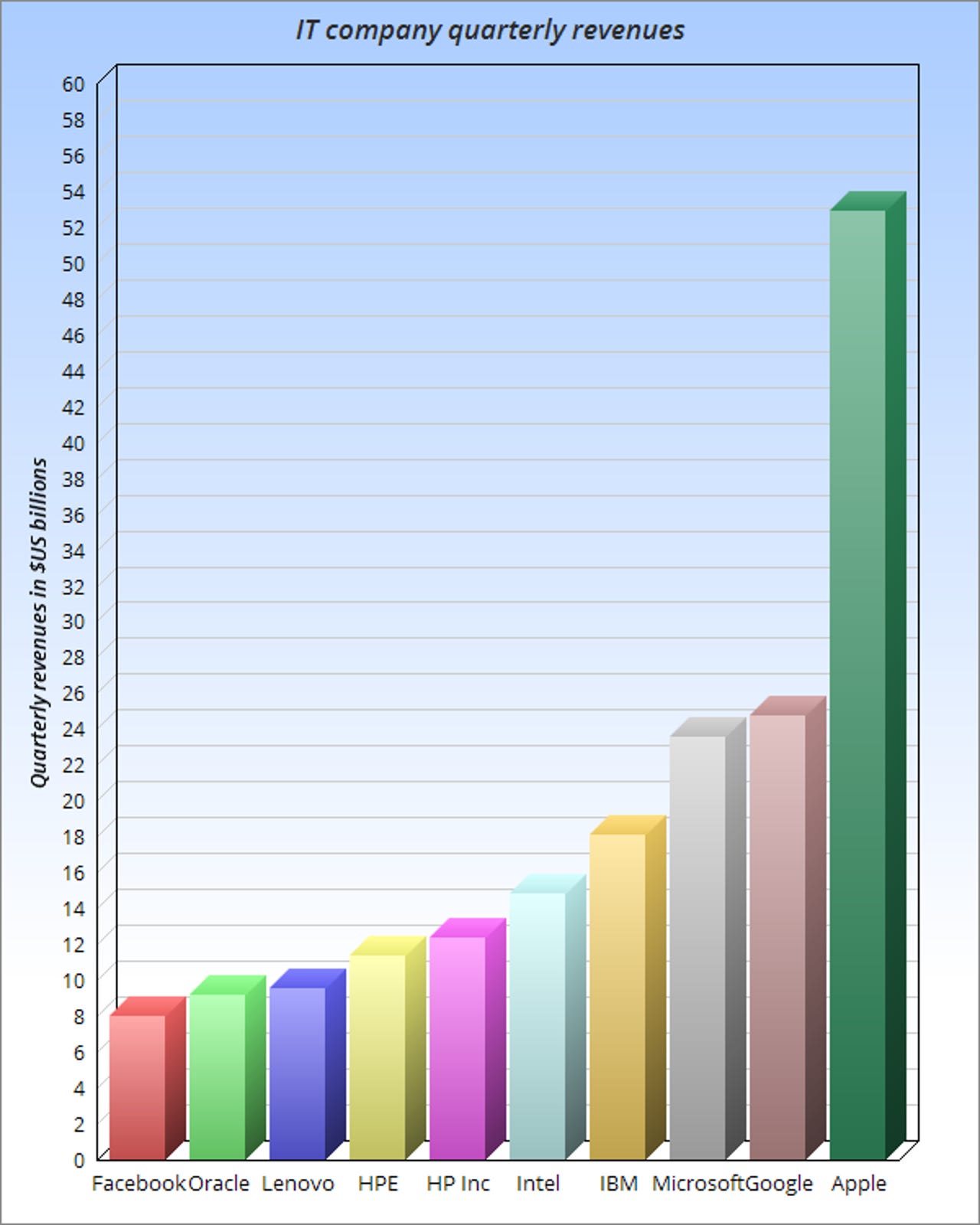

Apple still towers over other IT companies in quarterly revenues and profits, but there are changes in the chasing pack

Tech companies often have different fiscal years and announce their quarterly result on different days, so it's hard to make comparisons, even if you have a superhuman memory.

However, a simple bar chart makes the obvious point: the old order has changed. IBM no longer dwarfs every other IT company. That function has been taken over by Apple. Worse, IBM has fallen behind Google and Microsoft in the pecking order, and it is nowhere near as profitable (see below).

I last did this exercise two years ago in Apple towers over other IT companies in quarterly results. If you compare bar charts, Google's advance (more accurately, Alphabet's advance) is the most notable difference, though Facebook has also done well. Apple's turnover appears to have slumped dramatically, but this isn't the case. Apple's results are seasonal and the numbers in the previous bar charts were for a different quarter.

The two charts also differ for other reasons. First, I've dropped Yahoo, which is now irrelevant, and replaced it with Oracle. Second, HP now appears as two companies instead of one. The old HP has been split into HP Inc, which includes PCs and printers, and HP Enterprise, which includes the serious IT products and services. The original idea was that the PC business was holding back the share price of the enterprise part of HP.

This split has not quite gone as some anticipated. The PC part of HP has shown new life and become the world's largest PC supplier, while HP Enterprise has not seen a similar lift.

My timing is bad in that HPE reports its next quarterly results later this week, on May 31. Analysts are projecting a large decrease in revenues (-24 percent year-on-year) from $12.7 billion to $9.6bn. See Hewlett Packard Enterprise Earnings Face 'Significant Headwinds' at Seeking Alpha for details.

The next time I do this, I'll include Dell Technologies which, following the merger with EMC, is currently a company in transition. In March, Dell announced fourth quarter revenues of $20.1bn with an operating loss of $1.7bn. In the full year, Dell declared revenues of $61.6bn and an operating loss of $3.3bn. It also paid off $7bn of debt.

Dell, like HP Inc, reported some success in its PC business, with 11 million shipments representing year-over-year increase of 8.2 percent. It also claimed it "regained the No. 1 worldwide server unit share position driven by strength in the mainstream PowerEdge business".

As an IT professional, you should keep half an eye on the leading companies' financial performance because nobody wants to buy from a company that looks like struggling in the foreseeable future. We have all seen the once mighty fall: DEC, Data General, Wang and Prime are examples. Following its 20 consecutive quarters of year-on-year declines in revenue, it's not hard to spot today's weak link. Remember when nobody ever got fired for buying IBM?