What Tim Cook left out about China in Apple's revenue guidance

Within just two months, China, the world’s largest smartphone market, has turned from a growth driver to a weak spot for Apple.

“Our business in China was very strong last quarter,” Apple CEO Tim Cook told investors on November 1, citing 16% growth. “iPhone, in particular, was very strong double-digit growth there. Our other products category was even stronger than the overall company number.”

But the uptick didn’t continue. In a letter Wednesday announcing a cut in its fiscal first quarter 2019 guidance, Cook said the revenue shortfall is due to lower than anticipated iPhone revenue, which primarily happened in Greater China. Blaming mostly macro headwinds, he failed to admit the launch of new iPhones haven’t successfully lured consumers and acknowledge growing competition from domestic players.

“Most of our revenue shortfall to our guidance, and over 100% of our year-over-year worldwide revenue decline occurred in Greater China across iPhone, Mac and iPad,” Cook wrote. The company also sees the traffic to retail stores and partner sellers in China declining in the quarter.

Apple attributes disappointing sales to the slowdown of China’s economy. “We did not foresee the magnitude of the economic deceleration, particularly in Greater China,” Cook wrote. In the third quarter, China reported a GDP growth of 6.5%, the weakest since 2009. Trade tensions between Beijing and Washington have also intensified with tit-for-tat tariffs. With iPhone’s production lines in China, Apple has been caught in between the world’s two largest economies.

Consumers are more likely to curb spending on big-ticket items during economic downturns, and there are worries over “consumption downgrade” in China. In an interview with CNBC on Wednesday, Cook said less subsidies from carriers also caused people to buy fewer iPhones, although he acknowledged it “didn’t all happen yesterday.”

Those reasons don’t fully explain iPhones’ declining market share in China, especially in a quarter when it released new models, which used to be welcomed by Chinese consumers with much fanfare. Apple said the smartphone market in China has been contracting, and that’s true. China’s smartphone market has been down 6% year-over-year in the third quarter of 2018 and is expected to drop by 3% in the fourth quarter of 2018, according to IDC.

Apple rivals are still growing

But the decline didn’t start in the second half of the year, when Apple reported a problem in iPhone sales. In China, there were less than 100 million smartphone shipments in the first three months, and the second quarter saw a 5.9% year-over-year decline.

Still, some local players managed to grow against the trend and they may be eating into Apple’s market share. In the third quarter, Huawei’s premium line, Honor, grew by 14% year-over-year while sales volume of VIVO was up by 2%, data from Counterpoint Research shows.

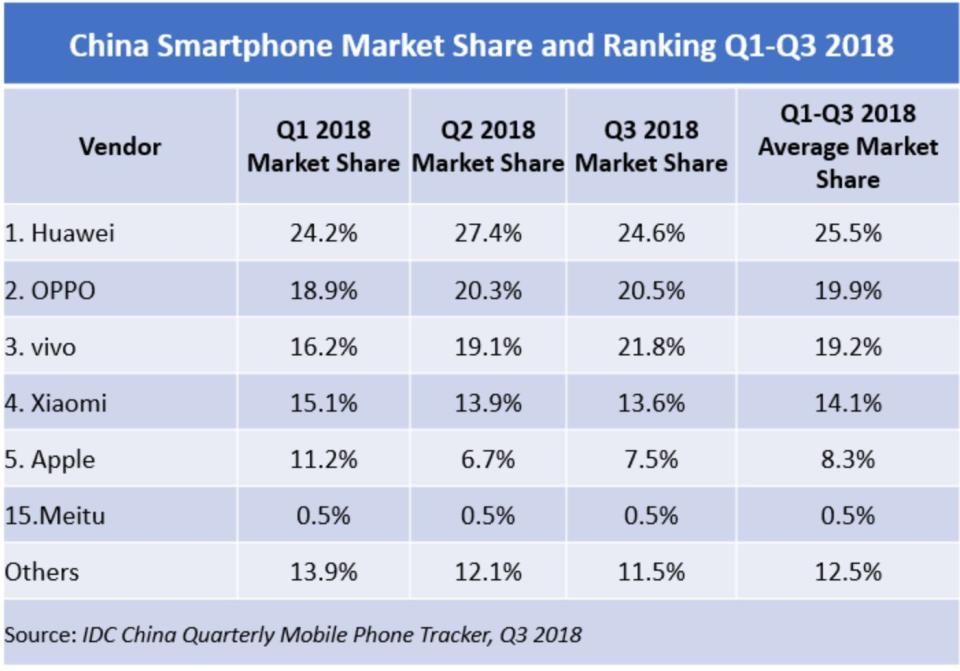

One thing Cook didn’t mention in his letter is Apple’s declining market share in China and the rise of domestic rivals like Huawei and Oppo. Apple’s market share has dropped to 7.5% in the third quarter from 11.2% in the first quarter, while Huawei has been in the lead with an average market share of 25.5%, according to IDC.

Analysts see iPhone’s high price point and lack of major updates as the major reasons for the Chinese market’s lukewarm reaction to its new iPhone releases. “A lack of clear innovation in product design and functionalities compared to its predecessors and the high prices dampened the purchasing passion of Chinese consumers for the iPhone XS series,” Flora Tang, an analyst at Counterpoint Research, wrote in November. Counterpoint reported iPhone sales dropped by 17% year-over-year during the third quarter due to the weak initial performance of the new models.

Krystal Hu covers technology and trade for Yahoo Finance. Follow her on Twitter.

Read more:

Chinese companies flooded into the U.S. IPO market in 2018

Amazon got over $42 million worth of free publicity from its HQ2 search

Shares of these U.S. suppliers are getting slammed in the wake of the Huawei arrest