What just happened? Micron Technology Inc. has announced it is exercising its right to buy Intel's stake in IM Flash Technologies, a joint venture between the two companies. The deal includes a $1.5 billion cash payment and will see Micron take over Intel's debt to the enterprise, which is about $1 billion.

IM Flash was set up in 2005, with both firms contributing around $1.2 billion to the venture. The agreement saw Micron control 51 percent of the company and gave it the right to buy out Intel's share under certain conditions. Micron said it will exercise that right starting from January 1, 2019.

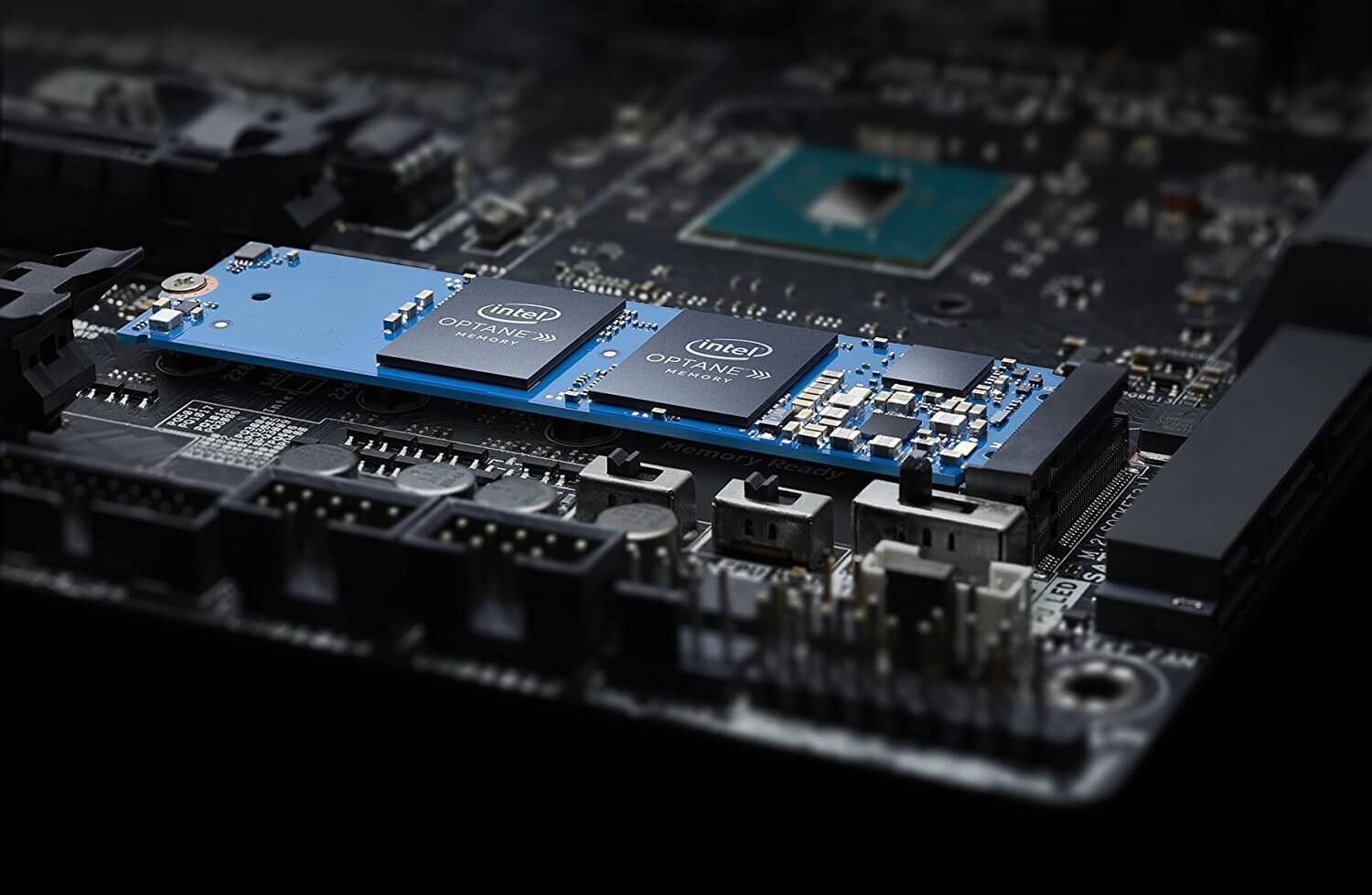

IM Flash is the only producer of 3D XPoint memory, a non-volatile memory that is designed to be much faster, denser, and with more endurance than conventional memory. It's used in Intel's Optane-branded storage products.

"Micron's acquisition of IM Flash demonstrates our strong belief that 3D XPoint technology and other emerging memories will provide a unique differentiator for the company and be an essential solution for new data-hungry applications," says Micron CEO Sanjay Mehrotra.

Back in July, Intel and Micron announced that they would be going their separate ways after completing development of the second generation 3D XPoint technology in the first half of next year. The companies added that they would be independently pursuing further improvements to the tech following the breakup.

It's reported that while Intel sees 3D XPoint being used for server applications, Micron's interests include automotive, mobile, and special-purpose use.

The existing agreement states that Micron will sell 3D XPoint memory wafers to Intel for up to a year after the IM Flash deal closes. After this period, Intel may have to negotiate a new deal with Micron or, as noted by Anandtech, manufacture 3D XPoint memory at its Fab 68 facility in China, though that would mean scaling back 3D NAND Flash production at the plant.

Micron said IM Flash would become a wholly-owned subsidiary of the company once the deal closes.