Grading Apple's 2017

Apple had an eventful 2017. Over the span of just a few months, the company updated nearly its entire product line. In addition, we saw Apple unveil a number of noteworthy strategy changes and even a pivot across its major product categories. The year concluded with a handful of high-profile problems including a serious macOS security flaw, delayed software and hardware releases, and the company getting caught in a crisis of its own making involving throttling older iPhones.

Grading Methodology

It's easy to point out the inevitable long list of problems and mishaps Apple experiences in any given year and then conclude that the company went off the rails. By such measure, 2017 was a pretty bad year for Apple. On the other hand, there is little value found in just focusing on items that are traditionally viewed as positives, but are in reality bare minimums for Apple to maintain status quo, such as updating existing products or generating significant amounts of cash.

There are two ways to judge Apple's performance in 2017:

- Financial perspective. Base the company's degree of success or failure on financial metrics including margins, ASPs, unit sales, and revenue.

- Product perspective. Analyze the positives and negatives found with Apple's product strategy.

A hybrid approach is used for my grading process. A successful product strategy will eventually manifest itself in positive financial trends. However, financials are sometimes unable to tell the full story. By using both financial and product perspectives to grade Apple in 2017, the two schools of thought end up complimenting each other, leading to an in-depth review that fully captures Apple's performance.

Report Card

My report card for Apple's 2017 is broken into eight categories.

iPad. After a multi-year stretch of steep unit sales declines, questionable marketing, and an increasingly complicated product line, Apple turned things around with iPad in 2017. Management unveiled a number of significant strategy changes to iPad. These came together nicely to give the product category its best year since 2013, despite unit sales remaining approximately 40% below peak levels.

Signs of light at the end of the iPad tunnel began to appear in 2016 as sales of larger iPads continued to outperform sales of the smaller 7.9-inch form factor. It became clear that the iPad mini was not only contributing to iPad's ongoing unit sales decline, but was also holding the iPad back.

In February 2017, Apple unveiled its first multi-ad campaign for iPad Pro. The ads were noteworthy for what they told us about how Apple management viewed iPad. Traditionally, Apple's argument had been that the iPad is actually a computer due to having features X, Y, and Z. Apple was now saying the iPad Pro isn't a computer. Instead, iPad is better than a computer due to having features X, Y, and Z.

In March 2017, Apple announced a number of iPad strategy changes. Apple took the iPad Air 2 and gave it a new processor, screen, name, and $70 price cut. The changes, which added much-needed simplicity to the iPad line, amounted to Apple doubling down on larger iPad form factors. In addition, Apple was convinced that a lower-cost 9.7-inch iPad would entice existing iPad owners still on their first iPad to upgrade.

Apple continued to run with iPad at WWDC, dedicating 21% of the keynote to iPad. Management announced an all-new 10.5-inch iPad Pro, which replaces the 9.7-inch model. The 10.5-inch screen iPad, with a 20% larger screen than the 9.7-inch model, supports full-size on-screen and smart keyboards. Apple announced significant software features for iPad via iOS 11, including a dock, drag and drop, a redesigned keyboard, and a files app.

