Facebook on Wednesday afternoon unveiled its Watch tab, which will be the new home for video viewing on Facebook and serve as a showcase for existing as well as new and exclusive video within the app. This effort follows several months’ availability of Facebook’s apps for various TV platforms, which have served as a test of sorts for the new in-app video tab. Facebook is clearly hoping that its big video push makes it more competitive against YouTube and allows it to both increase time spent in its apps and generate higher ad revenue, but there are significant risks to this pivot.

The Evolution of Facebook’s Video Strategy

Facebook’s strategy around video has evolved over the last few years in much the same way as its mobile strategy had to evolve around the time of its IPO. Back in early 2014, Facebook talked about video mostly in a passive way, discussing the rise of sharing of video on its service by users, and its expectations that this sharing would grow as smartphones became more capable and widespread. A year later, Facebook was actively talking about proactively building a platform for video, and in 2016 Mark Zuckerberg began talking about video as a third phase in a shift that had already seen the majority of Facebook content go from being text-based to image-based.

The last couple of years have seen an active investment by Facebook in not just tools for creators but in content itself, first around live video and more recently around produced video which would eventually end up in the Watch tab it announced this week. It has primed the pump by subsidizing the creation of content to populate that tab and increase the amount of high-quality content available on Facebook, while also creating new ways for video creators to monetize on its platform, starting with mid-roll ads. Now we’re seeing the creation of a place within the mobile app where the vast majority of users engage with Facebook which is explicitly devoted to video.

The Theory and the Risks

Facebook’s strategy here is fairly transparent: as consumption of content on Facebook has shifted from text to images to video, the content consumed has gone from being hosted on Facebook to being hosted elsewhere, notably YouTube. That, in turn, has meant that any ad revenue generated directly from the viewing of those videos has gone into Google’s coffers rather than Facebook’s. As such, it wants to shift that viewing and the associated ad revenue from YouTube to its own platform, much as its Instant Articles initiative has done that for news articles. In the process, it clearly hopes to increase time spent on content hosted on Facebook servers, and generate the higher CPMs that video ads command. That’s the theory.

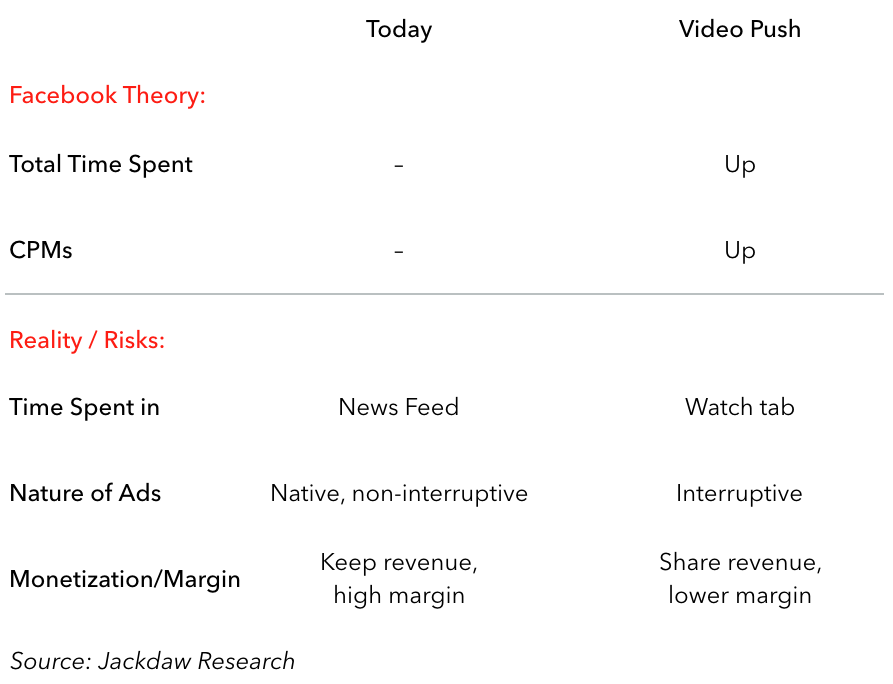

However, there are a number of risks associated with this strategy, at least some of which stem from the decision to autoplay videos in the News Feed with the sound off. That, in turn, meant that ads could never run before videos as they do on YouTube, and mid-roll advertising was therefore the only viable option to monetize video on the platform. We’ve seen a push in that direction over recent months, and it’s the anecdotal evidence I’m seeing from that push that has me worried here. The chart below illustrates both the theory and the risks associated with this new video pivot:

As shown in the chart, the theory from the Facebook side is that total time spent will go up, and that the ads people see while watching video will generate higher CPMs. The risks are as follows:

- The time people do spend will shift from the News Feed to the Watch tab

- The nature of ads they will see will go from being native and non-interruptive to being non-native and extremely interruptive

- Facebook will go from ad formats where it keeps essentially all the revenue to models where it has to pass along much of the revenue to content owners and therefore generate lower margins, as Mark Zuckerberg confirmed on the company’s recent earnings call.

All told, there’s a significant risk here that instead of people spending more time on Facebook, people try spending some time in the new Watch tab, which Facebook will no doubt promote heavily as it has with the Marketplace and other recently added tabs, and then be put off by the mid-roll ads which will run in the videos they see there. The few ads that people do see, meanwhile, will generate less margin for Facebook than the highly profitable ads they currently see in the News Feed. Instead of increasing time spent and ad revenue generated, Facebook could actually turn people off and end up with less revenue.

Autoplay Will Turn Out to be a Costly Unforced Error

I return here to the decision to run videos in an autoplay mode without sound, which massively increased engagement with videos and therefore served that purpose well, but made it impossible for Facebook and its content partners to monetize those videos in the way that other ad-supported online video is monetized. People simply aren’t used to watching video on either Facebook or YouTube which breaks partway through and shows ads, and Facebook only has itself to blame for limiting its options now that it’s ready to turn on monetization for video. The great irony is that Facebook is now turning sound on by default for these autoplay videos, eliminating arguably the most effective aspect of the format and in the process neutralizing any benefits it might have gained from it in the first place.

It’s still possible that Facebook may be able to work its way through what at this point looks like a really costly unforced error. Perhaps the new content available on Facebook will end up being so compelling that the digital natives who’ve grown up on YouTube videos will sit through the ads anyway, but a generation trained on pre-roll ads on YouTube and no ads at all on Netflix is likely to have a tough time with random ads in the middle of very YouTube-like videos on Facebook. And that may make the hard pivot towards video Facebook is about to embark on really tough.

This post post made me think. I will write something about this on my blog. Have a nice day!!

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic.