This past week, there was lots of coverage of perceived demand for the iPhone 8 models in the media. Shorter lines at retail stores were seen as evidence of poor sales, and there was the usual handwringing about what it might mean for Apple. To put all this in context, it’s helpful to look at Apple’s financial guidance for the September quarter and see what that tells us about what Apple was expecting by way of early iPhone sales, and whether it’s still on track.

Apple Guidance: Growth of 5-11%

Apple’s guidance for the September quarter is as follows:

- revenue between $49 billion and $52 billion

- gross margin between 37.5 percent and 38 percent

- operating expenses between $6.7 billion and $6.8 billion

- other income/(expense) of $500 million

- tax rate of 25.5 percent.

We’ll focus here on the revenue portion for the most part. That $49-52 billion range represents a year on year revenue growth range of 5-11% compared to the September quarter in 2016, when Apple reported total revenue of $46.85 billion. For context, Apple’s last four reported quarters had growth rates of -9%, 3%, 5%, and 7% respectively. So the midpoint of the guidance, at 8%, would be roughly on track with the recent trend of rising revenue growth. In dollar terms, the range suggests between $2.15 and $5.15 billion year on year revenue growth.

iPhone Versus the Rest

Now, given that the iPhone is so dominant in Apple’s overall results, it’s tempting to look at it in isolation, but of course it isn’t the only product Apple sells, and Apple’s year on year growth is also heavily dependent on what’s happening in the rest of its business. One under appreciated facet of Apple’s period of negative growth during the iPhone 6s cycle was that several of its other products also experienced revenue declines during that time, exacerbating the iPhone shrinkage. Conversely, the June 2017 quarter was the first one in which every product line reported revenue growth in several years. So Apple enters the September quarter with the wind behind its back.

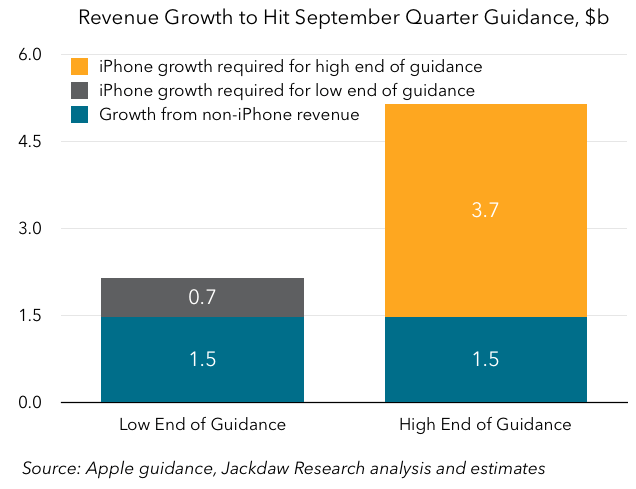

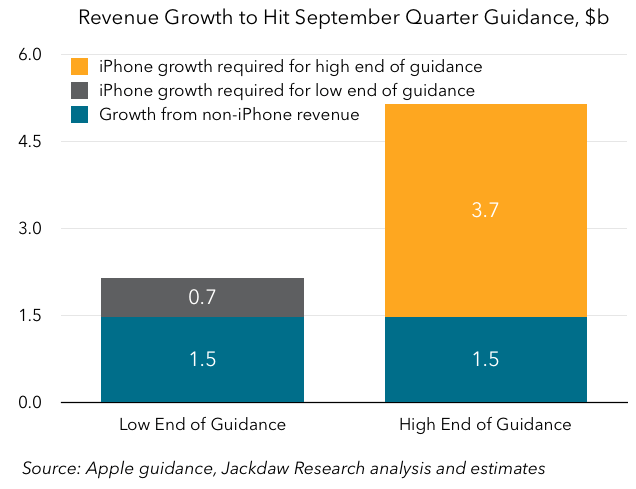

We can make some reasonable assumptions about how other products will have performed in the September quarter from a growth perspective as a foundation for talking about iPhone growth and guidance. Based on recent trends, I would forecast a roughly $1.5 billion year on year growth in revenues from products other than the iPhone in the September quarter. That would get Apple 70% of its way to the low end of its revenue guidance by itself, leaving just $650 million of growth to come from the iPhone. Hitting the high end of its guidance, meanwhile, would require $3.7 billion in additional revenue growth from the iPhone. This is illustrated in the chart below:

What the iPhone Has to Do

Now that we know what the iPhone has to do in order to help hit guidance, we can parse that out a little more. We’ve already said the revenue range is $0.7-3.7 billion dollars, but let’s put that in percentage terms. That translates to a range of 2-13% of last year’s September quarter iPhone revenue. So the iPhone has to achieve somewhere in that growth range if it’s to help Apple hit its overall revenue guidance for the quarter.

