What started off as a grim year for smartphone sales turned into an optimistic look forward. 2012 saw record returns for Samsung and its arch rival Apple, as both companies experienced tremendous growth in sales numbers and worldwide market share. And with this year's handset models, the two competitors essentially set the precedent for what sells in today's smartphone market.

As consumers face an onslaught of sales from retailers—and as handset makers consistently push forward new models—the market has become more than just a two-tyke playground. Consumers should have choices like never before in 2013, what with RIM trying for a comeback and Microsoft's Windows Phone 8 aiming to take off. Ars chatted with a few analysts about what the 2013 landscape might look like, which brands will make it through the year into the next, and which companies will need to straighten up their act to make it at all.

All hail king (or queen?) Samsung

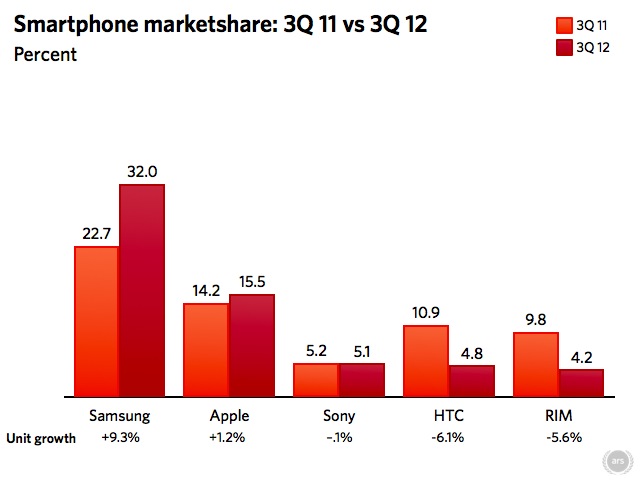

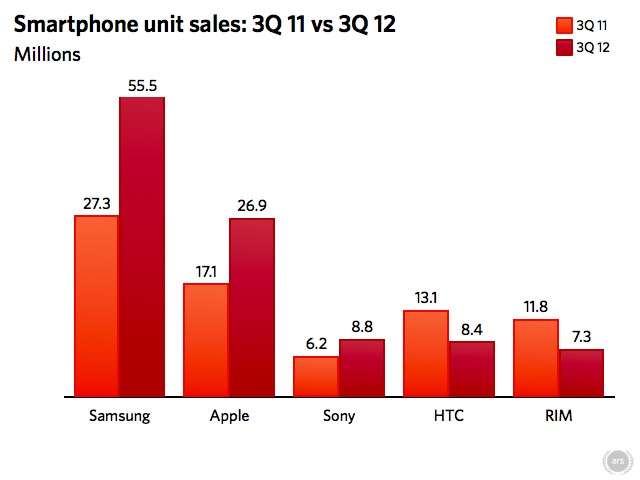

A look at the third-quarter results provided by Canalys shows Samsung currently reigns as the top vendor on the market: 55.5 million smartphones sold last quarter. This is largely due to the handset offerings the company pushed forward within the last year, including the top-selling Galaxy SIII. Samsung managed to increase its global market share from 22 percent this time last year to 32 percent. It also nearly doubled its profit in the third quarter, hitting its very own all-time record for handset shipments. Overall, Samsung made about $47.6 billion in sales and increased revenue by 26 percent.

Samsung's advantage here—and the reason it remains on top—is that its consumers know it by brand. The name "iPhone" is synonymous with Apple's smartphone, and the word "Galaxy" is just as well-regarded. "Consumers know their Galaxy," Carolina Milanesi, research VP of consumer devices at Gartner, told Ars. "Some know Galaxy before they know Samsung."

It also helps that Samsung offers smartphones across many different carriers to further establish its leadership in the Android sphere. It will be interesting to see if Samsung can have the same success with its Ativ smartphones in the Windows Phone lineup. "It's going to be a little harder in the beginning," explained Milanesi. "Right now it seems that their Windows Phone approach is very cautious. They only have one device shipping."

