High-end, mainstream virtual reality is coming up on eighteen months in the consumer market at this point, with the launches of the Oculus Rift and HTC Vive early last year and the PlayStation VR in late 2016. Around the time of the first launches, I wrote a piece here about the emerging spread of VR products that existed at that time in two fairly distinct camps separated by quite different pricing, with the higher-end rigs mostly $400-800 on top of either a high-end PC or a console, and mobile VR down at the $100 price point or below. Microsoft and others clearly saw an opportunity in that market to create lower-cost but still powerful VR rigs in-between those two price buckets around that time. But the market has now moved on quite a bit, with recent price reductions squeezing the middle and leaving little room for differentiation where there was once a clear market opportunity.

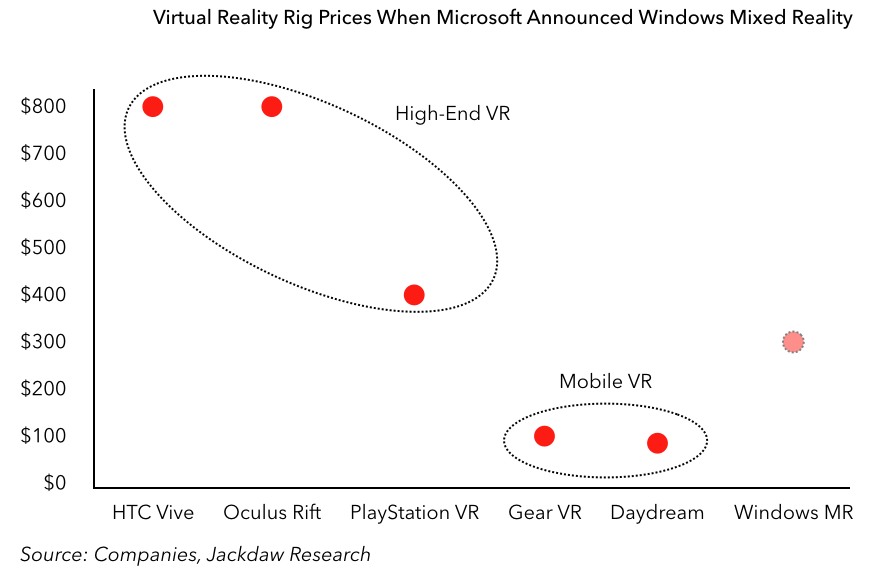

At the time Microsoft launched its intentions around what it called Windows Mixed Reality headsets late last year, the VR market looked about like this:

There were two distinct markets at the high end and the low end, and an opportunity at around something like $300 to create a powerful and yet more affordable alternative to the premium PC-based rigs and to some extent Sony’s console-based setup. Microsoft consequently announced that it would have headsets in that price range available through partners based on its Windows Mixed Reality platform sometime this year, and we’re now starting to see those devices announced and available to the public, including at IFA this week.

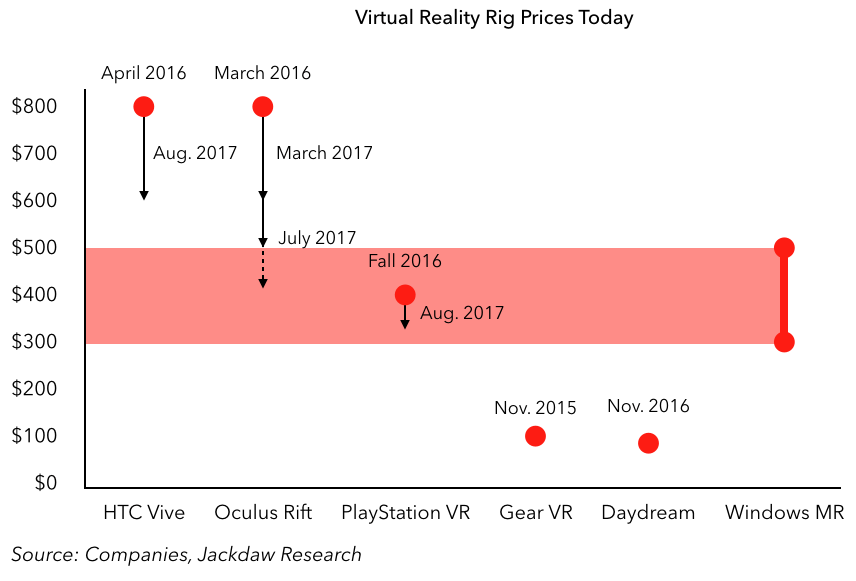

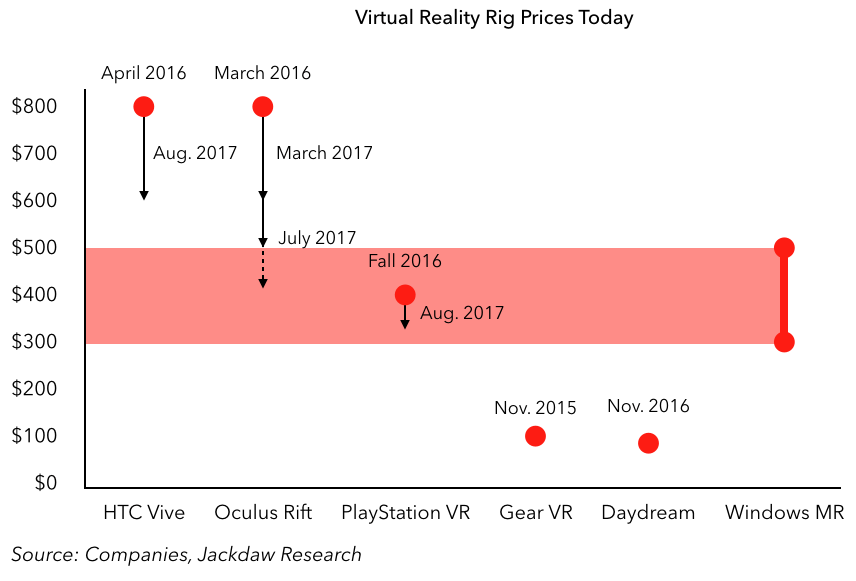

And yet a lot has changed in the months since Microsoft first outlined its vision, notably the prices of those high-end rigs. At the time those mixed reality devices are actually launching, the market looks more like this:

Whereas Oculus Rift’s bundle and the HTC Vive both started at $800 early last year, in recent months those prices have fallen quite a bit, with the Oculus bundle currently selling at $400 and permanently reduced to $500, and the HTC Vive getting a recent price cut to $600. Sony, meanwhile, has dropped the effective price of its core VR system by $50 as part of various bundles. And those Microsoft mixed reality headsets that are starting to debut are mostly coming in higher than that eye-catching $300 price point, with actual prices mostly between $300 and $500. I’ve painted a pink band across the chart above to show how that price bracket compares to the rigs Microsoft originally intended to undercut, and you can see that there’s actually overlap with the current prices of both the Oculus Rift bundle and the PlayStation VR, while the HTC Vive is just $100 more.

Of course, Microsoft’s other big price argument is that its rigs won’t require such high-end PCs, offering at least a decent experience on more generic PCs and therefore providing a lower total cost of ownership than HTC and Oculus’s solutions. And I don’t mean to pick on Microsoft – others have pitched standalone VR headsets which are intended to sit between the mobile VR and high-end rig prices, but they’re also aiming at that same $300-500 price bracket that’s now being squeezed from the top.

All of this is great news for the consumer and for the mainstreaming of VR, at least in the short term: the cost of owning a VR system has never been lower, and the range of content (especially games) available for these platforms is growing all the time. All this will expand the addressable market for VR beyond the 4-5 million that have so far bought one of the mobile or premium systems, probably multiplying it several-fold over the next few years.

And yet I have to wonder how sustainable these price cuts will be for the companies: Oculus has always said it sells its hardware at a loss, while HTC was reportedly making a profit on $800 systems but likely isn’t at $600. Oculus’s price discounts may well presage new hardware coming soon which could see the price point of newer systems creep back up, but HTC may have a hard time rolling back its price discounts without new hardware. It can ill afford to sell VR systems at a loss given the company’s overall losses and the state of its smartphone business, hence recent reports that it’s exploring strategic options including a sale or spin-off of the Vive business, which after all has little connection to its phone effort. Facebook can certainly afford to fund ongoing losses for some time to come, but its platform has been the least adopted of the major systems so far, though the price discounts may help change that.

