Hold onto your hats and get ready for a big day.

Here are the five things you need to know before the opening bell rings in New York:

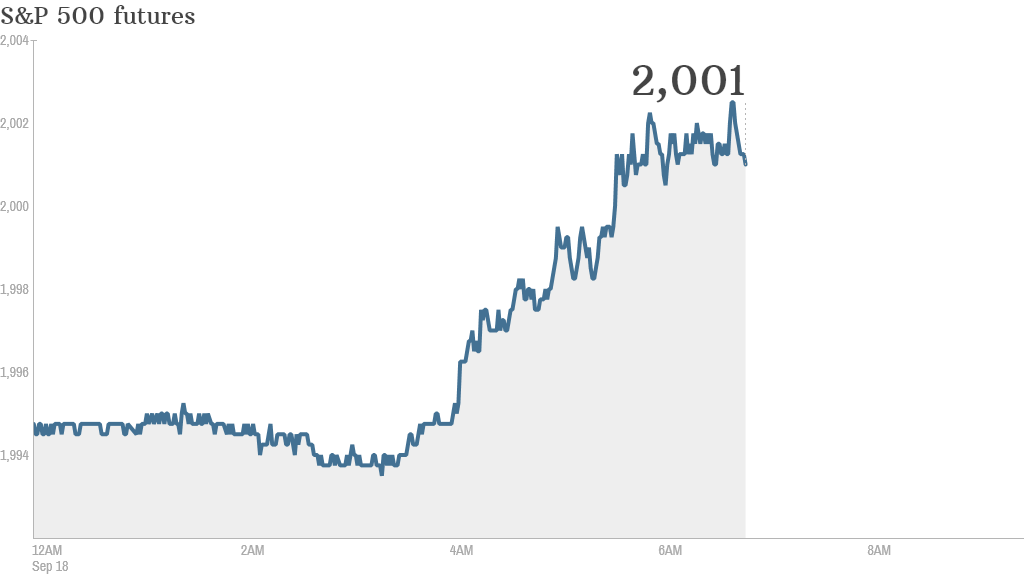

1. Upbeat markets: U.S. stock futures were looking perky, setting the stage for what could be another record high for the Dow Jones industrial average.

The Dow closed at a new high of 17,157 Wednesday after the head of the Federal Reserve, Janet Yellen, said interest rates would stay low for a "considerable time" after its bond-buying program wraps up. Investors cheered the announcement, also pushing up the S&P 500 by 0.1% and the Nasdaq by 0.2%.

Most European and Asian markets were also in positive territory Thursday. The Mumbai Sensex surged by 1.8% and the Dax in Germany was rallying by 1% in early trading.

2. Get ready for Alibaba: The company is expected to price its IPO after the market close in a range of $66 to $68 per share. The Chinese e-commerce giant is set to start trading in New York Friday in what could be the biggest initial public offering of all time. The company could raise more money than Facebook (FB) or Visa (V) when they went public.

3. Scotland votes on independence: Scots have begun voting Thursday morning to decide whether Scotland should become an independent country.

More than 4.2 million people have registered to vote, the largest electorate ever in Scotland, and turnout in the referendum is expected to be high.

A vote for independence would mean Scotland splits from the rest of the United Kingdom, made up of England, Wales and Northern Ireland.

Polls close at 5 p.m. ET. Results are expected early Friday.

London's main market index -- the FTSE 100 -- was moving higher alongside other European stock markets. The British pound was firmer against the U.S. dollar.

4. Stock market movers: Shares in Sony (SNE) came crashing down in Tokyo after the company forecast it would post a staggering net loss of $2.1 billion for its fiscal year ending next March. Shares fell by as much as 13% before recovering slightly to close with a loss of 8.6%.

Watch Pier 1 Import (PIR)trading Thursday. Shares plunged in extended trading after the company said profit was nearly cut in half during the most recent quarter.

5. Earnings and economics: Rite Aid (RAD) will report quarterly earnings before the opening bell and Oracle (ORCL) will report after the close.

The U.S. government will post weekly jobless claims at 8:30 a.m. ET. August housing starts and building permits come out at the same time.