Why Apple Is a Great Dividend Growth Stock

You probably already know that getting paid to own a stock (i.e. receiving a dividend) is pretty great. You know what's even better? Having that payment grow over time.

Here's where a popular method of investing commonly known as dividend growth investing comes in. In a nutshell, a dividend growth investor looks to invest in stocks that pay significant dividends and can both sustain those dividends and grow them for the foreseeable future.

One stock that every dividend growth investor should consider for his or her portfolio is Apple (NASDAQ: AAPL), as it ticks all the right boxes.

Image source: Apple.

Apple's dividend is large and sustainable

As of this writing, the company behind the iPhone pays a dividend of $0.73 per share each quarter, or $2.92 annually, which works out to a yield of around 1.56%. This isn't the highest you'll find among potential dividend growth stock candidates, nor is it even close to the highest-yielding tech stock out there, but it's a respectable payout roughly in line with the S&P 500.

Perhaps more importantly, though, Apple's dividend is sustainable. Generally speaking, dividend payments come out of a company's free cash flow. So, to try to understand how sustainable a dividend is, we need to look at how much cash the company generates and compare that to the amount it pays out in dividends.

The percentage off free cash flow used to cover the company's dividend expense is known as the cash dividend payout ratio. The smaller the percentage, the more sustainable the dividend is (since it's more likely to be maintained even during a significant business downturn).

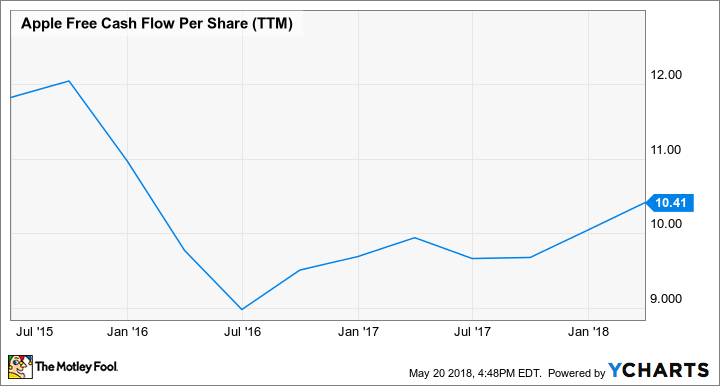

AAPL free cash flow per share (TTM). Data by YCharts.

Apple's current dividend payout ($2.92) represents just 28% of the company's overall free cash flow per share ($10.41). Income investors should take comfort that Apple could cover its dividend expense several times over out of the cash it generates.

Dividend growth capacity

Since Apple pays out just 28% of its free cash flow per share in the form of a dividend, it could increase its payout -- and do so quite substantially -- by simply choosing to allocate more of its free cash flow to the dividend.

While I think this is a possibility, Apple seems to prioritize share repurchases because management thinks the stock is undervalued.

The good news, though, is that Apple's free cash flow per share has been trending up over the last 10 years (with some lumpiness here and there). So, if you believe that the company has significant growth potential left, then you'd have reason to believe that the company's overall free cash flow will go up as well. Even if Apple chooses to hold their cash dividend payout ratio constant, increasing cash flow would lead to further dividend increases.

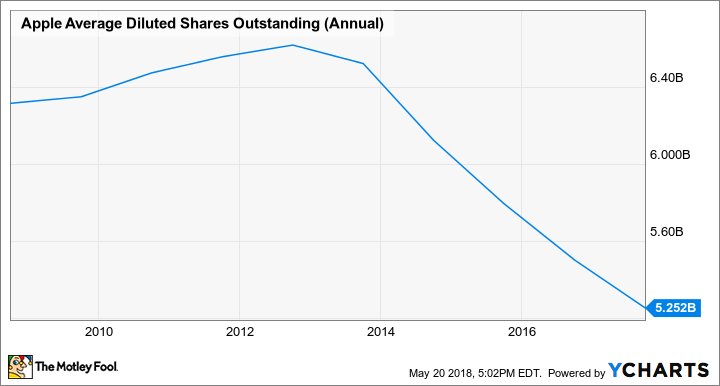

Another thing to consider is that Apple has been aggressively repurchasing stock and even announced that its board of directors had authorized yet another share repurchase program good for $100 billion worth of the stock. Share repurchases have the nice effect of increasing free cash flow per share because the share count comes down. Higher free cash flow per share should ultimately translate into a fatter dividend for stockholders.

AAPL average diluted shares outstanding (annual). Data by YCharts

So, with the combination of potentially increasing free cash flow, a shrinking share count, and room for Apple to funnel more of its free cash flow per share to the dividend, dividend growth investors should find plenty to like here.

More From The Motley Fool

Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.