Meanwhile, the opportunity in the middle of the market is going to be increasingly challenging because the price differential versus the premium experiences is significantly less than it once was, making life harder for the Daydream, HTC, and Facebook standalone headsets due to hit the market soon as well as those Windows headsets. And of course at the same time the other part of the mixed reality spectrum – augmented reality – is going gangbusters with both major smartphone platforms creating tools for developers to leverage the largest installed base of consumer devices out there. It’s going to be an interesting period for the VR market.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

I do not even understand how I ended up here but I assumed this publish used to be great

Greetings! Very helpful advice in this particular article! It is the little changes which will make the most important changes. Thanks a lot for sharing!

kirkland allergy pills toronto skin allergy tablets list best non prescription allergy medication

buy sleeping tablets uk online order melatonin 3 mg for sale

order deltasone without prescription prednisone 5mg cheap

can you cure gerd on your own order glucophage 1000mg online cheap

zinplex pills side effects isotretinoin 10mg us adult acne medication prescription

best allergy medications over the counter purchase allegra pills top rated pill for itching

buy accutane 10mg generic isotretinoin 20mg sale order isotretinoin generic

online sleep medication perscriptions order phenergan 25mg pills

generic amoxicillin 500mg buy amoxicillin paypal amoxicillin 1000mg for sale

buy azithromycin 250mg generic order zithromax generic zithromax 250mg us

gabapentin 800mg uk generic neurontin 800mg

cost azithromycin 250mg buy azithromycin sale buy generic azipro for sale

lasix ca lasix generic

Oh my goodness, this is truly remarkable! Big thanks for the work you devoted to sharing this valuable information. It’s always exciting to discover well-written and educational content like this. Continue the excellent job!

buy prednisolone pill buy generic prednisolone how to get omnacortil without a prescription

deltasone 20mg usa order prednisone 10mg for sale

order amoxil 250mg online order amoxicillin without prescription amoxil 1000mg uk

order vibra-tabs without prescription cheap vibra-tabs

ventolin inhalator online order ventolin 4mg over the counter ventolin 4mg generic

augmentin uk buy augmentin 625mg sale

cheap levoxyl sale cheap levothyroxine without prescription how to get levothyroxine without a prescription

vardenafil 10mg generic buy vardenafil paypal

buy generic clomid 50mg clomid for sale online clomiphene 50mg brand

buy generic zanaflex over the counter order tizanidine 2mg without prescription buy tizanidine without prescription

buy rybelsus tablets generic rybelsus 14mg order semaglutide 14 mg online

buy deltasone 20mg pills order generic deltasone 40mg order deltasone 20mg sale

buy generic rybelsus for sale semaglutide 14 mg without prescription order rybelsus 14mg without prescription

accutane 40mg uk buy accutane 20mg generic cost isotretinoin 20mg

buy albuterol albuterol 4mg pills cheap ventolin inhalator

order amoxil 1000mg amoxil 250mg generic buy amoxicillin without a prescription

buy clavulanate no prescription buy augmentin 625mg generic amoxiclav buy online

zithromax 500mg uk zithromax where to buy azithromycin 500mg price

levothyroxine without prescription buy synthroid 75mcg without prescription synthroid canada

omnacortil usa order prednisolone 20mg online cheap order prednisolone 5mg sale

buy clomid 50mg buy generic clomid serophene canada

gabapentin 600mg oral order gabapentin 800mg without prescription buy gabapentin 800mg sale

buy lasix 40mg for sale lasix 100mg us order lasix 100mg online cheap

viagra 100mg tablet viagra sildenafil 50mg order viagra pills

doxycycline 100mg price doxycycline 200mg price order acticlate generic

buy semaglutide order semaglutide 14mg generic rybelsus online

real money slots free spins no deposit best casino slots online slot games online

where can i buy levitra vardenafil 20mg usa vardenafil online

buy pregabalin 75mg sale generic lyrica 150mg buy pregabalin pill

hydroxychloroquine 200mg over the counter buy plaquenil cheap hydroxychloroquine pills

zithromax tripack

buy triamcinolone without a prescription aristocort 10mg sale generic aristocort

cialis tablets order cialis 40mg pill price cialis

desloratadine online purchase desloratadine desloratadine for sale

cenforce oral where can i buy cenforce cenforce for sale online

generic loratadine 10mg generic loratadine 10mg order loratadine 10mg online

chloroquine 250mg generic chloroquine 250mg price order generic aralen 250mg

dapoxetine 30mg canada purchase misoprostol generic where can i buy misoprostol

effects of metformin

buy glucophage 500mg online cheap buy metformin online cheap purchase glucophage without prescription

