Major Tech Trends Ahead of Apple's Big Event

With Apple about to host its largest product event in years, much of the attention continues to be focused on the details. Plenty of questions remain regarding the various changes Apple will announce across its iPhone, Apple Watch, and Apple TV lines. A closer look at the broader trends taking place in these product segments go a long way in adding much-needed context to Apple’s inaugural event at Steve Jobs Theater.

Smartphones

On the surface, the smartphone battle seems to be largely settled. Predictions calling for iPhone’s demise at the hands of Google and Android have subsided although some are now eager to replace Google with WeChat as Apple’s arch nemesis.

Behind this facade of relative calm, the smartphone market continues to evolve at a rapid pace. Three major trends are unfolding regarding how consumers view smartphones:

- Larger screens continue to gain momentum.

- Form factor size is hitting a ceiling.

- The pricing gap is widening.

With an increasing amount of content consumed on smartphones, consumers and manufacturers alike continue to get behind larger screens. Once deemed excessive and niche, large smartphones with 5-inch to 6-inch screens are seeing growing sales momentum. This large screen smartphone trend has materialized across the industry, indiscriminate of geography and even price.

While there is still evidence that a portion of the market is OK with smaller screens as seen by continued 4-inch iPhone SE sales, this segment is more likely to contract than expand over time.

The newest and most intriguing development in the smartphone space is found with the relationship between screen size and form factor. Historically, smartphone screen size faced a ceiling in terms of its relationship to form factor. Mobility is greatly reduced if a smartphone is so large that it is unable to fit comfortably in pockets, purses, and pouches. The trend of removing front-facing bezel and dedicated home buttons is eliminating this form factor limitation. Smartphone manufacturers are able to ship larger screens without increasing form factors.

The OLED iPhone is rumored to include a 5.8-screen, which is larger than the 5.5-inch iPhone Plus screen, in roughly the same form factor as an iPhone 7. This will have a major impact on how consumers think about smartphone size preference. It is inevitable that all iPhones will eventually contain the same design language - no home buttons and little to no front bezel. Large swathes of the iPhone user base will likely want to upgrade to these new iPhone models over time. It is the type of multi-year upgrade cycle that PC makers hoped would occur in the laptop space but never materialized.

As manufacturers increasingly bet on camera and screen innovation to stand out from the competition, smartphone pricing has been on the rise. While smartphone prices are increasing at the high-end, as seen with the $750 Samsung Galaxy S8 and $950 Galaxy Note 8, there continues to be a significant portion of the smartphone market desiring price accessibility. The key for smartphone manufacturers will be balancing higher-priced smartphone SKUs packed with the latest technology with increasingly lower-priced SKUs still offering a premium experience.

Wearables

The wearables market has had a rocky start. Some of the initial wearables players have retreated out of the space while others have taken a more cautious view. Only a handful of companies are seeing wearables sales success. It is fair to say everyone, including Apple, has seen their fair share of strategy changes over the years.

Three major trends are unfolding in the wearables space:

- Sales momentum is flowing to smartwatches.

- Fashion and luxury continue to gain importance.

- The wearables battle is slowly expanding beyond the wrist.

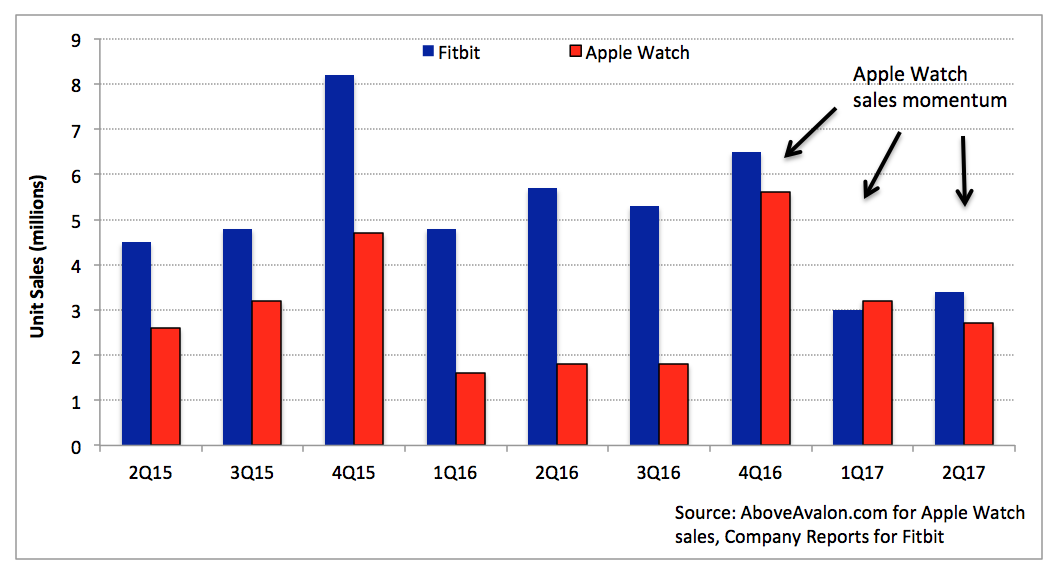

Dedicated fitness trackers have lost momentum while Apple Watch continues to outperform sales expectations. Fitness and health tracking is moving from being a product to a feature. Nowhere is this seen more than in a comparison of Fitbit and Apple Watch sales over the past year.

