HPE posts mixed Q4 results

HPE reported its fourth quarter and full fiscal year 2016 results on Tuesday. Quarterly earnings were effectively in line with expectations, but revenue was below the mark.

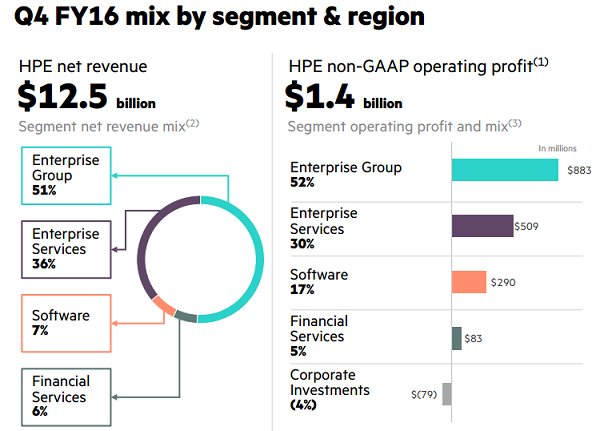

The company reported $12.5 billion in Q4 revenue, down 7 percent from the period a year earlier. Its non-GAAP earnings came to 61 cents a share.

Wall Street was looking for earnings of 60 cents a share on revenue of $12.85 billion.

For the full fiscal year 2016, non-GAAP earnings came to $1.92, while revenue hit $50.1 billion, down 4 percent from the prior-year period.

"FY16 was a historic year for Hewlett Packard Enterprise," said President and CEO Meg Whitman in a statement. "During our first year as a standalone company, HPE delivered the business performance we promised, fulfilled our commitment to introduce groundbreaking innovation, and began to transform the company through strategic changes designed to enable even better financial performance."

Fourth quarter revenue was down year over year across all groups, except for financial services, which at $814 million was up 2 percent. Enterprise Services revenue reached $4.7 billion, down 6 percent, while software revenue was $903 million, also down 6 percent.

Enterprise Group revenue came in at $6.7 billion, down 9 percent year over year. Specifically, servers revenue was down 7 percent, storage revenue was down 5 percent, networking revenue was down 34 percent, and Technology Services revenue was down 4 percent.

While revenue in Q4 declined, HPE highlighted several areas of encouraging growth across its portfolio. Aruba was up 13 percent, all-flash arrays were up more than 100 percent and high-performance compute was up more than 30 percent.

On a conference call Tuesday, Whitman stressed the strategic changes the company has made to strengthen its position over the long term. For instance, in May, HPE announced a spin-off and merger of its computing services business with Computer Sciences Corp. Then, in August, the company announced its acquisition of SGI, in a deal aimed at complementing its existing datacenter, HPC, and big data businesses. In September, HPE said it will "spin-merge" its non-core software assets with Micro Focus, a software company based in the UK, in a transaction worth around $8.8 billion.

These moves will enable HPE, Whitman said, to be more nimble, play higher growth margins, and have an enhanced financial profile. The company's goal, she said, is to be the industry's leading provider of hybrid IT built on the secure, next-generation software-defined infrastructure that runs customers' data centers today, bridges them to multi-cloud environments tomorrow, and powers of the emerging intelligent edge.

For Q1 2017, HPE forecasts a non-GAAP EPS in the range of 42 cents to 46 cents. For fiscal 2017, HPE expects its non-GAAP EPS to be in the range of $2 to $2.10.