Cisco's Q2 highlights enterprise tech shifts: Here are six takeaways

Cisco's second quarter results highlighted a few themes in the enterprise technology sector from the data center to cloud services worth noting.

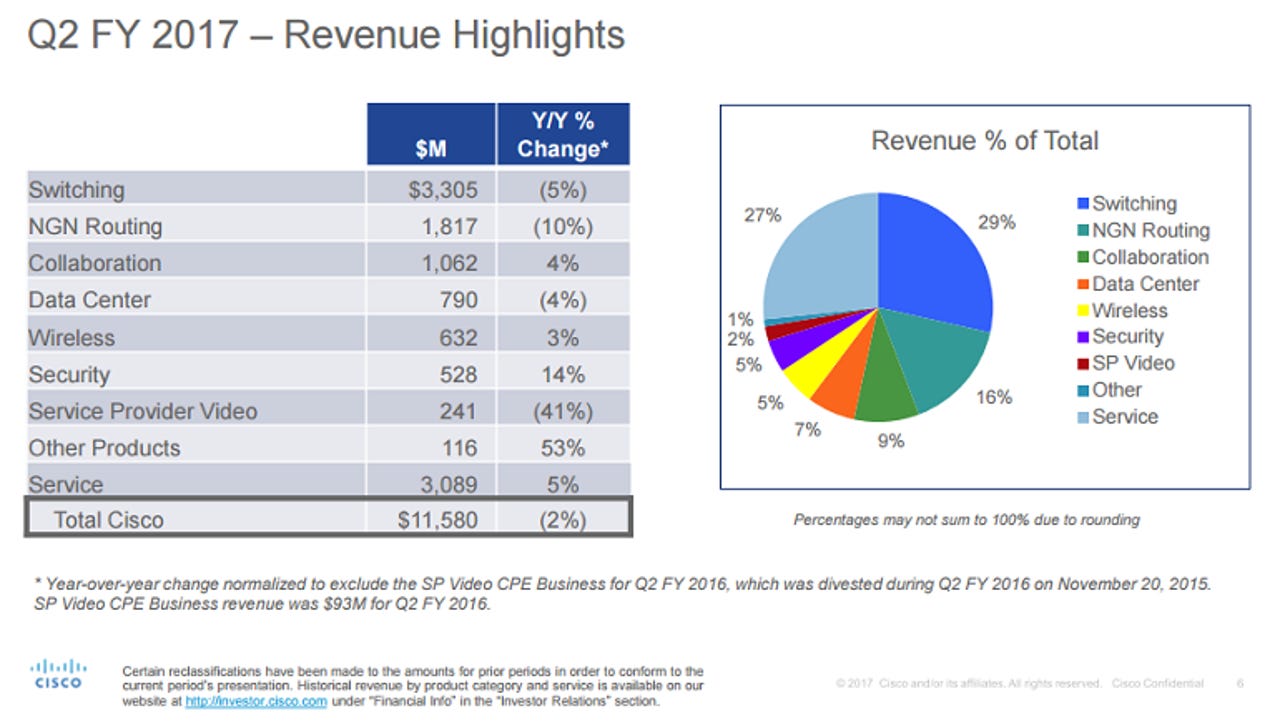

The company reported solid financial results that beat earnings expectations by a penny a share. Cisco delivered non-GAAP earnings of 57 cents a share on revenue of $11.58 billion. Here's a look at the moving parts:

But the between the lines reading in Cisco's results highlight a few shifts. Consider:

Cisco's hyperconverged systems, notably HyperFlex, are off to a slow start. CEO Chuck Robbins responded to a question about boosting the data center business. Robbins said:

I think on the hyperconverged, we certainly would like to see it moving more quickly. We have recently had a release of software that has helped with some of the capabilities, and I think that there are a couple more coming that should continue to give us more capabilities in that space.

More Cloud TV videos

There are high hopes for the integrated Microsoft Azure-Cisco system. Cisco said last week's launch of a system that enables Microsoft Azure to be delivered on-premise may boost its data center unit.

In the data center, blades are out, rack-based systems are in. Cisco CFO Kelly Kramer said its data center business was down 4 percent largely due to a shift from blade servers to rack-based systems. The move is hurting sales of Cisco's Unified Computing System.

Cisco's collaboration portfolio is performing well with second quarter revenue growth of 4 percent. The WebEx product line delivered "ongoing solid performance," said Kramer.

The company is becoming a subscription-based business. Whether it's a subscription that goes with Cisco's Spark Board, SaaS-based WebEx and other services. Kramer said subscriptions are better for Cisco and customers because it's an easier way to run their IT operations. Cisco will look into more acquisitions similar to the purchase of AppDynamics. Deferred revenue for Cisco related to recurring software and subscriptions was up 51 percent to $4 billion in the second quarter.

Cisco's ACI platform is doing well and highlights the company's software strategy coupled with hardware. Robbins said: "Our ACI data center switching portfolio grew revenue by 28%. This includes 1,300 new Nexus 9000 customers and 450 new ACI customers in Q2, bringing the total install base to 10,800 and 3,100, respectively." Also: Executive's guide to the Software Defined Data Center (free ebook)