Intel has just wrapped up its earnings call for the third quarter of 2018. Interim CEO Bob Swan reports the company has surpassed expectations for a total revenue of $19.2 billion, with data centre and client computing both overperforming for the quarter. However, the company admits it faces “growing competition” going forward.

What investors and onlookers really wanted out of the call, perhaps naively, was news on the company’s ill-fated 10nm process, which has been stuck in development hell for many years. Intel’s current estimated shipping date continues to be sometime in the holiday 2019 season, with both Swan and Renduchintala refusing give any more insight beyond their teams are making “good progress” on the node.

But the financial call still held exceptionally good news for Intel’s many investors. Despite a shaky year for the tech company’s supply chain and a continuing decline in share value since mid-way through the year, the semiconductor giant’s revenue is up 19% year-over-year. That’s largely thanks to growth in two segments of the business: data centre and client computing.

PC-centric sales are up 16%, which Intel claims to be down to strong gaming and commercial sales, and data-centric income is up 22% for the quarter.

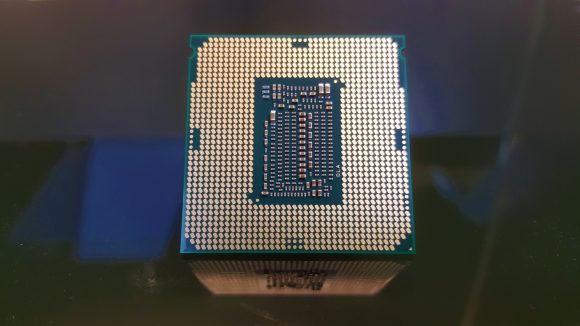

Intel looks to have defied the analysts predicting it would miss the mark towards the end of 2018 due to supply concerns. The shortage has been widely reported, and the symptoms of which have become endemic with the company’s recent product launches. The 9th Gen launch, headlined by the Core i9 9900K, has been anything but smooth sailing for the company, or retailers for that matter, and even Intel’s key data centre customers have been affected by the production standstill.

The shortage was confirmed by Bob Swan in an open letter last month. The letter outlines a $1 billion increase in capital expenditure to combat the shortages that Intel relates to increased growth, but from the outside looks to be due to a slowdown in 10nm node development.

“We are focused on doing everything possible not to constrain our customers’ growth,” Swan says during the call. “We’ve increased our CapEx by $1.5 billion since January to a record $15.5 billion. We’ve repositioned some 10-nanometer capacity to 14-nanometer, and we’re making progress with our 10-nanometer process technology.”

While Intel is siphoning some 10nm capacity back to 14nm, it also expects margins to fall in Q4 due to increased spending on R&D and the cost of bringing new 10nm tools online as the node ramps up.

“Yields are improving, and that’s giving us the confidence to in effect turn on more equipment and incur the depreciation cost associated with that. So that will impact our Q3 to Q4 gross margins. And it’s a function of the progress we’re making on 10-nanometer.”

But Intel has admitted that it faces “growing competition”. That’s not entirely just AMD – Intel also faces off with the likes of Qualcomm, among others, in various markets – but as far as we’re concerned for client computing the red team is very much Chipzilla’s nemesis. AMD is storming towards 7nm Zen 2 CPUs next year, but CEO Swan expects this renewed CPU race to act as a “headwind” for Intel as it attempts to retain the market dominance it has been ceding since 2017.

AMD’s financial call, despite an incredibly successful year, was not as positive for Q3, 2018. CEO Lisa Su contributes the under-performing quarter to a slowdown in GPU sales, although hopes that the 7nm Vega 20 GPU, followed by AMD Navi and Zen 2 on the dense node next year, will deliver for the red team going forward.

Intel expects Q4 to be tame, although still hopes to end 2018 on a positive note. Q4 is on track for $19 billion in revenue, and the semiconductor giant is hoping to rake in $71.2 billion over the course of the year. Intel’s stock is currently trading 4.46% up following the call.