The recent decision by Hewlett Packard Enterprise to stop selling commodity servers to companies that operate the world’s biggest cloud platforms and focus its efforts on selling hardware and services to smaller cloud companies, other types of service providers, and enterprises is a smart strategy, industry analysts say.

With commodity servers, “there is no money to be made in the Super 7 cloud providers, [but] the tier 2 market is the fastest growing [portion], percentwise, of the cloud market,” said Patrick Moorhead, president and principal analyst of Moor Insights & Strategy. Companies that make up the “Super 7” (an Intel expression) are Alphabet, Microsoft, Facebook, Amazon, Apple, Alibaba, and Tencent.

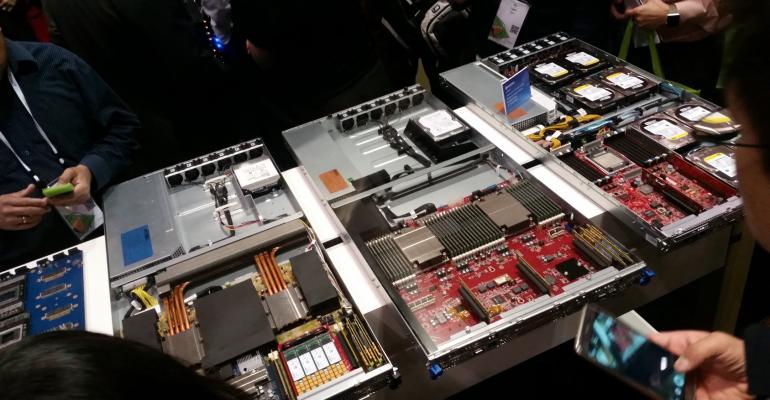

HPE this month announced it is exiting the business of selling commodity Cloudline servers to these companies, also often referred to as tier 1 service providers. But it will continue selling its higher-margin products, including high-end Apollo servers, 3PAR storage systems, and networking equipment to these large providers, a company spokesperson said. The company will continue selling a standardized set of Cloudline servers to smaller cloud companies and service providers, such as Salesforce and eBay.

“We are shifting our resources and doubling down on tier 2 and tier 3 providers,” the spokesperson said.

Industry analysts say HPE’s decision to abandon the hyper-scale commodity server business is a sound strategy, because the vendor is no longer getting a return on investment from its partnership with original design manufacturer (ODM) Foxconn, which built the custom commodity servers for HPE.

HPE and Dell used to sell a lot of servers to the tier 1 providers, Moorhead said. But in recent years, their sales have plummeted, as cloud providers began designing their own servers and buying them directly from Asian ODMs – the likes of Foxconn.

HPE partnered with Foxconn in 2014 to get a piece of the action, analysts say. But earlier this year, HPE chief executive Meg Whitman said her company faced significantly lower demand for the commodity servers from one tier 1 customer, which was reportedly Microsoft.

The heavy competition from Asian ODMs has forced traditional server vendors, such as HPE and Dell EMC to decide how best to serve these customers or walk away entirely from the low-margin business, said Jeffrey Fidacaro, senior analyst of data center technologies at 451 Research.

While HPE is pulling out of the hyper-scale custom commodity server market, Dell has no plans to do so anytime soon, said Ravi Pendekanti, senior VP of server solutions, product management and product marketing, at Dell EMC.

“We continue to ship and keep our customers happy,” he said, responding to a question about Dell’s plans in selling hardware to the biggest cloud companies.

Aiming at Smaller Providers

The smaller providers don’t have the staff to design their own hardware and service it in their data centers like the hyper-scalers do, so they need the hardware and services OEMs like HPE provide, Fidacaro said. The same goes for enterprises.

“For second- and third-tier service providers, colocation companies that aren’t very large, and enterprises, the services ecosystem that includes design, procurement, testing, and validation is still important,” Fidacaro said. “It’s something they can’t replicate internally because they don’t have the resources. This is where HPE can offer a lot of value.”

Ashish Nadkarni, IDC’s program director of computing platforms, said HPE’s move resolves the awkwardness of having Foxconn build its custom commodity servers while competing with the ODM for the same business.

The move is also part of HPE’s continuing effort to focus on higher-margin businesses, he said. Last year, HPE spun off and merged its non-core software with Micro Focus in a deal worth $8.8 billion.

“It cleans up their business model,” he said. “HPE is shedding all the low-margin products and becoming more streamlined and nimble and only focusing on areas where it can make money.”

For example, the company in 2017 has beefed up its product portfolio and now offers customers hyper-converged infrastructure, technology it gained through its SimpliVity acquisition in January, and flash storage hardware gained through its Nimble Storage acquisition in March.

HPE can bolster revenue through its broad portfolio of products for smaller providers and enterprises, Nadkarni said. “There is money to be made with the whole solution.”

HPE is a member of the Open Compute Project, the organization through which Facebook, Google, Microsoft, and others open source custom specs and have suppliers compete among each other for large orders of data center hardware.

An HPE spokesman didn’t immediately respond when asked whether the company plans to stay in the organization. Moorhead, however, still sees value in HPE staying put.

“I still see the value of HPE’s continued participation in OCP, as it can drive specifications for Cloudline, [which is] very much still an entity in tier 2 providers,” Moorhead said.

Yevgeniy Sverdlik contributed to this report.