue growth in the iPhone and Mac segments, respectively.

But how long can growth in this segment remain this robust? Driven primarily by strong growth in App Store sales, Apple will need newer services like Apple Pay and Apple Music to begin contributing more to services revenue when App Store sales growth begins to slow down. Furthermore, given the more predictable nature of services relative to products, investors would likely prefer that Apple continue to introduce new services to help beef up this segment.

Look to see if Cook shares more insight into the long-term potential of the services segment.

Apple reports second-quarter results for its fiscal 2017 after market close on Tuesday. The company will host a live conference call to discuss the quarter's performance at 5 p.m. EDT (2 p.m. PDT).