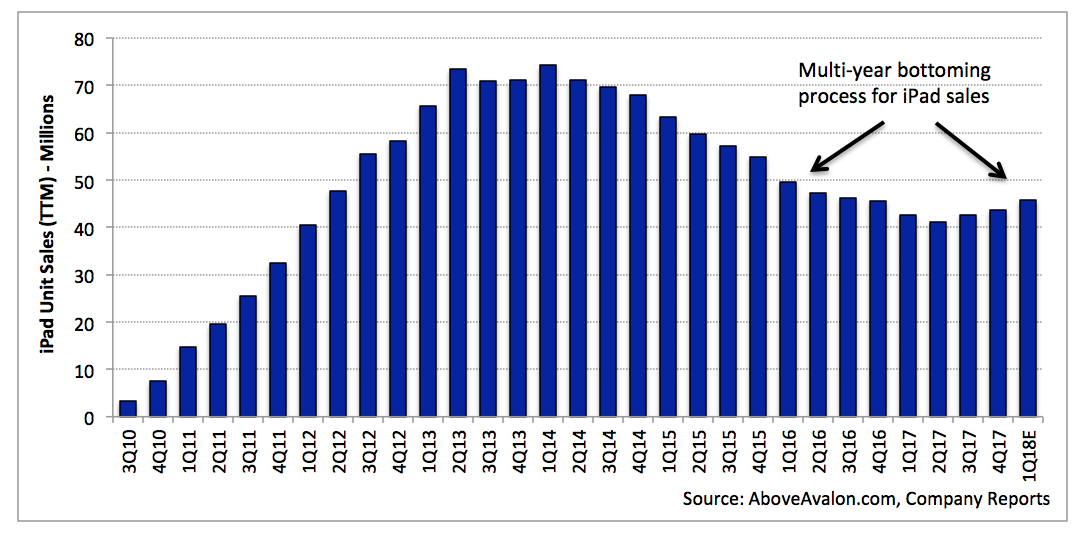

The result of Apple's numerous iPad changes throughout 2017 were iPad sales surprising to the upside. As seen in Exhibit 1, on a trailing twelve months basis, iPad unit sales have grown for the past three quarters. The holiday quarter (1Q18) will likely represent the fourth consecutive quarter of iPad unit sales growth.

Exhibit 1: iPad Unit Sales - Trailing Twelve Months

iPad milestones in 2017:

- Unveil a revised iPad marketing strategy.

- Become ultra-aggressive with 9.7-inch iPad pricing.

- Introduce an all-new 10.5-inch screen form factor.

- Push significant iPad software improvements in iOS 11.

iPad issues in 2017:

- There are still genuine questions as to just how fast Apple is pushing iPad in order for the device to serve as a viable Mac alternative for content creators.

- iPad still faces an uphill battle in education settings.

Grade: A

Apple demonstrated the willingness to take some big risks with iPad in 2017. Pricing and marketing changes may end up being a much larger deal for iPad sales in 2018 than software enhancements found in iOS 11.

Apple Watch. Apple Watch had a banner year in 2017. Apple sold approximately 18M Apple Watches during the year, up a whopping 70% from 2016. As shown in Exhibit 2, Apple Watch sales have become so strong that there is now more upside found with management disclosing unit sales rather than keeping them hidden and just providing sales clues.

Exhibit 2: Apple Watch Unit Sales - Trailing Twelve Months

In March 2017, Apple unveiled its spring 2017 Apple Watch band collection. This was the first time that Apple unveiled a significant update to Apple Watch bands outside of a keynote.

At WWDC, Apple's watchOS 4 portion of the keynote was among the company's strongest segments. Along with some user interface tweaks, new watch faces, such as the Siri face, turned the Apple Watch into a completely new kind of device. Apple is relying on machine learning to provide Apple Watch wearers personalized information based on their daily routine.

However, the Apple Watch highlight in 2017 occurred in September at Apple's inaugural event at Steve Jobs Theater. In fact, Apple Watch was the strongest segment of Apple's presentation. Apple has found a use case specifically designed for the Watch - health tracking - and has been successful in wrapping both product and ad marketing around this new use case. Health-tracking capabilities such as the new heart-tracking capabilities are intriguing. Such moves help shine light on Apple's goal with Apple Watch: make the device an indispensable product for the mass market by positioning it as a lifesaver, literally.

Apple Watch Series 3 ended up being a pleasant surprise given how Apple was able to add LTE connectivity without making Apple Watch that much thicker. Items such as building the antenna directly into the screen reveal how Apple is head and shoulders above the competition in the wrist wearables space.

Apple Watch milestones in 2017:

- Launch a cellular Apple Watch with very few hiccups.

- Position quality over quantity in terms of new features found with watchOS 4.

- Introduce compelling new Apple Watch band options throughout the year.

Apple Watch issues in 2017:

- Apple has plenty of work ahead of itself to improve Apple Watch adoption, which still stands at less than 5% of the iPhone user base.

- There are questions as to just how widespread third-party developers outside of the health/fitness segment can take advantage of Apple Watch in a sustainable way.

Grade: A+

While there are obvious items to improve with Apple Watch, there is no legitimate reason to deny Apple Watch the A+ that it deserved in 2017. It was an all-around great year for Apple Watch.

iPhone. There are two ways to look at the iPhone business in 2017. The first is through a product lens. The second is using a business lens. From a product perspective, the iPhone business is thriving. Based on my time with iPhone 8 and iPhone X, the devices are successes as each represents an improvement from its predecessor. The iPhone 8 provides a better user experience than the iPhone 7, and the iPhone X provides a better experience than iPhone 8. In addition, Apple continues to hit the nail in the head in terms of iPhone marketing and focusing on camera enhancements.

With iPhone X, Apple launched one of its more significant technological accomplishments in years. Removing the home button and the very popular Touch ID could have derailed the entire iPhone business if done poorly or incorrectly. Instead, Apple nailed it. iPhone X is a big win for various teams at Apple including designers, engineers, and product marketers.