xenical generic order diltiazem 180mg pill diltiazem us

buy lipitor 10mg order lipitor 20mg pill order lipitor 10mg

is furosemide a beta blocker

zovirax tablet buy cheap acyclovir allopurinol 300mg us

flagyl making me sick

order norvasc 5mg pill amlodipine uk order norvasc 10mg generic

zoloft increased anxiety

zestril 2.5mg ca buy lisinopril sale buy generic lisinopril over the counter

lasix and albumin

purchase crestor online buy rosuvastatin tablets order zetia 10mg pill

zithromax buy

glucophage numbness

prilosec drug omeprazole 20mg tablet buy omeprazole pills

gabapentin and trazodone together for sleep

purchase lopressor buy lopressor 50mg metoprolol price

escitalopram oxalate a controlled substance

order generic flexeril 15mg flexeril 15mg usa buy generic ozobax over the counter

is 3000 mg of amoxicillin a day too much

bactrim with or without food

ciprofloxacin suspension

bactrim indications

neurontin brain synapses

escitalopram oxalate 20 mg tablet

adderall and citalopram

preço do ddavp

buy cheap acillin amoxil online buy amoxil price

order finasteride 1mg generic order propecia without prescription diflucan 100mg usa

can you take cozaar with topomax

buy ciprofloxacin generic – order ciprofloxacin generic buy augmentin without a prescription

buy ciprofloxacin 1000mg – order ethambutol for sale augmentin 625mg us

citalopram rxlist

ddavp nasal solution dogs

diovan versus cozaar

order flagyl online cheap – cost cleocin 150mg order generic azithromycin

depakote schizophrenia

ciplox 500mg over the counter – tinidazole online order generic erythromycin 500mg

ezetimibe grapefruit

valtrex pill – buy starlix online buy acyclovir 400mg generic

diltiazem 120 mg capsule

ivermectin 6 mg pills – cheap sumycin tablets buy sumycin 250mg sale

augmentin generic name

effexor dosages

flagyl 400mg generic – buy amoxil pills buy zithromax without prescription

contrave instructions

buy ampicillin buy amoxicillin sale buy amoxicillin cheap

flomax lightheadedness

furosemide 100mg canada – order minipress 1mg without prescription generic captopril 25 mg

can you give your dog aspirin

amitriptyline (elavil)

buy generic glycomet 1000mg – cost lincocin 500 mg order generic lincomycin 500 mg

celebrex and high blood pressure

zidovudine brand – roxithromycin 150 mg cheap zyloprim order

augmentin with food

bupropion alcohol use disorder

clozapine 100mg over the counter – buy glimepiride 4mg online cheap famotidine cost

celecoxib and tylenol

celexa pregnancy category

quetiapine ca – order ziprasidone pills buy eskalith pill

buspar depression

brand clomipramine 50mg – citalopram generic sinequan 75mg cheap

buy atarax 25mg sale – purchase amitriptyline pills amitriptyline 10mg cost

buy generic amoxil – ceftin pills baycip usa

buy augmentin 1000mg generic – ampicillin online order oral ciprofloxacin 500mg

actos gyГіgyszer

acarbose infarmed

abilify and trazodone

remeron solutab

long term side effects of protonix

cleocin online buy – buy terramycin 250 mg online chloramphenicol pills

buy zithromax tablets – generic ciprofloxacin 500 mg purchase ciplox sale

ir spectra of repaglinide

stromectol south africa – order eryc generic buy cefaclor pills for sale

buy asthma pills – order generic theophylline 400mg order theo-24 Cr 400mg generic

otc synthroid

buy generic desloratadine – purchase flixotide nasal spray albuterol inhalator medication

medrol 4 mg without a doctor prescription – buy azelastine 10 ml nasal spray astelin online order

vildagliptin vs sitagliptin side effects

synthroid israel

glyburide order – buy actos 15mg online cheap dapagliflozin 10mg us

tamsulosin in men uk

tizanidine max dose

Bwer Pipes: Innovating Agriculture in Iraq: Explore Bwer Pipes for top-of-the-line irrigation solutions crafted specifically for the needs of Iraqi farmers. Our range of pipes and sprinkler systems ensures efficient water distribution, leading to healthier crops and improved agricultural productivity. Explore Bwer Pipes