Cisco Q4 better than expected

Cisco reported a better-than-expected fourth quarter as the company weathered a tricky fiscal year.

The company reported fourth quarter earnings of $1.9 billion, or 36 cents a share, on revenue of $11.7 billion, up 4 percent from a year ago. Non-GAAP earnings were 47 cents a share.

Wall Street was expecting non-GAAP earnings of 45 cents a share on revenue of $11.6 billion.

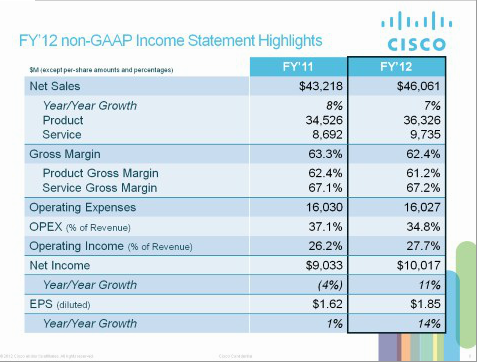

For fiscal 2012, Cisco reported earnings of $8 billion, or $1.49 a share, on revenue of $46.1 billion, up 7 percent from a year ago.

In a statement, Cisco CEO John Chambers said that the company is executing well and poised to capitalize on cloud computing, mobility and video traffic among other trends.

Cisco projected revenue growth in the first quarter to be 2 percent to 4 percent higher than a year ago. Non-GAAP earnings in the first quarter are expected to be 45 cents a share to 47 cents a share, in line with Wall Street estimates.

Going forward, Chambers explained during the quarterly call with investors on Wednesday that Cisco will be focusing on "five foundational priority areas in terms of revenues," most of which revolves around Cisco's core businesses: routing, switching, wireless and security.

But Chambers cited security, in particular, as a growth spot for Cisco.

Expect to continue to invest and execute here. Transitions like the move to cloud based delivery models and transitions to bring your own device play to our strengths, and we plan to continue to capitalize on these opportunities -- especially inthe security space.

Chambers also emphasized networking and related partnerships such as those with EMC and VMware as highlights and potential growth spots.

An area that many of you have asked us to discuss is our view and the focus on software-defined data centers and specifically the effect on our strategy as it relates to networking. As a quick summary, the discussion is around evolving networks to be more programmable, more virtual, and more flexible. Make no mistake about it, our goal is to lead this evolution along with our partners and I would point to three advantages that we have in this marketplace. First, customers understand that optimizing for the hardware and software combination to drive consistent experience, policy, quality of service, security and mobility is the only way in our opinion to meet their total cost of ownership, reliability and scalability requirements. They want their networking vendor to deliver an evolutionary and also a comprehensive approach. Second, we have a complete framework, across the portfolio that addresses all the elements of network virtualization.

Chambers later cited Cisco's global market presence as the third factor that gives the San Jose, Calif.-based corporation a "unique glance into customer requirements."

Going into Cisco's earnings, analysts were expecting a strong fourth quarter on decent enterprise demand. A long-term issue for Cisco, however, is the trend toward network virtualization.

By the numbers:

- Cisco ended the quarter with $48.7 billion in cash, cash equivalents and investments.

- Product sales for the fourth quarter were $9.15 billion and service revenue was $2.54 billion.

- Cisco spend $5.49 billion on research and development in fiscal 2012.

- Total inventory as of July 28 was $1.66 billion, up from $1.48 billion in the same period a year ago.

- Days sales outstanding in the fourth quarter was 34, down from 38 a year ago.

- Inventory turns were 11.7, roughly even with a year ago.

- Cisco had 66,639 employees at the end of the quarter, up 1,400 from a quarter ago. Half of those new additions have been added to emerging markets.