Happy Friday to anyone working today–or not working–and poking around the inter webs. Although it’s the Friday before the holiday break, some interesting data came out from the Kantar Worldpanel today that I thought I would highlight. Kantar’s latest smartphone sales data is showing that despite the increased competition, Apple has actually grown its smartphone platform market share in the United States.

Global Consumer Insight Director Dominic Sunnebo stated:

“Apple has reached a major milestone in the US by passing the 50% share mark for the first time, with further gains expected to be made during December.”

Other data from the report highlights platform share in other parts of the world and the various changes. However, despite all the questioning I continually see from the investor community of whether Apple can remain competitive despite increased competition, increase in latest Android smartphone subsidies from carriers, other platforms like Windows Phone 8 emerging, yet amidst those questions and what seems like steep odds, Apple is actually gaining market share.

Keep in mind this is all being done with a limited iPhone lineup. One current generation, and two legacy products still selling well in the marketplace. I’ve said for a while now that Apple is competing against an army of Android devices. The continual sales numbers and marketplace demand for the iPhone remains incredibly impressive despite the massive Android army they are competing with.

That alone is enough to show this market is not acting like many of the pundits and financial analysts assume. Many assume this market looks like the PC industry of old where the market is dominated by one single platform. Wrong on every level.

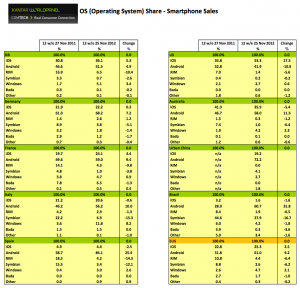

Take a deeper look at this chart (click on it to enlarge it) as it is very telling in a number of areas. First iOS grew from 35% to 53% in the US market, a change of 17.5% from the same period a year ago. Android went from 52.8% to 41.9% in the US market, a decline of 10.9%. The US market is arguably the most mature smartphone market on the planet. I wonder the degree other markets, as they mature, begin to look like the US, keeping in mind the carriers and how and what devices they subsidize over others. All things equal, however, may paint a similar picture. And don’t think for a second the US an insignificant market and/or litmus test for others. No sane executive at any OEMs believes that and in fact I continually hear from them how important the US market is.

This is a huge market and keep in mind the total addressable market for smartphones is not static but it is dynamic. It is growing by hundreds of millions of new customers every year and will do so for at least the next five years. So to say Apple has increased market share in the US, means that they are also attracting new customers and benefiting from the TAM expansion, arguably more than any current vendor.

I’m yet to write my predictions for 2013, and I will the week following the holiday break. But I believe the smartphone market will look very different this time next year and perhaps not in some of the ways assumed by the pundits.

1) We often measure iOS, Android, Windows and RIM in terms of popularity. But distribution obviously plays a huge role. Until February 2013, the iPhone was only sold on AT&T. It then expanded to Verizon in February 2012, Sprint and several regional carriers in 2011 and it’s not expected to be on T-Mobile in 2013. These additional points of distribution have obviously made a huge difference.

2) It will be interesting to see if a similar pattern occurs in Europe. Off the top of my head, I believe there are some 600+ carriers worldwide. Android is on 450 or so carriers and iOS is on 220 or so. Apple seems to be expanding its carrier network as it increases its supply of iPhones. It’s possible that as the number of carriers carrying the iPhone in Europe grow, the market share of iOS devices will increase there too. (Of course, the only carriers that seems to matter right now is China Mobile which is nearly as big as all the U.S. carriers put together.)

3) An Aside: One of the reason people were so excited when Nokia signed on with Windows Phones was because of their extensive distribution network. I believe that Nokia is on as many or more carriers as Android is and they have many other distribution points as well. Obviously distribution is important – but it’s also not everything. One has to have a phone that people want to buy before distribution matters.

