Apple to post fiscal Q4 miss on cannibalized Mac sales, analyst says

Despite raising sales estimates for both the iPhone and iPad, BMO analyst Keith Bachman said the just-ended June quarter and upcoming final fiscal quarter of 2012 will be "challenging" for Apple as the tech giant moves into a new product cycle, reports Barron's.

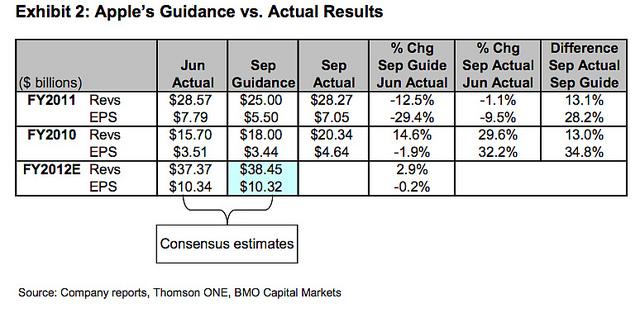

Apple could see a $5.5 billion miss from the $38.5 billion consensus for the company's fourth fiscal quarter ending in September if its third quarter performance is in line with the current $37.5 billion forecast, according to historical patterns and outlooks.

Bachman reiterated an "outperform" rating for AAPL, however, and bumped the stock's target price to $700 from $695 on higher iPhone sales for the ensuing six quarters. Including the fiscal third quarter that just ended, Bachman upped iPhone unit sale estimates for the next year and half by 1.5 million units and also raised his iPad sales estimate by 3.8 million units.

Apple's strong iDevice forecast was tempered by a lowered Mac sales estimate that is expected to drop 1.6 million units over the same six quarter period. Bachman dropped his Mac sales estimate from 18.65 million units to 18.22 million for 2012 and sees that decline carrying over into 2013 which slipped to 20.18 million from 21.38 million.

"Net, we are lowering our Mac forecast by 1.6 million units over the next six Qs," Bachman writes. "We think strong iPad demand is negatively affecting Mac sales, despite the recent MacBook refresh. For the next six Qs, we reduced our Mac sales by 40% of the increase in iPad sales."

Source: BMO Capital via Barron's

It was noted that investors are unlikely to overreact to the rare miss as Apple revenue is likely to rebound following the launch of a next-generation iPhone this fall.

"However, we think investors are well aware of the product cycle, and likely negative revision to near-term estimates," Bachman said. "Moreover, we think Apple shares will respond in a positive way to the pending launch of the new iPhone, as we look to year-end. If Apple is able to launch the new iPhone in the month of September, then actual unit shipments in the September Q will be less relevant, as management and investors will focus on the momentum of the new iPhone."

Mikey Campbell

Mikey Campbell

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

David Schloss

David Schloss