Trump-proposed corporate tax reform predicted to have minor positive impact on Apple EPS

Given current speculation on tax reform in the U.S., analysts predict that with all other factors unchanged Apple will see a negative impact on its cash hoard because of a repatriation tax, and an increase on taxes paid to import manufactured goods from China, but an overall slight uptick on earnings per share as a result of all factors.

The biggest impact to Apple from proposed tax reform would likely be taxation on imported goods. The proposal as it stands suggests no deduction for imported goods such as the iPhone, and no taxes paid on exported goods.

Apple's product line, including the iPhone, is manufactured overseas, and will be subject to the removal of the deduction. Analytical firm UBS predicts that just based on this, the company will take a $0.22 hit on earnings per share.

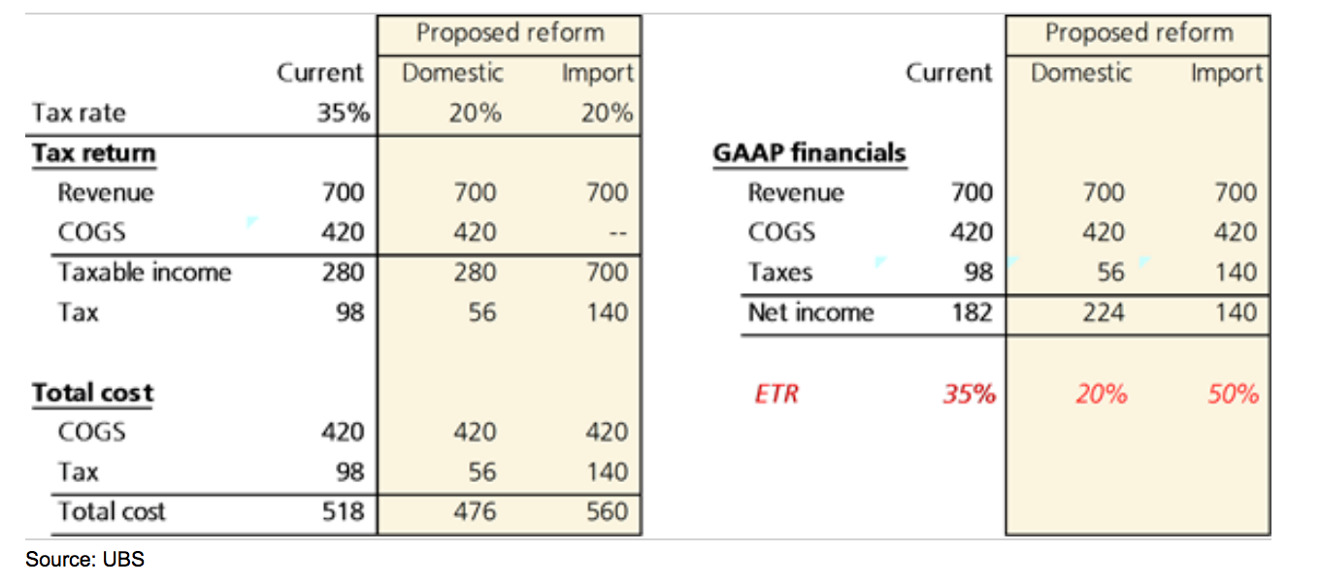

For a grossly simplified example of the tax reform on manufactured goods, assuming Apple has one phone priced at $700, the taxable income on the phone in the US is $280 because of production cost deductions and other factors generating $98 in tax for the U.S. at present rates.

Apple's expected overall tax rate is expected to fall to 20% versus the current 35% as a result of the "blueprint."

So, after reform, If the phone were manufactured in the US, the taxable income remains the same at $280, but the lower effective tax rate drops the owed taxes to $56. If the iPhone continues to be manufactured in China, the entire $700 is taxable, but at the lower 20%, ending up in an effective tax on the phone of $140.

Regardless of the source of the cost increase, be it the expense of moving manufacture of the iPhone to the U.S. or keeping production overseas, any cost increase would likely be applied to consumers.

Impacts from overseas cash

A proposed repatriation tax of 8.75 percent will cause a slight hit on cash on hand on the books.

However, the positive impact on earnings per share based on deferred tax liability on the overseas cash no longer making as much of an impact on Apple's earnings is expected to drive Apple's earnings per share up, offsetting the complex import tax situation.

Other considerations impacting Apple

Wholesale tax changes will have a much larger financial impact outside of Apple globally, which will reverberate back to the company. It is unclear what the wide application of what is effectively a higher tax rate to the U.S. on imported goods will have globally, which will alter the dollar's exchange rate, and the currency exchange headwinds that Apple frequently talks about during quarterly earnings calls.

Additionally, under the proposal, Apple would be able to deduct U.S. investments in part more than the current code allows, such as the Apple Campus currently under construction. Also deductible will be the cost of building-out Apple-owned construction facilities, should it choose to do so.

The tax reform proposal, entitled "A Better Way" was published at the height of the election process on June 24, 2016. It promises simplification of the tax code, and a broadening of the taxable base, alongside a reduction in effective tax rates overall.

No bill has been written, nor proposed at this time. Specific figures and any benefits spelled out by the plan are expected to change.

China has threatened that a trade war against the country will result in more harm to the U.S., with a state-run paper threatening that the government will take "countermeasures" against Apple and the automotive industry if an economic conflict comes to pass.

Mike Wuerthele

Mike Wuerthele

William Gallagher

William Gallagher

Malcolm Owen

Malcolm Owen

Sponsored Content

Sponsored Content

Christine McKee

Christine McKee