Bloomberg butchers Samsung OLED statements to portray iPhone X as weak

Bloomberg is taking full advantage of Apple's quiet period in the week before its earnings release to issues a series of reports suggesting data points that could possibly be used to support its narrative that demand is somehow "weak" for the most profitable, attention-getting smartphone in the world— even as other vendors scramble to copy its looks and features.

In its latest attack on Apple's iPhone X, Bloomberg isolated selected statements from Samsung, the exclusive source of the phone's OLED display panels, and threw out facts that didn't support its narrative.

Citing mere 3 percent growth in the company's Display Panel business segment and a company earnings statement that DP profits "were affected by slow demand for flexible OLED panels," Bloomberg presented the conclusion that iPhone X sales must be "weak."

A false portrayal of Samsung's statements

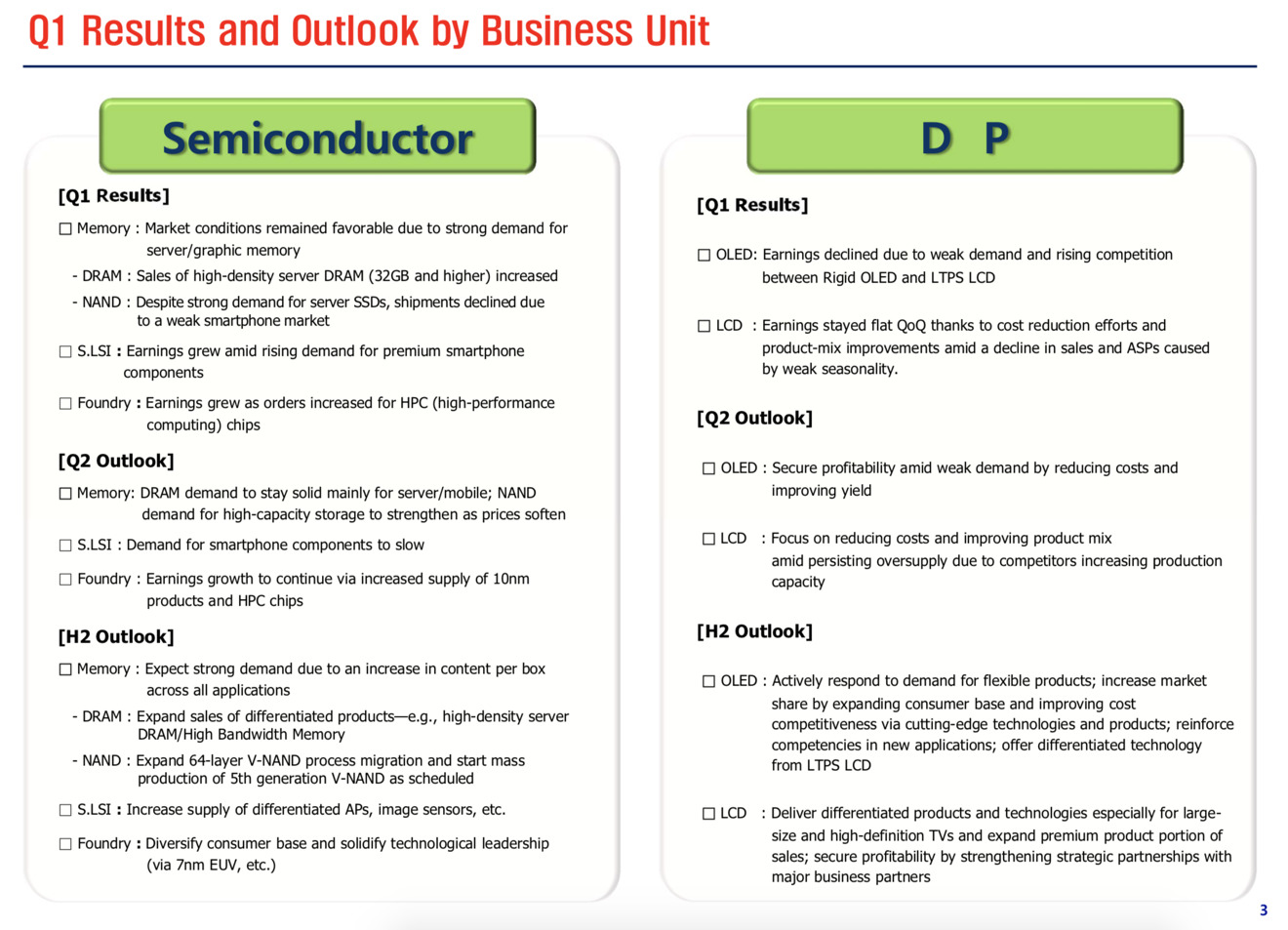

Samsung didn't say that its Display Panel segment turned in weaker results due to iPhone X. What the company actually reported in its earnings statement for the March quarter was that its DP "OLED Earnings declined due to weak demand and rising competition between Rigid OLED and LTPS LCD."

It also stated that its DP segment "LCD Earnings stayed flat QoQ thanks to cost reduction efforts and product-mix improvements amid a decline in sales and ASPs caused by weak seasonality."

So rather than Bloomberg's contrived messaging portraying that Samsung's OLED profits were declining because iPhone X was tanking, the reality is that Samsung reported that its entire DP unit was hammered in profitability during the quarter due to intense competition (from other suppliers and from other, cheaper screen technologies) and from weak demand and a decline in sales in general, across both OLED and LCD panels.Samsung didn't say that its Display Panel segment turned in weaker results due to iPhone X

For its Q2 outlook, Samsung said it aimed to "Secure profitability amid weak demand by reducing costs and improving yield." It didn't say it planned to 'find alternative OLED customers beyond Apple because nobody wants an iPhone X.'

And in regard to its LCD business, the company said it would "Focus on reducing costs and improving product mix amid persisting oversupply due to competitors increasing production capacity."

There are many reasons why Samsung's DP turned in lower growth than the rest of the company. But Bloomberg's efforts to project that directly on iPhone X is just facile and lazy at best, and maliciously misleading at worst.

Bloomberg itself actually cited a second half 2018 projection by Samsung that stated: "OLED panels in the smartphone industry are expected to see a rebound in demand, especially as demand for flexible panels remains strong in the high-end segment."

That appears to directly contradict that assumption that any and all weakness in Samsung's OLED (and the Display Panel segment in general!) profitability is tied to Apple's ultra-premium, exclusive sourcing of custom, perfect OLED panels for iPhone X.

Hiding failures at Samsung to invent problems for Apple

Bloomberg noted that Samsung also supplies OLED screens for its own phones. It further portrayed the firm's 21 percent increase in phone sales during the quarter as if evidence that its screen business was only suffering due to iPhone X "weakness."

However, the March quarter was the launch quarter for Samsung's flagship Galaxy S9. Despite that launch, Samsung phone sales were only up 11 percent over the December quarter. Further, in the year-ago quarter, Samsung was still dealing with the Galaxy Note 7 crisis, so YoY growth from its catastrophic failure is hardly impressive. Samsung phone sales haven't actually grown since reaching the Galaxy 4 peak.

Also, production of new flagships would have sourced many displays in advance of the launch quarter, making the comparison between Samsung's March quarter sales of displays and finished mobiles a vast logical leap.

Bloomberg (also) neglected to point out that Samsung gave a rather dire outlook for its own phone sales: "Profitability in the mobile business is expected to decline quarter-over-quarter due to stagnant sales of flagship models amid weak demand and an increase in marketing expenses to address the situation."

Bloomberg actively repressed any mention of Samsung— the world's largest Android maker— reporting "stagnant sales" and "weak demand" of its own flagships to invent a line between iPhone X sales and Samsung's other problems occurring in its display segment.

By reporting that Samsung's DP segment was only experiencing OLED issues, and that its IM/Mobile segment was growing exceptionally— rather than just recovering from last year's massive blunder— it's clear that Bloomberg either doesn't understand much about Samsung at all, or was intentionally creating a false story just to desperately portray Apple's wildly successful iPhone X as a failure in some possible way.

The shifting goalposts of iPhone X

At its release last fall, the $1,000 starting price of iPhone X was presented as an insurmountable challenge by pundits who decided in their own minds that nobody would pay that much for a cell phone, much the same way that the original iPhone's $650 price was literally laughed at by Microsoft's Steve Ballmer.

Yet in both cases, the pundits were wrong. Apple's focus on new technologies and capabilities resulted in a shift in what people chose to pay for a phone, because neither the first iPhone nor iPhone X was really just a phone. Both are mobile computers with general purpose functionality that also replaced many users' dedicated music players, cameras and even the need for a PC.

Paying a few dollars a week to own the most advanced, easy to use mobile technology has resulted in "phone" prices going up, but has virtually erased the prices that were supporting many other businesses, from camcorders to MP3 players to PDAs to point and shoot cameras and netbooks.

Paying $1,000 for an iPhone is, therefore, a very reasonable proposition for many users, but certainly not everyone. If Apple actually expected to sell iPhone X to virtually all of its customers (the idea inherent in projections of 40 million extra units that it supposedly "cut" in the March quarter), why did it even bother to develop two, more affordable iPhone 8 models, and why did it spend so much of its iPhone event on those other models?

In reviewing iPhone X last winter, we stated that the premium new model would definitely appeal to early adopters, but that other models would likely be more attractive to users who weren't yet ready to change how they use their phone (or pay the new premium). No reasonable person should have expected iPhone X to outsell iPhone 8, even though it did during the launch quarter.

Today, Bloomberg is shoveling out daily suggestions that Apple is in a full panic because everyone on Earth isn't buying iPhone X, six months after it launched. Surely it knows that Samsung doesn't "mostly" sell Galaxy flagships, given that its overall Average Selling Price for phones is very close to $200.

The predictable cycle of iPhone sales

Additionally, despite selling incredible numbers of iPhones over the last ten years, the way that Apple introduces its products and immediately puts them on sale creates a surge of sales that always begins to fall off after demand is satisfied— much more so than other hardware makers.

This surge has been negatively presented as a problem by critics who instead focus on the drop in sales afterward. But the alternative would be for Apple to stretch sales out its launch curve and sell devices slower, exposing its offerings to more direct comparisons with competitors' subsequent products.

By surging sales during the holiday quarter, Apple monopolizes attention during the biggest buying season. Months later, Samsung and other vendors introduce new models around the beginning of the year at MWC, generally held in February. That's a stupid time to launch products because it's 4-5 months past the point where Apple has already sold buyers on its latest phone.

Yet in every March quarter, you hear braindead analysts and ignorant bloggers pointing out that some company has introduced a new phone with impressive specs, while the same time as they pretend to be concerned about Apple's falling sales. Across ten years, they still haven't figured out a very simple pattern.

Daniel Eran Dilger

Daniel Eran Dilger

Chip Loder

Chip Loder

Andrew Orr

Andrew Orr

Marko Zivkovic

Marko Zivkovic

David Schloss

David Schloss

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher