73% Oracle customers upgrade to stay supported, no reported ROI

A report from Oracle Application User Group and sponsored by Oracle entitled ERP Upgrades: What's Your Philosophy? makes stunning reading. The report, which runs 33 pages and is graphics heavy kicks off with a masterful piece of spin:

Moving to the latest release of an enterprise application suite (enterprise resource planning, or ERP system) is often perceived as a daunting task in the popular imagination. Fears are further exacerbated by media and analyst reports of such projects as expensive and invasive time-sinks that take up the attention of the business. However, a new survey of enterprise application managers finds that the vast majority of ERP upgrade efforts tend to be short in duration, fall within reasonable budgets, and rarely disrupt the business at large.

Also contrary to perceptions, many ERP upgrades benefit the entire business, not just IT departments. Once properly executed, initiatives to improve and update ERP systems can be far reaching, providing enterprises with improved productivity, greater streamlining, and more robust capabilities for reaching out and serving new markets and constituencies.

That sounds hopeful doesn't it? But when you dig into the numbers a very different picture emerges from the 327 enterprise customers surveyed. The key takeaways per the report for my purposes:

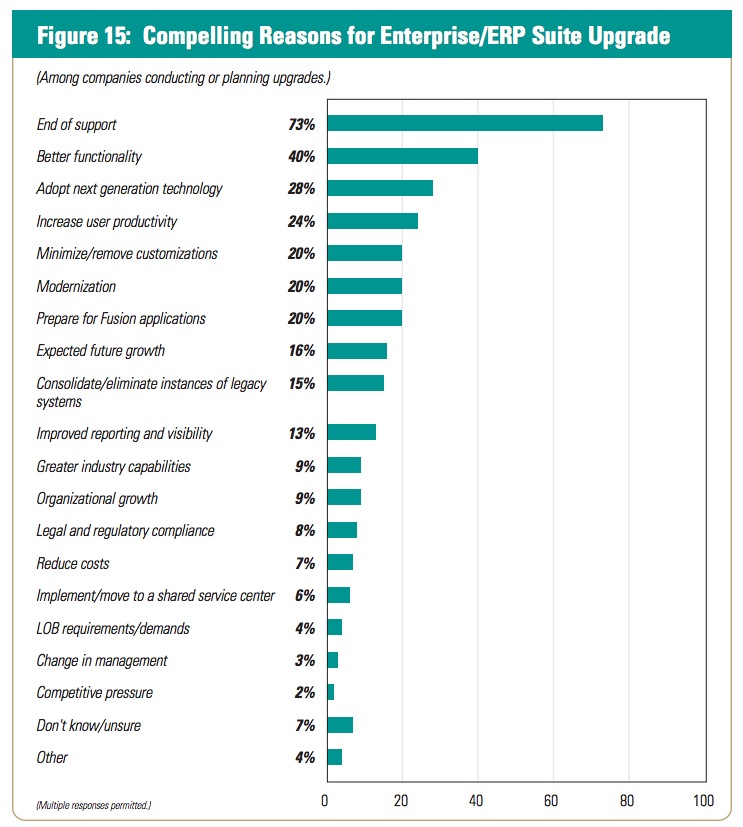

Close to half of respondents intend to move to the latest release of their enterprise/ERP suite within the next two years. While it’s inevitable that end-of-support will drive many upgrade decisions, respondents are anxious to be able to access new functionality, as well as implement applications that will boost their users’ productivity.

What the highlights don't say is that 73% cited 'end of support' as a compelling reason to upgrade their ERP suite. 40% anticipate better functionality but only 20% were preparing for Fusion applications. (Multiple answers were permitted.) That cannot be good news for Oracle, which has been trying to get traction for Fusion. You can argue that this is a relatively new suite so you would not expect the numbers to be that great. But then Oracle has expended plenty of effort marketing the Fusion message and has actively encouraged its largest partners to bang the drum on its behalf.

It doesn't get any better once you start examining the scope of upgrade. See the next illustration:

The typical length of time for an enterprise/ERP upgrade is between six and 12 months, as cited by 44 percent of respondents. A third of respondents overseeing limited upgrades (confined to technical or functional upgrades), completed their projects in less than nine months’ time. For a majority of respondents, disruptions to their businesses were minimal; close to half say they experienced five or fewer days of disruption or downtime.

What the highlights don't say is that 44% of respondents took more than 12 months to upgrade including a staggering 13% not knowing how long it took. Where the scope of upgrade was deemed transformational, 60% took more than 12 months. Even where the upgrade was technical 28% took more than 12 months. A whopping 34% of those undertaking an ERP upgrade did not know or were unsure about the length of business disruption.

Even more worrying is that a full 47% of respondents upgrading ERP did not know the total cost of upgrade, with 23% saying it cost more than $1 million. That lack of visibility was pretty much across the board with 30% of business employing more than 5,000 people reporting an unsurprising $1 million plus bill. In that same group, 47% didn't know the cost of upgrade.

Despite the report's attempted spin about value, 54% of those implementing within an ERP footprint were not implementing additional modules. Those who were implementing new were either in the low teens for financials (10%) or single digits for new projects, procurement, CRM and HCM.

The one staggering omission from this report is that the survey never asked about the ROI of upgrading. In other words, the survey has carefully avoided one of the most critical questions that any CIO should be able to answer.

By any measure, these statistics make damning reading. You can look at them a number of ways:

- Customers are hoping and praying they don't get left stranded so are forced into upgrade

- The situation is so dire that many are throwing money at the problem without really thinking it through

- Anticipated benefits are just that - faith based expressions of what Oracle will deliver as a result of the upgrade.

- Fusion won't be going prime time anytime soon.

But then it is not all bad news:

I can't understand why customers feel compelled to pay for improved performance and scalability. In the SaaS/cloud world, your performance had better be world class or the application gets kicked to the curb. Scalability is taken for granted. Customers are anticipating new functionality as the headlines say but just how much? PeopleSoft HR customers for example have had precious little to show for their maintenance dollars since the company was acquired.

All of this will be good news for the third party maintenance brigade. Companies like Rimini Street, which is locked in legal proceedings with Oracle will see this as a gift. What better way to sell a value proposition than to beat Oracle over the head with its own customer data?