iOS 5, 6, and 7 got many minor updates throughout their life cycles, but each received only one "major" update in their year or so as Apple's newest mobile operating system. iOS 5.1, 6.1, and 7.1 were all released several months after the initial release, and each update marked the point where the version became "mature."

Apple is mixing things up with iOS 8. Version 8.1 is here just a month after the initial release, and plentiful evidence shows that both versions 8.2 and 8.3 are already in testing at Cupertino. It's a rapid-fire schedule more in line with iOS 4, a release in which bug fixes and new features were introduced at a steady but more gradual clip.

iOS 8.1 shouldn't be compared to iOS 7.1, which gestated for a full six months and was vetted in five separate beta builds. It still introduces quite a few new features, though, and in the spirit of keeping our comprehensive iOS 8 review up to date, we've taken the most important ones for a test drive. This release doesn't fix all of iOS 8's biggest problems, but it's an important first step toward a more stable and more useful OS.

Apple Pay

-

Apple Pay is handled through Passbook.Andrew Cunningham

-

Andrew Cunningham

-

Enter credit card information manually or take a picture of it with the camera. In good light it's usually pretty accurate, but the more worn your card is, the more it struggles.Andrew Cunningham

-

Adding a card requires a confirmation message to an e-mail address or phone number associated with the card.Andrew Cunningham

-

Typing in the confirmation code.Andrew Cunningham

-

If your credit card provider doesn't support Apple Pay, the phone will tell you so.Andrew Cunningham

-

Cards offer lists of recent transactions and ways to get in touch with banks.Andrew Cunningham

-

The Staples app, which supports in-app Apple Pay purchases.Andrew Cunningham

-

Using Apple Pay to buy a Coke from an NFC-enabled vending machine. It only failed because I didn't hold the phone to the NFC reader for long enough.Andrew Cunningham

-

Once the transaction goes through, it shows up in Passbook.Andrew Cunningham

Apple Pay lets you scan compatible credit cards into your iPhone or iPad and then use that card to make purchases within apps and at NFC-enabled checkout counters. The credit card is stored locally in your device. It does not sync with iCloud. It is deleted if you wipe the phone. No part of the credit card number is ever available to Apple or to any of the retailers you're paying. A device ID and a unique per-transaction ID is used to confirm the purchases and charge your card, and once charged, the money you spend racks up rewards points and any other perks just as standard purchases would.

Apple Pay requires two pieces of hardware to work in apps and three pieces of hardware for contactless payments. The first is the TouchID fingerprint sensor, which is used to authenticate. Hold your phone to an NFC-enabled spot (usually something at the register, though I used a vending machine) while holding your finger on the TouchID button and the payment will go through. If TouchID isn't working, you can also enter your passcode to authenticate, which is just another reason to use longer passcodes if you're already using TouchID.

The second piece of hardware is what Apple calls the "Secure Element," a dedicated chip in supported devices. This is what's responsible for storing and protecting your credit card data—it can apparently be paired with any of Apple's SoCs, which is why the iPad Mini 3 can use Apple Pay in apps while the iPhone 5S can't. If you have those two things, the Apple Pay button can be used in apps that support it.

The third piece of hardware is the NFC sensor, exclusive at this point to the iPhone 6 and 6 Plus. It might have been nice to include NFC in the iPads to account for edge cases, but the decision to exclude it from tablets make sense. People look goofy enough using their tablets as cameras—they don't need to be waving them around at cash registers too. Retailers using iPads as point-of-sale systems already have plenty of options if they want to enable NFC payments, though it would be neat to have a POS system that supported Apple Pay out of the box.

Apple Pay is great when it works, and using my phone to pay for stuff was one of those "it feels like it's The Future" moments for me. Using NFC means it's already compatible with the wireless payment systems already out there, which is why I could snag a Diet Coke from the machine in the mall even though that Coke machine has been sitting there for who knows how long. The problems facing Apple Pay now are the same as the ones facing any mobile payments service—lack of universal availability and other businesses looking out for their own interests.

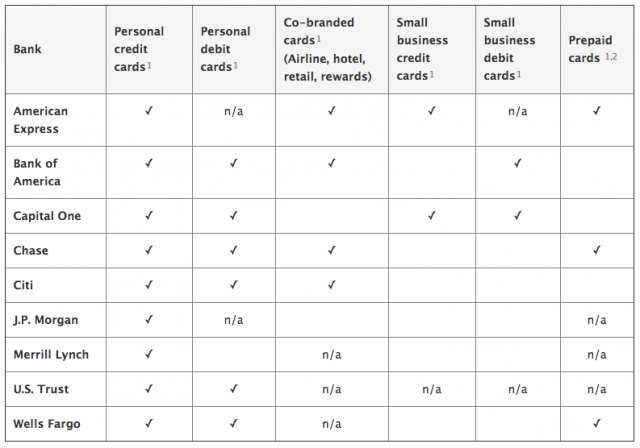

The lack of ubiquitous contactless payment systems is going to resolve itself eventually, so let's focus on the second point—check out this Apple-provided matrix of the providers and specific types of accounts that support Apple Pay. To cherry-pick an example, notice that "co-branded" cards (that is, cards serviced by a bank but with another company's logo on it) are supported by many providers, but "some cards might not be supported in Apple Pay." A standard card provided by Chase Bank works just great with Apple Pay. An otherwise identical card co-branded by Amazon.com does not.

This is the same kind of corporate backbiting that has hampered Google Wallet. US cell carriers like Verizon, AT&T, and T-Mobile have united behind Softcard (née Isis, changed for obvious reasons), yet another contactless payment system. Their desire to boost Softcard has been a brick wall for Google Wallet. All companies involved protect their best interest, and the customers are caught in the middle.

Apple Pay has a lot of promise, but where you live and shop will have a lot to do with whether it becomes a reliable staple or an "ooh look at this" party trick, at least in the beginning. On Apple's end, at least, the service appears to work exactly as intended. As Apple's list of partner banks and retailers grows, it will hopefully begin to work as intended for more people.

reader comments

129