SAP, Oracle negotiations: It's complicated

You know the enterprise software drill by now and the ever-evolving models of SAP and Oracle are making negotiations a bit more complicated.

Here's the deal:

- Maintenance fees increase every year and resemble college tuition rates when it comes to inflation.

- Oracle and SAP are buying up cloud vendors, which provide an additional revenue stream to these giants. And potentially more lock-in.

- Audits are becoming more intense as enterprise software players aim to preserve revenue.

- Virtualization and even things like sensor data can increase your costs.

With that not-so-happy picture, here's a look at a few negotiation takeaways when dealing with SAP and Oracle. Gartner analyst Joseph Neapolitan gave the presentation on SAP and his colleague Jane Disbrow covered Oracle later in the day.

SAP

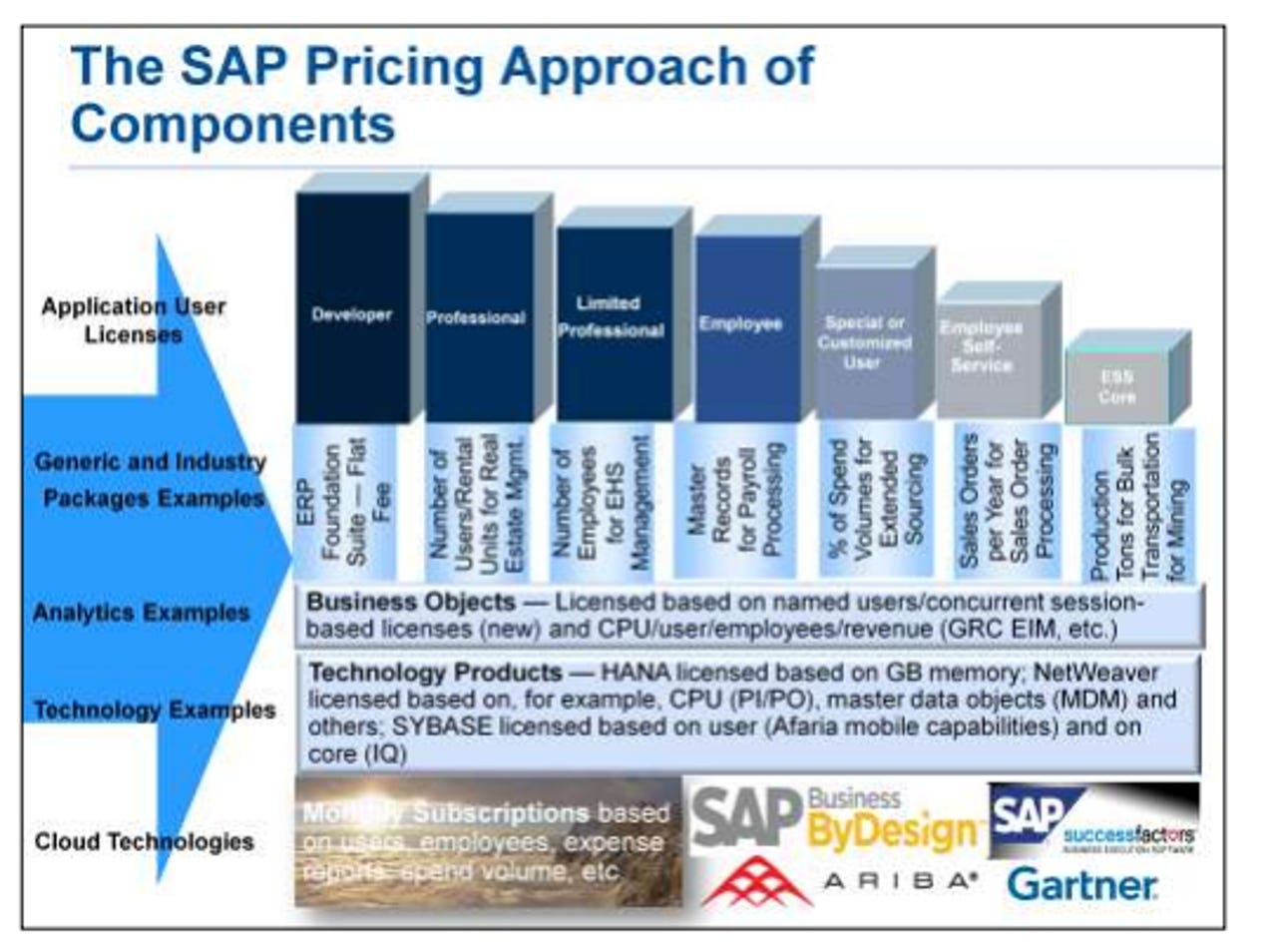

First off, SAP's pricing model is a wee bit complicated. Check it out:

Confused yet? Me too. But at a high level, SAP buyers need to know the following:

- You can squeeze SAP with alternatives. Investigate Oracle, custom development, third party maintenance and SaaS as options instead of SAP. "Using SaaS providers of services, particularly in the areas of HCM and CRM but also increasingly even in finance, can be effective; reinventing the homemade solutions, especially using offshore resources, and looking at third-party support options, such as Rimini Street, all provide good leverage," said Neapolitan.

- SAP pricing is different based on region. List prices vary around the world. Europe is the least expensive option for SAP buyers. SAP happens to be based in Germany.

- Discounting is more aggressive today than it has been in the past---especially for those large transactions that make or break a quarter.

- SAP customers are struggling to justify the enterprise support offering. Standard support may be a better option.

- License capabilities not products so there's not product bundling and overlap.

- HANA pricing isn't discounted.

Oracle

- Oracle has a bevy of moving parts. The biggest issue for IT buyers is that the company acquires companies repeatedly. The Oracle you negotiated with three years ago is a different entity today.

- Changing technology, cloud or licensing agreements can translate into increased costs.

- Discounts are all over the place, but maintenance fees rise. Deal size also nets you discounts.

- Most of your leverage comes when you do the first deal with Oracle.

- Server refreshes impact your Oracle licensing costs. Why? Oracle recognizes hardware partitioning, but not software. Oracle VM may get you out of a pickle. Partial licenses are difficult to remove from Oracle support. Oracle also charges more for servers using multiple cores.

- Global pricing is based on the U.S. dollar so international companies are getting a deal due to a weak Greenback.

- Application licensing is offered based on revenue, operating-budget and employees.

- Unlimited use licenses may cost you more in the long run. Negotiate with Oracle six months before your deal is up.

- Oracle can and does change license metrics for acquired products.

- Watch Exadata pricing carefully regarding software updates and gotchas.

- Cloud agreements are a mystery. Disbrow noted:

At this point, Gartner has seen few Oracle Cloud contracts. However, organizations should expect a high level of sales and marketing focus on Oracle's cloud offerings in the next 12 months. Several Oracle products are available as cloud serviced today (Fusion, CRM on demand, Taleo, RightNow). But the selling and marketing appears to be ahead of the scalable delivery of the new offerings, and sales presentations are not contractually binding to Oracle.