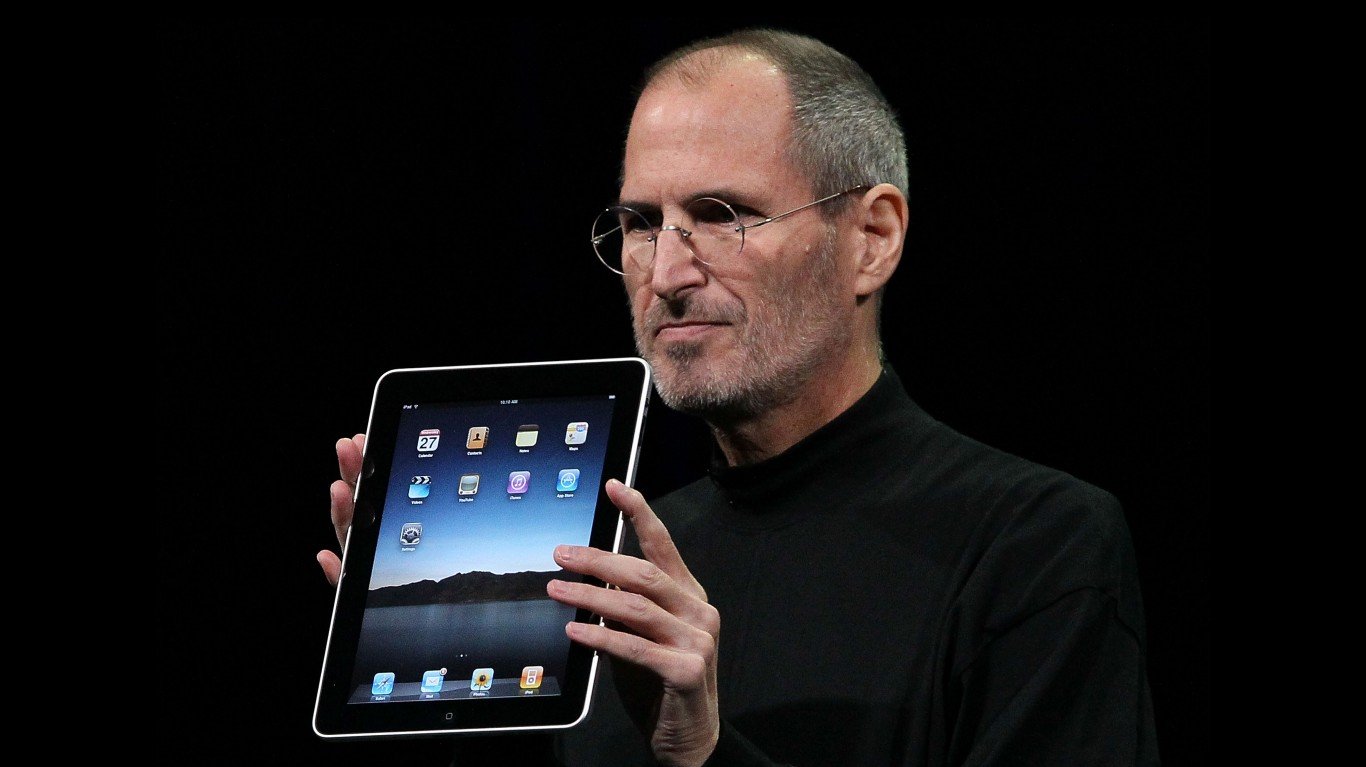

Shares sold short in Apple Inc. (NASDAQ: AAPL) rose 1.3 million to 56 million in the most recent settlement period. The very modest increase happened as Apple’s share price was mostly rising, and over a week before earnings. Apple’s shares moved 2% lower after it announced a quarter in which revenue fell from the same period a year ago, and it posted its first year of down revenue since 2011.

In the past three months, Apple’s shares have risen 22% to $118, and several analysts believe it will go much higher. Earnings helped the case somewhat, as they beat expectations:

Apple today announced financial results for its fiscal 2016 fourth quarter ended September 24, 2016. The Company posted quarterly revenue of $46.9 billion and quarterly net income of $9 billion, or $1.67 per diluted share. These results compare to revenue of $51.5 billion and net income of $11.1 billion, or $1.96 per diluted share, in the year-ago quarter. Gross margin was 38 percent compared to 39.9 percent in the year-ago quarter. International sales accounted for 62 percent of the quarter’s revenue.

Also:

Apple is providing the following guidance for its fiscal 2017 first quarter:

- revenue between $76 billion and $78 billion

- gross margin between 38 percent and 38.5 percent

- operating expenses between $6.9 billion and $7 billion

- other income/(expense) of $400 million

- tax rate of 26 percent

More good news should come with the holidays, as the iPhone 7 is expected to sell briskly and to be helped by the disaster of the competing Samsung Galaxy Note 7. On the other hand, Apple disclosed that demand for the iPhone 7 Plus was so high that Apple may be unable to keep up with orders.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.