Exhibit 1: Fitbit vs. Apple Watch Unit Sales

Meanwhile, Fitbit’s new Ionic smartwatch is a "bet the company" type of move in an attempt to capitalize on this new wearables landscape. Garmin has seen similar trends with sales momentum flowing from dedicated fitness and health trackers to its smartwatch offerings. We are only seeing the initial fallout from this development.

One of the items Apple got correct out of the gate with Apple Watch was interchangeable watch bands. This dynamic is now viewed as natural and almost inevitable when discussing smartwatches. Going forward, technology companies will continue to face pressure in the wearables space given how consumers are demanding luxury and fashion options.

As the battle for the wrist evolves, the ear is shaping up to be the second major wearables battleground. Apple, Samsung, Fitbit, and a slew of smaller hardware companies and start-ups will have wireless or cordless headphone offerings in the market for the upcoming holiday season. Apple is the clear leader in the space with its W1 chip-equipped AirPods and Beats. More importantly, given the company's sales success with Apple Watch, Apple has the most formidable wearables platform. We are moving to a point at which the wearables narrative will evolve. No longer will it only be about wrist devices. Rather, it will also include platforms consisting of hardware and software solutions for different parts of the body.

Television

After years of unknown, we are starting to get a glimpse of TV's future. The large cable bundle's days are numbered. Netflix, Amazon, Facebook, Google (YouTube), and Apple are the new power brokers in the TV space. There is a long list of others including Disney (ESPN), HBO, and Hulu that would like to join that coveted list of influencers. Netflix and Amazon are the newest TV networks with massive budgets for funding scripted video content. YouTube and Facebook continue to reign supreme when it comes to offering ad-supported video content. Apple owns the most lucrative platform that involves consumers accessing paid video subscriptions.

Major themes unfolding in the space include:

- Price is playing a major role in the streaming set top box market.

- Momentum is found with smaller screens.

- New content players are holding optionality.

Roku is the current streaming video box leader with approximately 40% market share in the U.S. Amazon, Google, and Apple hold second, third, and fourth place, respectively. The market is unfolding largely based on price. Roku has been able to position itself as the cheapest way for people to access Netflix and YouTube on a large television screen. The company is going so far as to give away its Roku OS to TV manufacturers for free. Meanwhile, with Apple TV priced nearly five times higher than Roku, Apple's streaming TV box is bringing in nearly 6x more gross profit than Roku earns from its players.

While much attention continues to be placed on large screen televisions, such focus ends up being grossly misleading. Apple is actually selling more than 250M "TVs" per year called iPhones and iPads. These smaller screens are responsible for delivering an increasing amount of video content to consumers.

In a battle for our time and attention, content creators with formidable content budgets are winning. There is a brain drain underway in Hollywood as talent in front and behind the camera is moving to the new players in town. There are still genuine questions as to just how sustainable some of these streaming video business models are as independent entities. However, there is no question that a company like Netflix has earned itself optionality from providing a superior entertainment experience to more than 100M people.

Home

The smart home ended up being the surprise tech topic of 2016. Much of this was due to sheer fascination in Amazon's Alexa digital voice assistant and accompanying Echo speakers. The narrative has shifted in 2017 as mindshare is now splintered due to additional companies entering the scene. Apple is expected to discuss HomePod in detail at its upcoming product event. Major themes in the smart home space include:

- Voice is being positioned as an early user interface.

- Companies are basing their home strategy around core competencies.

- It is still early to declare definitive leaders and laggards.

As the number of smart items for the home available for sale increases, questions have swirled as to the best way to control these devices. Voice continues to grab much of the attention although the automation capabilities found in Apple's HomeKit hold much intrigue. At the same time, we are seeing pretty dramatic differences in strategy for the home based on a company's core competency. While Google and Facebook will look to monetize the data obtained via microphones and cameras through advertising, Amazon is looking for Alexa to serve as a better shopping assistant in order to drive Prime memberships. The preceding strategies include giving away hardware at or below cost. Meanwhile, Apple's strategy to sell the best-sounding speaker people have ever owned gives the company a good shot at becoming the most profitable device in the smart home space.

Even though Amazon has garnered much good press in the space, it is simply too early to declare winners and losers in the smart home. The way that Apple and pretty much every large consumer-facing technology company are running forward with stationary speakers and screens for the home brings back flashbacks to the early wearables rush. Many companies will end up being disappointed. At the same time, the attention given to stationary devices has taken the spotlight off the importance of mobile devices in our home. The smartphone remains the most valuable computer in our home and we should not underestimate it when contemplating the smart home's future. Of course, a home won't likely truly be a smart home until Silicon Valley firms begin building their own housing, but that topic is for another day.

Apple's Big Event

Apple's upcoming event at Steve Jobs Theater has the ingredients to be the largest Apple product event since the Apple Watch unveiling at the Flint Center in 2014. Apple will unveil at least three new iPhones in addition to new Apple Watches and a refreshed Apple TV. In some areas, Apple's goal will be to improve upon existing themes unfolding in the smartphone and streaming video arenas. In other areas such as smartwatches, Apple will likely take a true leadership role in pushing the market forward.

I will be attending Apple's inaugural event at Steve Jobs Theater. My full thoughts and observations on the event will be sent exclusively to Above Avalon members. To receive this analysis and perspective, visit the membership page. Members also receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week).