Samsung's plan with the Windows Phone 8 lineup may be to sit and wait until consumers are really sold on the brand. So far, Nokia has the most well-known Windows Phone handset, and breaking that notion will be difficult. Still, Samsung has a leg-up with its halo effect. "[Samsung has a] big leadership in TV and is kind of seen as an innovator," Forrester Principal Analyst Charles Golvin told Ars. "They transformed themselves from being a fast follower to an innovator with new capabilities. They're clearly positioned as a leader with the various devices that they make."

The unstoppable iPhone

Keeping with the playground idea, if Samsung is first, Apple can confidently claim "second is the best." The September 21 launch of the iPhone 5 means it came out too late to be included in Canalys' third quarter sales figures, but Apple is still holding strong. The Cupertino-based company holds the number two spot with 26.9 million iPhone units sold. Shipments of the venerable handset have grown 57.6 percent since last year. It helps that, like Samsung's offerings, the iPhone is available on almost every major carrier. It's also possible the numbers could get even higher with the iPhone 5 as more people switch over their two-year contracts.

Golvin said that despite Android's diversity in price, it still won't keep spendthrift consumers from switching mobile platforms. Previously, price sensitive consumers were relegated to Android phones because of the iPhone's exclusivity on AT&T. But now that it's more widely available, consumers can use the carrier's subsidized price to get an iPhone 4S for little to nothing. "It's an important change, because now these entry-level, price-conscious smartphone buyers have more choice," continued Golvin. "They have an iPhone on the table that is a potential solution."

This could also help tilt unit sales in the iPhone's favor going into the new year. "I think there will be a good list on iPhone 4 and 4S sales as a result of [the carriers] being able to offer that product fully subsidized," Golvin said.

While the iPhone 5 is sure to be a big seller this holiday season, it will be interesting to see if it keeps the fervor going once the phone hits the half-year mark in 2013. Consumers could instead start putting away cash for the next iteration of the device. Though Apple now typically launches its new handsets closer to the holiday season, the company may not want to cede the market to other smartphone makers during the "off" season. Ultimately though, past figures have shown the iPhone remains a strong seller no matter how close the date gets to the next iPhone release.

The little guys

Sony comes in as the number three handset maker in the world according to Canalys. The company sold about 8.8 million units worldwide. Although its market share in the US still isn't much—less than 0.5 percent—it's holding strong globally. According to Golvin, Sony has always had better traction in Europe because of the Ericsson brand. In the US market, Sony's disadvantage is that it doesn't offer many CDMA products, which limits the company mostly to AT&T and T-Mobile.

LG also saw tremendous growth last quarter. This surprised analysts, as the company has been struggling to make a profit since 2011. Its sales went up nine percent for the third quarter and about seven million phones were sold. Seventy percent of its revenue this quarter also came from smartphone sales, and LG says it's because it met the demand for LTE-capable handsets.

Despite the good news for LG, the company's market share has severely diminished since Q3 2011. Last year it had about 4.8 percent global handset market share, but that dropped down to 3.3 percent this year, according to Gartner's numbers. The company's lack of traction with its Android handsets in the US may have hurt its global significance, and its entrance into Google's Nexus program might not help too much, either.

"To be honest, LG is the least clear of these players," said Golvin. He says LG has attempted to mirror what Samsung has done with its Android handsets: introduce a broad product lineup that includes every type of handset from top to bottom and offer different models from entry-level to the high end. "I think that the question mark here is how much traction LG is going to get with the big operators for a premier device," added Golvin. "Can they displace or put themselves alongside Samsung with a product that the market will see as good as the SIII? They don't seem to have captured the mind share of consumers in the way that Samsung has."

HTC also has some catching up to do. Though it managed to stay ahead of RIM in fourth place, Canalys showed the company still only attracted 4.8 percent of the global smartphone market share last quarter. The company launched its One series of Android handsets earlier this year ahead of the iPhone 5, but that wasn't enough to give it an edge (or get its name back on the public's radar). In total, HTC sold only about 8.4 million smartphones and fell about 36 percent from last year's earnings.

