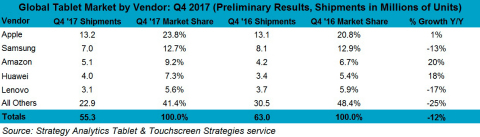

BOSTON--(BUSINESS WIRE)--For most of 2017, the tablet market has shown resilience as Apple turned it business around and key Android vendors were either growing by strong double digits or recovering. The final quarter was a big shock as the tablet market fell 12% year-on-year, pushing the entire year down 9% to hit only 185 million units shipped. Gains by Apple, Huawei, and Amazon were not enough to offset a big retrenchment by unbranded vendors as well as double digit declines at Samsung and Lenovo. Strategy Analytics’ Tablet and Touchscreen Strategies (TTS) report, “Preliminary Global Tablet Shipments and Market Share: Q4 2017” offers perspective on whether other industry players can duplicate this success or will they will continue an aggravating journey through the market.

The full report with detailed market breakdown is available here: https://www.strategyanalytics.com/access-services/devices/tablets/tablets/market-data/report-detail/preliminary-global-tablet-shipments-and-market-share-q4-2017-050218

Eric Smith, Director – Tablet and Touchscreens concluded, “The Windows tablet and 2-in-1 market hit a soft spot in 2017 as market share fell 1 percentage points to only 14%. Apple slightly cut its iPad Pro prices mid-year and found success while too many Windows 2-in-1s are aimed at the crowded enterprise and prosumer market. Consumers in the middle of the market are currently best-served by convertible PCs but the coming wave of ARM-based, always connected Windows 2-in-1s and rumored Chrome-based 2-in-1s could help turn this trend around.”

Peter King, Director – Devices Practice added, “Winners in the Android tablet market are few and far between. Huawei and Amazon have clear strategies as they attack the connected tablet segment and the low-cost entertainment slate segment, respectively. Vendors like Samsung and Lenovo must refocus and simplify their portfolios with clear marketing to reach the right customers, or they will continue to lose share to new comers and Apple.”

Tablet Market Dynamics by Operating System

- Apple iOS shipments (sell-in) grew 1% year-on-year to 13.2 million units in Q4 2017, pushing its worldwide market share to 24% of the Tablet market. This represented a 28% sequential increase due to the holidays. iPad Pro has been priced low enough that Apple is taking share from higher-priced Windows 2-in-1s among consumers and boosting total iPad ASPs higher year-on-year to $445.

- Android shipments fell to 34.8 million units worldwide in Q4 2017, down 13% from 39.9 million a year earlier and up 28% sequentially on high seasonality. Market share stayed steady year-on-year at 63% as White Box vendors continue to exit the market and many branded Android vendors have been unable to fully reclaim this lost, low-cost volume. Huawei and Amazon are some of the only Android vendors showing positive growth right now while Samsung, Lenovo, Asus, and Acer are struggling to fully turn around their Android business.

- Windows shipments fell 27% year-on-year to 7.3 million units in Q4 2017 from 10.0 million in Q4 2016. Shipments increased only 13% even during the holiday quarter. Most Windows tablet and 2-in-1 vendors are targeting the premium tier for enterprise users to make higher profits but not all vendors can reap these benefits in such a crowded market. As a result of taking focus off of the larger consumer market, Windows market share fell by three percentage points to 13% year-on-year.

About Strategy Analytics

Strategy Analytics, Inc. provides the competitive edge with advisory services, consulting and actionable market intelligence for emerging technology, mobile and wireless, digital consumer and automotive electronics companies. With offices in North America, Europe and Asia, Strategy Analytics delivers insights for enterprise success. www.StrategyAnalytics.com