Microsoft's Q3: Azure, commercial cloud strong, but earnings, revenue light

Microsoft's third quarter was light relative to expectations, but the company said Azure delivered strong results and its commercial cloud business is on a $10 billion annual revenue run rate.

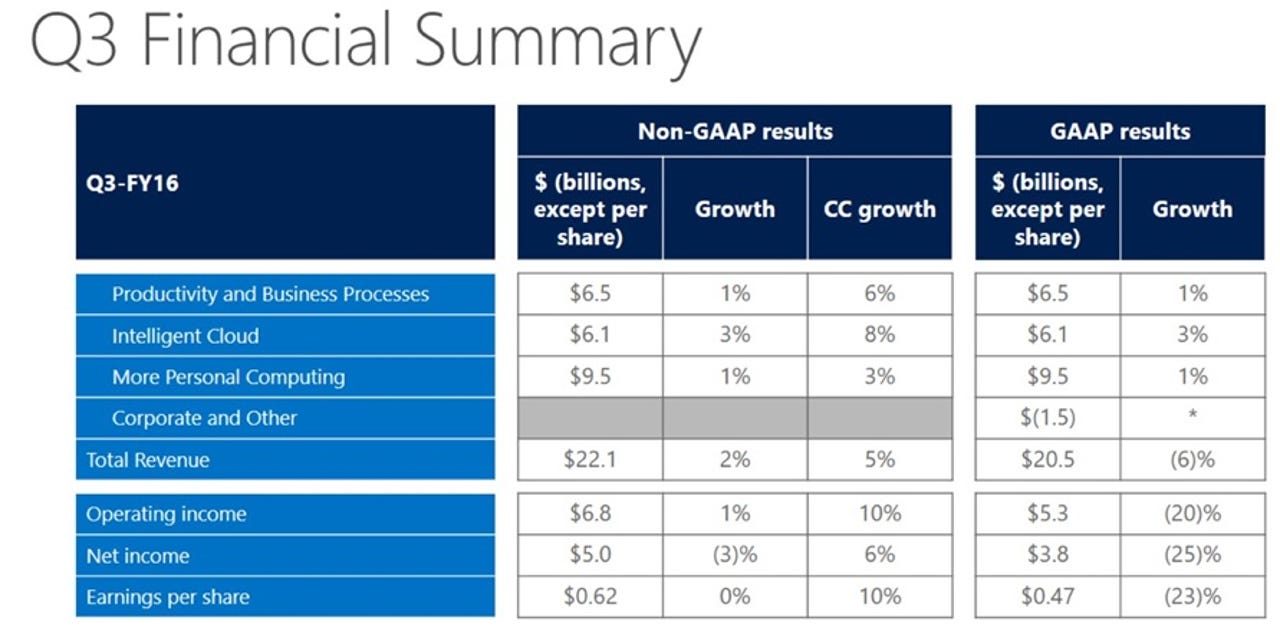

The company reported earnings of $3.8 billion, or 47 cents a share, for the third quarter on sales of $20.5 billion. Non-GAAP earnings for the third quarter were 62 cents a share on revenue of $22.1 billion, down 6 percent from a year ago.

Wall Street was looking for third quarter earnings of 64 cents a share on revenue of $22.09 billion.

Microsoft said that a 4 cents a share one-time tax payment resulted in the earnings miss. Without that tax hit, earnings would have been 66 cents a share. "This quarter's income tax expense included a catch-up adjustment to account for an expected increase in the full year effective tax rate primarily due to the changing mix of revenue across geographies, as well as between cloud services and software licensing. As such, the GAAP and non-GAAP tax rates were 25% and 24%, respectively," said Microsoft.

By unit, Microsoft's commercial business carried the team again. Productivity and business processes revenue was up 1 percent to $6.5 billion. Commercial office and cloud services sales were up 7 percent and Dynamics software and cloud revenue was up 9 percent.

Intelligent cloud revenue was up 3 percent to $6.1 billion as Azure surged. Server products and services were up 5 percent.

On the consumer front, also known as the more personal computing unit, Windows OEM revenue fell, Surface sales surged as did search and phone revenue tanked 46 percent in constant currency.

By the numbers:

- Office 365 consumer subscribers were 22.2 million in the fiscal third quarter.

- Commercial Office 365 commercial seats were up 57 percent from a year ago.

- Four out of every 5 Dynamics CRM Online seats are cloud deployments.

- Azure compute and SQL database usage more than doubled from a year ago.

- Enterprise mobility customers topped 27,000.

- Windows OEM Pro revenue growth fell 11 percent.