Nokia’s carrier presence in the U.S. had become virtually non-existent and the Windows brand doesn’t carry as much cachet overseas as it does here … and I wouldn’t call Windows a very dynamic brand here either. If Nokia is getting Windows Phone into channels that rival Android’s distribution, then that clearly isn’t a good sign for Windows Phone because there has been almost no buzz or numbers to indicate WP is moving.

Sorry for the second post, but it occurred to me that one of the trends I am seeing everywhere is that there is a DOWNWARD push on any mobile device not named Apple or Samsung. Windows and Amazon, in particular, seem to be taking a beating this holiday quarter. Also, if this trend is real – and I believe it is – RIM’s chances of a resurgence are going from slim to non-existant.

You know I’ll disagree on RIM 😉

RIM has far better carrier support than Windows Phone worldwide and a die hard fanbase. Blackberry 10 has official Twitter, Facebook, Foursquare and EverNote support and a still-credible enterprise presence. Most importantly, it has a very low bar; it’s projected that RIM can sell as little as 20 million devices next year to stop the bleeding and it sold 7 million last quarter. Slim chance? Yeah but I wouldn’t say non-existent.

i wonder who will be buying the blackberry 10 when the blackberry is dropped by corporations left right and centre and the latest fee increased is another nail.

The pundits who did the projection should be in another field.

John, what would you say is causing this downward push?

…and all Apple had to do was release a new phone!

What bothers me is that Apple releases the iPhone 5 and, “See? Android is getting trounced!” But when Samsung released the Galaxy S3, “Well, obviously the numbers are going to be higher because it’s a new release!”

I think whatever disrespect Samsung faced evaporated when it sold 10 million Galaxy Notes, a phone that, based on conventional wisdom, had no business selling as well as it did. Any tech pundit who does not recognize Samsung as a credible threat to Apple by now should go into a different field.

I wonder did the buyers of galaxy note have buyer remorse when the note 2 was released.

I believe there will be 10 million less buyers of the galaxy 4 when it come out and it will be just a incremental update of whatever.

Two things struck me in this information. First is that Apple sells all they can make and that there remains room in world markets for significant growth. Second, pricing of Apple gear makes a lot of sense when your primary market is subsidized. I imagine we will see some changes in prices when selling unsubsidized phones is more important.

I agree, FalKirk, it doesn’t look very hopeful for RIM or MicroSoft’s non-windowing software based smart phone.

Ben, I’ll be very interested to read your predictions for 2013.

Analyzing the analysts, it seems odd to me that when they talk about European numbers, while they point out that Apple isn’t doing as well as the US, they never seem to mention that Apple still saw gains in the EU over all and some pretty decent gains in European countries that aren’t about to tank, like GB, Germany, and France. And then they switch from generic Android figures to Samsung specific numbers. I guess whatever context makes Apple look like they are struggling. Whatever. I find the Australian numbers more problematic than the European.

If I were Nokia I’d be very concerned that the Brazilian numbers aren’t transitioning to Windows from Symbian.

Joe

In Australia have the highest adoption rate of smart phones in the world. You don’t have to pay any money up front for any phone, including the iPhone. Samsung phones are very popular in Australia at the moment. The 20 somethings love their Samsung Galaxy S3s. It’s been the phone to get. But the market is fluid. These young people aren’t that committed to any platform. Some Android users I know have gone and bought the iPhone 5. These kids are simply not as die-hard as were people back in the days of the PC wars. They will argue long and vehemently and then just up and change their minds. Some people who get talked into Android phones, tend to express some regret. “I should have just got an iPhone.” It could be Android is at an apex. Particularly when people realise Android’s world-wide marketshare figures mean diddly squat. When Apple releases its sales figures for this quarter, I think what we’re going to see is this “war” fade away. Pundits will not say “well, maybe we got things wrong”. They will stop talking about it. Also what I see is the rise of “dumb” smart phones. People with smart phones who only want to call and text. As carriers stock mainly smart phones now, many people are ending up with smart phones who are not interested in any of the smart features. This trend includes the iPhone.

I really like reading through a post that can make men and women think. Also thank you for allowing me to comment!