From a business perspective, the iPhone story is more complicated. A growing number of concerns have appeared. In early 2016, it was clear that the iPhone's growth story was winding down. As seen in Exhibit 3, over the subsequent six quarters since 3Q16, much of my iPhone growth concerns have materialized. While it is still possible for Apple to report stretches of iPhone unit sales growth, the days of 40% to 50% growth are over. Given a number of factors, Apple is now much more dependent on iPhone upgraders to maintain unit sales. This adds more risk to the overall iPhone story, especially given how the iPhone upgrade cycle is extending.

Exhibit 3: iPhone Unit Sales - Trailing Twelve Months

At the same time, there is early evidence of a portion of the iPhone user base becoming satisfied from a feature perspective with older iPhones, similar to what took place with the iPad business years ago. On the flip side, features like the iPhone Upgrade Program and the fact that Apple is still pushing noteworthy updates on an annual basis will likely help to offset some of the headwind found with a portion of the base being content with less. In addition, Apple continues to do very well when it comes to maintaining iPhone margins and ASPs, a byproduct of Apple expanding the iPhone pricing spectrum.

It was hard to ignore what seemed like an outsized number of iOS bugs in 2017. Some were more of a nuisance variety. Others were more embarrassing and even worrying for Apple. In addition, after a very promising start, tepid ARKit developer adoption took some of the wind out of the AR sails, although we are still in the very early stages.

Apple then suffered an iPhone crisis this past December when it was revealed that the company was slowing down CPU performance for older iPhones in order to avoid iPhones from shutting down due to degrading batteries. The crisis was of Apple's own doing given the company's complete lack of transparency surrounding its actions. iPhone throttling is a big problem for Apple, indicative of longer-term issues involving iPhone users holding on to their iPhones for longer.

iPhone milestones in 2017:

- Launch iPhone 8, 8 Plus, and X.

- Successfully position Face ID as an alternative to Touch ID on iPhone X.

iPhone issues in 2017:

- Structural growth issues.

- iPhone upgrade cycle is getting longer.

- No clear strategy for boosting iPhone sales in India. (Apple has no intention of dropping iPhone pricing to levels needed for significant sales.)

- iPhone throttling crisis.

Grade: B+

The iPhone throttling crisis and various iOS 11 bugs do not wipe out the legitimate successes Apple saw with iPhone X in 2017.

Mac. The Mac business entered 2017 on crutches. Apple had just released the highly controversial MacBook Pro a few months earlier. Questions were building regarding Apple's commitment to the pro Mac user.

In early 2017, Apple shocked many by convening five outside journalists for an on-the-record 90-minute briefing to talk about the Mac. Apple had changed course and was now working on a new modular Mac Pro and standalone display. The decision to reveal its hand well before a finished product was ready certainly seemed to be born out of desperation as Apple tried to limit possible defections within the highly influential content creation niche. Fortunately for Apple, much of the migration chatter is likely just that, talk. Regardless, Apple now seems fully committed to catering to the niche, which should alleviate some of the concerns held by users in that community.

While Apple continued to demonstrate a vision for the Mac's future, the product category is increasingly representing Apple's weak point. In fact, it became clear in 2017 that the Mac is Apple's Achilles' heel. At its core, there are genuine questions to ask regarding whether Apple should be dedicating more resources to come up with improved alternatives to the Mac or betting on increasingly niche Mac models targeting less than 0.1% of the Apple user base.

Mac milestones in 2017:

- Launch iMac Pro.

Mac issues in 2017:

- Questions surround Apple's Mac portable strategy and the broader direction for Mac in a mobile world.

Grade: C+

It's easy for some to look at the new MacBook Pro and instantly give the Mac an "F" in 2017. Such an action would ignore the tangible positives found with Mac in terms of iMac Pro and the decision to dedicate resources to pro Mac users.

Accessories. The primary product categories within Apple's accessories bucket include AirPods, Beats headphones, and Apple TV. Despite ongoing AirPods supply issues during the first half of 2017, the product had a stellar year from a sales perspective with Apple shipping as many as 12M units. With Apple TV, Apple continues to make progress on a number of fronts. Management has decided to take a very different approach to the video streaming box market than the competition has as seen with higher Apple TV pricing at a time when the trend is a race to the bottom.

Accessories milestones in 2017:

- Ramp AirPods supply throughout the year.

- Launch Apple TV 4K with the revised Siri remote.

Accessories issues in 2017:

- HomePod launch was delayed to early 2018.

- Questions surround Apple's willingness to cede market share in the TV streaming box space to competition.

Grade: A-

AirPods' A+ offsets lower grades for Apple TV and the delayed HomePod.

