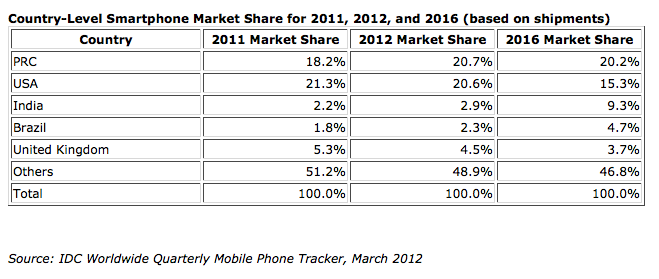

China is already a significant market for companies like Apple, with CEO Tim Cook describing “staggering” and “off the charts” sales of the iPhone in China last quarter. But according to IDC the opportunity is just beginning for Apple and others working in the smartphone world: China is set to become the world’s largest smartphone market this year, overtaking the U.S., which has led in years past.

IDC says this is part of a larger trend of emerging countries getting up to speed with developed nations: by 2016, China will be joined by Brazil and India in the top-five countries in terms of smartphone shipments. Countries like the U.S., U.K. and Japan will continue to see growth, but not at the rate of these other, more populated countries.

The growth of China is something that IDC had already started to track in 2011: China had already overtaken the U.S. in terms of shipments in the last two quarters of that year, it said today.

The shift raises questions about pricing and what we might expect in these devices as they roll out to bigger markets.

IDC notes that so far, in China, it has been the rush of sub-$200 Android devices that have benefited most from the surge in smartphone demand. But it believes that the trend will be for smartphones to cost less than $50.

The big names so far have been domestic handset makers like Huawei, ZTE, and Lenovo, but Samsung and Nokia (which had once led the smartphone market in China before the Android onslaught) are also playing a part with the launch of cheap devices. Nokia’s first Windows Phone handset China — one of its less expensive Lumia devices — is expected to launch by the end of this month.

That drive for domestic handset makers is not only being played out in China. In India, names like Micromax, Spice, Karbonn and Lava — also developing low-cost devices — are trying to set the agenda for what consumers demand and expect out of their smartphones. However, up to now more global brands like HTC and Samsung have been leading the pack.

Brazil, meanwhile, seems to be facing a still-high cost for devices, and it is only this year that average prices have come down to below $300 for a smartphone. Whether Apple chooses to try to create devices to better target users in markets like this one, rather than continue to aim for the high-end consumer, still remains to be seen.

IDC notes that it will not just be about cheap devices, however: it says that carriers will have to step up with innovative data plans, and probable handset subsidies, to get people using smartphones to their full effect.

Some good headway seems to already have been made in that area in some emerging markets:

Some statistics out yesterday from OnDevice Research found that in China, some 38 percent of consumers are only accessing the Internet from their mobile devices. In comparison, countries like the UK registered at 25 percent; while countries with less fixed infrastructure registered with even higher percentages: Nigeria’s figure was 56 percent, and Kenya’s was 51 percent. In effect, that means the opportunity is there not just for device makers, but for carriers and the many companies developing content as well.