Again, the problem here is that HTC has no outstanding brand name. The company once had the "new kid on the block" persona when it was first brought to Verizon as the flagship Android manufacturer. Since then, the company has had problems evolving with the times. The "Droid" branding once bestowed upon HTC has since been passed over to Motorola. Though HTC's Sense UI is one of the more usable versions of the OEM Android overlays (in this writer's opinion, anyway), the company has done nothing to advertise that. Its 1080p Droid DNA might not help it either: with 7-inch tablets infiltrating the market, its phones might be getting too big. To make matters worse, Samsung has already captivated that niche market with its Note. "They need to stand out. At the moment, they don't," said Milanesi. "They might have a chance in the Windows ecosystem, but with Nokia it's going to be hard. They need to put more muscle in advertising and really understand who they want to be."

RIM's comeback?

Still trailing behind is Canadian-based RIM. The company was once revered for its secure, business-ready handsets, but now it's teetering on life support. RIM managed to sell 7.3 million handsets last quarter, which puts it at a 38.4 percent loss since last year's Q3 financial results. Its last handset release was the BlackBerry Bold Touch 9930, which hit Verizon Wireless and Sprint last summer. To add insult to injury, more and more companies are ditching RIM and its BlackBerrys for other smartphones (Yahoo being one of the latest). Its current market share stands at 2.1 percent among overall handsets on Gartner's charts and 4.2 percent among smartphones according to Canalys.

RIM does have some new products coming down the pipeline, including its new BlackBerry 10 operating system. That's on track for a Q1 2013 release, and a slew of new handsets could give the OS the boost it needs. RIM is also doing whatever it can to garner interest from developers to distribute their apps within the BlackBerry App World. RIM opened its virtual marketplace to Android developers in the hopes that it could attract this population to fill App World with quality applications.

Regardless, RIM still has a difficult journey ahead. "It's going to be hard," Milanesi said. "Their big problem is the ecosystem and convincing developers that they have a shot. In the enterprise space, they've let somebody else in." Thanks to security advancements, enterprise users can now utilize iOS and Android devices instead of BlackBerry ones. Additionally, consumers have moved on from what RIM offered exclusively, like BlackBerry Messaging and Exchange e-mail support.

Essentially, it's going to come down to where RIM fits in the bigger picture. Consumers learned to stick with one ecosystem, which keeps them locked into one platform if they've already put forth the investment. "A lot of customers have gone to iPhone and Android, and they're probably not coming back," Golvin said. "These [new BlackBerry] devices will do well among RIM loyalists, but I think it's going to be really hard for them to win customers back."

2013: Four ecosystems to rule them all

There's no doubt in Golvin's mind that iOS and Android will continue to dominate in 2013, but there's also plenty of optimism about Microsoft's Windows Phone 8 platform. "I do expect to see Microsoft gain," he said. "There was a time when Microsoft had a more meaningful share of smartphones overall. I expect 2013 to be a bit of a rebound year—I think they're going to finally reverse [the downward] trend and start to see some uptick." Golvin added that with Microsoft's overall UI change in its desktop software, consumers will become a little more familiar with Windows Phone 8. This will give the platform a chance to become more relevant. "With people having that common experience with PCs and tablets, now [the UI] is going to be less of an issue."

Overall, 2013 looks to be a promising year for companies that have already pushed forward as the manufacturers to beat. Samsung and Apple will remain in the top spots as long as both companies continue to offer their premium products on all major carriers (and the smaller ones, too). The others playing catch-up—HTC, LG, and Sony—will have a tougher time unless they change their marketing strategies or strike up new deals with carriers. As for RIM, it's possible the company will keep its headway with old school loyalists and those who remember the brand for how trustworthy it once was. But the company will have a tough time attracting new customers otherwise—as the numbers clearly show, many other users are already locked into and happy with other ecosystems.

reader comments

62