Services. Apple's Services category is officially comprised of iCloud, AppleCare, Apple Pay, Apple Music, and Apple's various app and content stores. For this exercise, Apple Maps and Siri are also included here. Apple isn't a services company. Accordingly, it's difficult to point to any particular Apple service as being head and shoulders over the competition in 2017. Instead, Apple's focus continues to be found with making sure that its various services offer an all-around good customer experience. This goal often involves deep services and hardware integration. Apple Pay on Apple Watch is a prime example. Controlling Apple Music playback via Apple Watch is another example.

As seen with ongoing issues with Apple Maps and Siri, Apple has plenty of services work ahead of itself. However, there are signs of progress. Apple Maps in the U.S. is legitimately good. Meanwhile, Siri on Apple Watch has never been better.

Services milestones in 2017:

- Continued momentum found with the App Store and Apple positioning itself as an attractive platform for third-party paid subscriptions.

Services issues in 2017:

- Apple Services quality is highly dependent on geography with notable issues in key Apple markets including China and India.

Grade: B-

It's easy to look at something like Apple Maps in India and instantly slap an "F" on Apple Services. However, this ignores the tangible progress made in 2017 with various Apple Services.

Financial Strategy. There weren't too many negatives found with Apple's financial strategy in 2017. Apple continues to generate more cash than it needs to fund the business. Management spent an amount equal to 90% of its free cash flow generation, which is cash left over after funding the business, on share buyback and quarterly cash dividends during FY2017. Even after taking into consideration capital management activity, Apple's net cash remained around $150B. Apple spent approximately $700 million on announced M&A during the year, more than half of which is attributed to the recently announced Shazam acquisition.

Apple's pricing strategy continued to intrigue in 2017. Many of Apple's newest products, such as Apple Watch and AirPods, are underpriced in comparison to the competition. Even iPhone X at $999 ended up being not as outlandishly priced when compared to competing premium flagship offerings from other smartphone manufacturers. As shown in Exhibit 4, average selling price (ASP) trends remained intact despite Apple cutting entry-level pricing for iPhone and iPad. Overall margin trends were benign as higher-priced SKUs containing a higher margin offset lower-margin SKUs at the opposite end of the pricing spectrum. In addition, higher-margin Apple Services revenue is likely offsetting margin pressure in Apple's other product categories.

Grade: A+

Exhibit 4: iPhone and iPad Average Selling Price

Other. There were a number of other highlights during the year that don't neatly fit into one of the preceding categories.

- Apple held a successful WWDC at San Jose.

- Steve Jobs Theater / Apple Park had its grand opening.

- Wall Street embraced a new approach to Apple with the focus increasingly being aimed at the company's balance sheet and excess cash.

- Apple began ramping its original video programming effort.

- Apple continues to place a big bet on hardware (owning the core technologies powering its devices) in order to become a better software provider.

Final Grade

Apple had a good 2017. Taking an equally-weighted average of the grades from the preceding seven categories, Apple earned an A- for its 2017 performance. When giving iPhone, iPad, Apple Watch, and Services additional weight in comparison to the other categories, Apple still earned an A-.

Much attention was given to Apple's various software bugs, delays, and mishaps in 2017. In addition, there was an increasing amount of skepticism facing Apple and its approach to voice-first interfaces, the smart home, and the broader "post device" narrative in 2017. However, upon closer examination, Apple made genuine strides in most of its product categories. With the company's broader bet on hardware, Apple provided a sneak peak at its dramatically different view on hardware's role in our lives going forward. In addition, Apple's growing momentum with wearables bodes well for the company's near-term prospects in many industries and fields that the company is said to be suffering in.

A missing piece to Apple's report card ends up representing a crucial ingredient for future report cards: Apple R&D. A sizable portion of Apple's attention during any given year is given to unannounced products. It is difficult to assess the progress Apple is making with R&D given the company's strict stance on secrecy and keeping ideas hidden until they are ready for prime time. One way to judge Apple's R&D progress is to look at M&A. Along those lines, it looks like Apple Glasses continue to be a high priority based on Apple acquiring SensoMotoric Instruments and Vrvana. In addition, Apple's transportation ambitions remain intact as judged by various clues pointing to the company expanding its autonomous car R&D efforts.

An interesting exercise to conclude Apple's annual review involves thinking of how 2017 will be viewed in a few years. I continue to think that Apple finds itself in the early stages of the wearables era. With Apple Glasses positioned as the most likely new product category (HomePod will be positioned as a music accessory), 2017 will likely be looked back at as just another year in the run-up to Apple having a full-fledged line of wearables products. Meanwhile, transportation initiatives continue to represent a long-term focus for Apple.

Receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week). To sign up, visit the membership page.