Apple Brings Some Sexy to the Dow ETF

The Dow Jones Industrial Average has age and venerability on its side, but due to its oft-criticized price-weighting methodology and being home to just 30 stocks, the Dow and the SDPR Dow Jones Industrial Average ETF’s (DIA) have long been deemed less than relevant.

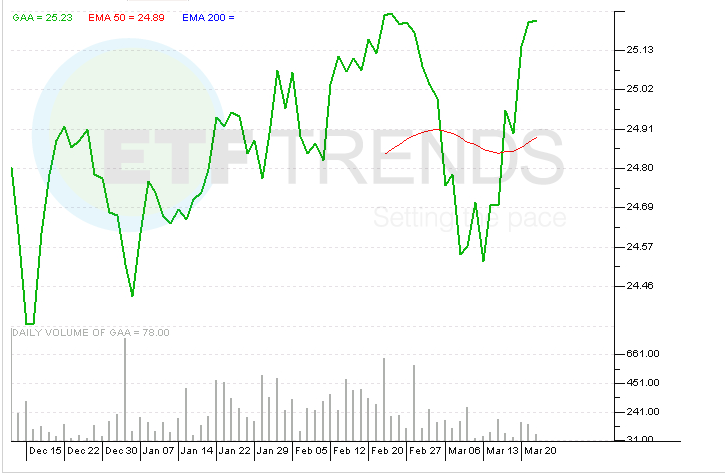

Perhaps the recent addition of Apple (AAPL) to the Dow will change that and spark renewed interest in DIA. Since March 6, the day S&P Dow Jones Indices announced Apple would replace AT&T (NYSE: T) in the Dow, DIA has added just over $102 million in assets. [Apple is Coming to the Dow ETF]

Since March 19, the day Apple debuted in the Dow, DIA has added nearly $336 million in assets. Perhaps that is just a coincidence, but is notable when considering that despite impressive showings in 2014 and 2013, DIA lost over $1.3 billion in assets combined over those two years.

Although Apple is the world’s largest company by market value, also making it the largest holding in an array of cap-weighted ETFs, the stock is not DIA’s largest holding due to the Dow’s aforementioned price-weighting methodology. Entering trading Thursday, Apple was DIA’s fifth-largest holding with a weight of 4.64%.

To put the skew created by the Dow’s price-weighting methodology in perspective, International Business Machines (IBM) has a weight in DIA that is 35 basis points larger than Apple’s even though IBM’s market value is $566 billion smaller than the iPhone maker’s at this writing. [A Look at Apple ETFs]

Apple’s addition to the Dow has taken the index’s weight to the technology sector to 17%, trailing only industrials at 20.1%. However, the Dow is still underweight technology by almost 270 basis points relative to the S&P 500. DIA’s weight to industrials is nearly double that of the SPDR S&P 500 ETF (SPY) , an ETF that features Apple as its largest holding.

Still, DIA has some drawbacks compared to a broad market ETF like SPY. The price-weighting methodology “and selection of securities by committee, also means DIA offers far less predictable returns than cap-weighted, rules-based indexes,” said Philip Blancato, CEO of Ladenburg Thalmann Asset Management in an interview with Aparna Narayanan of Investor’s Business Daily.

SPDR Dow Jones Industrial Average ETF

ETF Trends editorial team contributed to this post. Tom Lydon’s clients own shares of Apple and SPY.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.