There are two ways to look at Apple right now.

On one hand, the company's a profit machine — and investors are hoping to see some of that money given back to them Tuesday night in stock buybacks, as Apple divvies up overseas cash that it brought back to the U.S. thanks to tax cuts.

But the $999 elephant in the room — the iPhone X — tells a different story, at least according to some investors and suppliers. If you listen to them, there are many red flags around Apple's business, and it could be putting the future of the company in question.

- Apple suppliers — Samsung, Corning, Taiwan Semiconductor Manufacturing, Teradyne and SK Hynix — have reported financial results that hint at slowing smartphone orders.

- Wall Street analysts have slashed expectations for Apple and its other suppliers.

- Sales in China — Apple's third-largest market after the Americas and Europe — might also be weak, third-party data indicate.

- The company still makes the vast majority of its sales from phones, as its HomePod smart speaker has been late to compete with Amazon's Alexa and Google Home.

Those are just a few of the topics Apple's executives will need to address Tuesday night, when the tech giant reports quarterly earnings.

If you pull at the threads of Apple's businesses, there's evidence the company is moving in the right direction: The Apple Watch leads the wearables market, many billions of dollars have already been returned to investors, earnings are at all-time highs, and the software and services business brought in $8.47 billion in revenue last quarter (that's about the size of 13 Twitters). In fact, it's only been a few months since Apple got its most bullish Wall Street estimates ever.

Apple isn't exactly on the decline: Wall Street still expects it to post a nearly 28 percent jump in earnings and a 15 percent rise in revenue from a year ago, according to a Thomson Reuters consensus estimate. Apple's nearest competitor in terms of market capitalization, Amazon, posted income of just $1.9 billion over the holidays — when Apple's net income was $20 billion.

But Apple's runaway growth over the past few years has saddled it with big expectations: It has the highest market capitalization of any public company, a sign that investors think it has a bright present and future. That, in part, has been driven by "super-cycle" expectations that Apple would take its fancy new phone and sell it to all the customers it gained a couple of years ago, when it released the massively successful iPhone 6 series.

Apple has plenty of existing customers at 1.3 billion, but some analysts think the company overshot with its $999 price tag on the iPhone X, which competed with the iPhone 8 over the holidays. Apple's prices have been undercut by Chinese brands like Huawei and Xiaomi, which now offer higher-end handsets, and consumers are also keeping their phones for longer periods. Apple also has struggled to keep its "super-cycle" iPhone 6 customers stocked with replacement batteries after revelations that Apple had quietly changed battery settings to manage performance issues.

But it's also important to remember that Apple is a much bigger, more diverse company than it was when it released the iPhone 6-generation phones. While Apple's new handset was its most expensive yet, it also released cheaper products, like a new iPad. It's selling three high-end handsets, when it used to focus its efforts on one at a time.

The question is: Is Apple diversifying fast enough? Its last earnings statement suggests maybe not. IPhone revenue was $61.58 billion, compared with the next-biggest segment, services, at $8.47 billion.

That's why Apple's forward guidance will be so important, as the company balances growing its core iPhone business while focusing on future initiatives, like smart speakers, watches and augmented reality. Generous buybacks could keep investors around, at least short term, as the business model shifts.

"Apple has found a narrative revolving around capital allocation," wrote independent analyst Neil Cybart, who has a blog called Above Avalon. "Instead of iPhone sales or Apple Services revenue gaining importance, Apple's balance sheet strategy is driving the company's new Wall Street narrative."

Others, though, are less optimistic.

Apple's "expected large capital return program could mitigate the impact, but we believe the investor narrative post-earnings will likely be dominated by whether iPhone can grow over time," Bernstein analyst Toni Sacconaghi wrote. "Moreover, the history of the 6S cycle suggests that the stock may have further room to fall if consensus numbers decline following earnings."

— CNBC's Tae Kim and Patti Domm contributed to this report.

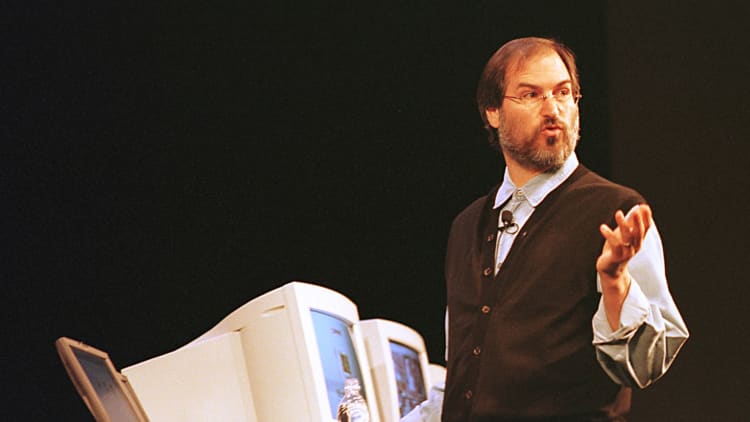

WATCH: Steve Jobs defends his commitment to Apple on CNBC in 1997