How hard is that? Well, the revenue growth for the iPhone for the previous three quarters was 5%, 1%, and 3%, so it’s been within that range for two of those three quarters, but very much at the low end of it. More importantly, Apple’s revenue in those quarters was driven entirely by demand, while during the very small portion of the September quarter when new phones are on sale is historically driven entirely by supply – i.e. how many iPhones Apple can manufacture. Normally, then, whatever the percentage growth rate in iPhone revenue is required, Apple has to either make that many more iPhones or raise the average selling price to make up the difference.

This quarter, predicting that mix is particularly challenging, for three reasons:

- iPhone demand – demand for the iPhone 8 is being impacted in a unique way by the announcement of the iPhone X, which seems to be causing at least some who would normally buy a new iPhone during the early sales period to wait

- Pricing – Apple raised the prices of the iPhone 8 models relative to the iPhone 7 equivalents, by between $30 and $50 for the base configurations, which could theoretically drive ASPs up

- Mix – but because some of the normal premium buyers are holding out for the iPhone X, the mix of early buyers likely won’t skew as much to the high end as it normally does.

Demand and ASP Projections

As such, though there is a driver that could push up ASP – the new prices – there’s another driver that could push it down – mix – while demand is also less predictable than usual. However, given that Apple typically sells out of its entire launch inventory and remains extremely supply constrained in the first ten days or so of sales that falls into the September quarter most years, we can reasonably assume that unless there has been a massive drop-off in demand for these models relative to last year’s, Apple will still sell out and lower demand will not by itself depress sales in the September quarter. In other words, Apple will still sell all the iPhones it can make in the quarter, and the question is therefore whether it was able to manufacture more iPhone 8 models for launch than it did iPhone 7 models last year. Given that many of the components and the overall shape of the device are unchanged, that’s certainly possible.

Then the question becomes ASPs. One scenario is that they drop from last year because of the mix shift among early buyers. Say they drop from $619, where they were last year, to $600: that’s about a 3% drop, meaning that Apple would have to manufacture and sell around 5% more iPhones in total to hit the low end of its guidance for the quarter, and considerably more than that to hit its high end (or even the midpoint). On the other hand, last year’s mix was likely impacted by the fact that some Plus models (notably the jet black finish) were in very short supply early on, so it’s possible that the mix shift this year will wash out much the same, leaving Apple needing to boost sales by just 2% to hit the low end of its guidance. I think the stretch scenario is a rise in ASPs off the back of the new pricing – early orders will still come predominantly from people who care about the newest, best thing, and therefore will skew towards the new models, which all start at $700 or above, which could push ASP higher, leaving Apple a much lower bar to clear in terms of increased unit shipments. It’s simply impossible to predict with any accuracy, but it’s fair to say that what happens to ASPs will be the biggest determinant in whether Apple hits its guidance.

At the end of the day, Apple knew all this when it issued guidance – what the new phones would look like, how many it could likely manufacture, the fact that it would also announce the iPhone X at the same time, and so on. So it based that guidance on its best estimates of what would happen in that scenario, which would play out just a couple of months after the guidance was issued. The reality is, though, that this is an unprecedented launch for Apple, and one which it would likely have struggled to predict accurately too. At the end of the day, I’m inclined to lean on the fact that Apple has been relatively conservative in its guidance recently, and will likely clear at least the low end of its range, and might still end up somewhere in the middle of it. I think it’s relatively unlikely, on the other hand, that it hits somewhere in the high end of its range given what we’ve seen so far, barring some big surprise in sales of its other products, like another quarter of unexpectedly strong iPad growth.

Beyond the September Quarter

Finally, it’s worth looking beyond the September quarter, which after all is so dependent on the few days right at the end of the quarter when the new iPhones are even on sale, and to the December quarter, which is always by far Apple’s largest. It’s in that quarter when the vast majority of early sales of the iPhone 8 line will occur, but it’s also when sales of the iPhone X will begin, roughly one third into the quarter. To my mind, the question of whether there is adequate supply of that device to meet demand at some point in the quarter is the single biggest factor in how the quarter will go, given how many people seem to be waiting to see or buy it rather than simply buying the iPhone 8.

It’s possible that some people, having seen it in person, will simply decide they want the iPhone 8 instead, and that demand for that device will be very strong and easily carry Apple through its quarter. But it’s also possible that a large number of people will want but not yet be able to buy the iPhone X in the quarter, and that many sales will therefore be pushed back into the March quarter. iPhone 8 sales (and sales of the other devices which still make up a considerable portion of the overall sales mix for iPhones) will be strong throughout the quarter, but whether we see strong overall growth off the back of both higher unit sales and much higher ASPs will be entirely dependent on the share of iPhone X models in that mix, which in turn will be heavily dependent on availability. At this point, that December quarter therefore looks a lot more uncertain than the September quarter on that basis, and so I’m very curious to see what guidance and management commentary looks like a month from now when Apple reports its September quarter results.

All of this will eventually wash out over the course of the next year. Apple will reach the point, likely sometime in the March quarter, when it can meet demand for the iPhone X with adequate supply, and it’ll likely see a very strong year of growth off the back of the new products. But until then, given the uncertainties of supply, it’s going to be an unusually unpredictable couple of quarters for iPhone sales and revenue.