How to Trade Apple Ahead of the Next iPhone Release

Some things in life are constant. You don’t spit into the wind. You don’t mess around with Jim. And you don’t bet against Apple (NASDAQ:AAPL) with a new iPhone release coming. But, with the shares trading at all time highs, is it really time to be bullish on AAPL stock?

Last month, Apple became the first U.S. company to hit a $1 trillion valuation. I’ve got mixed feelings on the AAPL stock situation. On one hand, the growth in services revenue is a major boon for the company. The growth in cloud services, iTunes store sales and ApplePay have been major adds to Apple’s bottom line during a period of slowing iPhone sales growth. On the other hand … well, iPhone sales growth is slowing.

This is partly due to an overall slowdown in the smartphone market as a whole. It is also partly due to Apple’s lack of innovation in a market in which it was once untouchable. Apple is still missing that old Steve Job’s “One more thing…” flair.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

And it may never get that flair back.

However, Apple has a chance to once again wow the smartphone market and millions of iPhone users later this year with the release of three new iPhone models: a 5.8-inch OLED model, a 6.5-inch OLED model and a 6.1-inch LCD model.

It goes without saying that the success of these new iPhones is crucial to Apple. Due to the company’s walled-garden approach to apps and software, its entire services business relies on a growing iPhone user base. However, “success” at Apple isn’t measured in quite the same way as its competitors.

This is because Apple commands the highest hardware margins in the industry. So, while Apple may not sell as many iPhones as Samsung does Galaxys, it is making considerably more money off each phone sold. This is doubly important when you factor in Apple’s after-sale services revenue for iPhones.

The point here is that Apple has a considerably bullish sentiment backdrop for a reason. While I don’t think the company is currently worthy of a $1 trillion valuation, it is just one solid iPhone launch away from justifying its lofty perch.

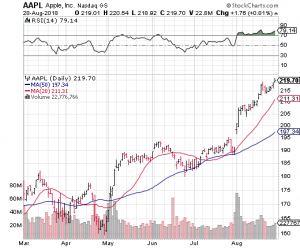

But herein lies the problem. AAPL stock is trading near all-time highs. The stock went on a 15% run higher in August, and is up more than 36% from its April bottom. As a result, the stock’s 14-day relative strength index (RSI) has traded above 70 for the past month. In short, this rally is now long in the tooth, and AAPL stock is overbought.

The shares technically need a consolidation period. Whether they will get one before the holiday shopping season is another matter.

Apple stock options traders are certainly preparing for a drawdown in AAPL. The September put/call open interest ratio has ballooned to a reading of 1.25 — among the highest such readings taking for AAPL stock this year. What this means is that more put options are open in September right now that are typically present for Apple. This signifies a bit of caution from a typically overly bullish Apple crowd.

September implied volatility, meanwhile, is pricing in a potential move of only about 3.5% for AAPL stock through expiration. This places the upper bound at $227 and the lower bound at roughly $212.

2 Trades for AAPL Stock

Call Spread: September options aren’t pricing in any big moves for AAPL stock ahead of expiration, but there is still potential upside to be had. Traders looking to capitalize on this limited upside might consider a Sep $225/$227.50 bull call spread. At last check, this spread was offered at 58 cents, or $58 per pair of contracts. Breakeven lies at $225.58, while a maximum profit of $1.92, or $192 per pair of contracts — a potential return of 230% — is possible if AAPL stock closes at or above $227.50 when September options expire.

Put Sell: For a more neutral trade on Apple stock, traders might consider a Sep $205 put sell. At last check, this put was bid at 55 cents, or $55 per contract. As always, you keep the premium received as long as Apple stock closes above $205 when September options expire. The downside is that should AAPL trade below $205 ahead of expiration, you could be assigned 100 shares for each sold put at a cost of $205 per share.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post How to Trade Apple Ahead of the Next iPhone Release appeared first on InvestorPlace.