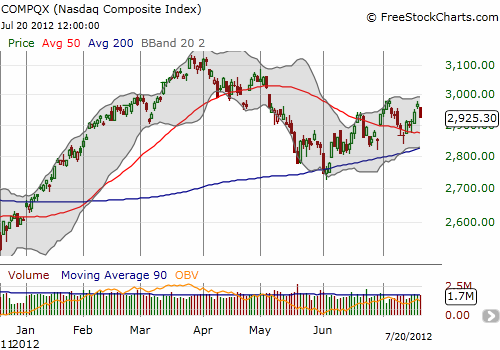

The NASDAQ has churned mightily in an uptrend that is slowly but surely grinding upward from the June lows. Support at the 200DMA held in June and now the technology-laden index is working on holding support at the 50DMA.

Embedded in this churning action are lots of chills and thrills. Two big cap tech stocks that have grabbed closer attention from me during this volatile period are are Intel (INTC) and Cisco (CSCO).

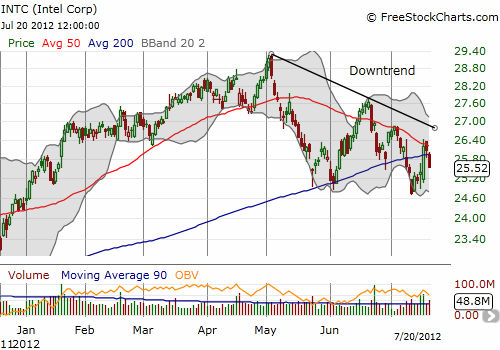

INTC was trading below its 200DMA before reporting earnings on July 17th and looked set to follow-through on the downside. INTC delivered a very lukewarm report and lowered its expectations for revenue growth this year: “As we enter the third quarter, our growth will be slower than we anticipated due to a more challenging macroeconomic environment.” The stock opened slightly down the next day only to soar in an abrupt move higher, presumably on the heels of remarks from Federal Reserve Chairman Ben Bernanke that morning. He once again promised to respond if the economy weakens further, and the market decided to treat this as new news.

INTC made an impressive move that looked bullish at the time. It cracked right through its 200DMA and for a brief time traded above its 50DMA. However, it closed below resistance at the 50DMA and has now sold off two days in a row. The stock is once again below the 200DMA. With looming resistance pressing lower, INTC seems primed to confirm its downtrend from the May highs with a lower low.

Cisco (CSCO) has yet to report earnings for this quarter, but it has yet to recover from May’s disastrous earnings report. Not only has it failed to reverse any of those losses for longer than a few days, the stock remains capped by a rapidly declining 50DMA. CSCO also benefited from the stock market’s hair trigger response to Bernanke’s sweet elixir, but it has almost returned all those gains. It does not seem likely that the stock will hold its 2012 lows for much longer without a major positive catalyst. A break of support sets CSCO up to return the rest of its rally from last October’s major bounce.

The bearish action in INTC and CSCO contradict the slow and steady (bullish) progress the NASDAQ is making from the June lows. It is hard for me to imagine this divergence continuing for much longer. For now, I am betting on further bearish action out of the individual stocks (CSCO is part of a pairs trade with Juniper (JNPR)). Based on my favorite technical indicator, the percentage of stocks trading above their 40DMAs (T2108), I am also expecting further weakness in the NASDAQ back to 50DMA and/or 200DMA support.

Be careful out there!

Full disclosure: short INTC, long CSCO puts, long JNPR calls

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Intel And Cisco: Pullback From Critical Resistance

Published 07/22/2012, 03:21 AM

Updated 07/09/2023, 06:31 AM

Intel And Cisco: Pullback From Critical Resistance

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.