Apple has been fighting gravity for years, and it’s starting to lose the battle.

The iPhone is by far Apple’s most important product, accounting for nearly two-thirds of the company’s sales last year. But iPhone sales have flatlined since 2015, frustrating the millions of investors in one of the market’s most widely held stocks.

Apple CEO Tim Cook has a plan: Bump up the iPhone’s price and sell customers services and other devices, like Apple Music and the Apple Watch, to go with them. Cook’s strategy has paid off. Apple set sales and profit records a year ago, and it eclipsed a $1 trillion market valuation in August.

But gravity is starting to win. In November, the company rattled investors when it decided to stop breaking out iPhone sales — not exactly a sign of strength. On Wednesday, Apple (AAPL) warned that it would miss its sales target for the previous quarter, mainly because of weak iPhone demand in China.

Apple’s stock has fallen 36% since October 3. By last week, Apple had fallen behind Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL) in market value. Apple has lost $500 billion in market value over the past three months.

It’s not time to panic: Apple remains a healthy company and could survive on inertia alone for years. Despite its revised outlook, Apple still expects to report $84 billion in quarterly sales. That’s a ton of money: That single quarter would be enough to rank No. 33 in last year’s Fortune 500.

Still, it’s lower than last year’s holiday quarter, and investors demand growth. If Apple wants to grow again, it’s time for a new plan.

Apple’s innovator’s dilemma

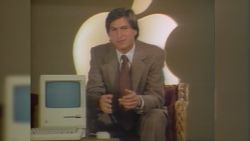

Cook’s predecessor, the late Steve Jobs, was a product genius. He knew what consumers wanted before most knew they wanted it. During his second stint as Apple CEO, from 1997 to 2011, he oversaw the revitalization of Macintosh, the music-industry-altering iPod and the world-changing iPhone.

When Jobs died in 2011, skeptics believed the company’s unprecedented run of success would quickly end.

Cook, Jobs’ top lieutenant, was an operations guru, building Apple’s network of partners into the world’s most respected supply chain. He was an expert at maximizing the company’s efficiency, but there was only so much blood he could squeeze from the stone before Apple would need another big product, critics argued.

The skeptics were wrong. Cook has done a masterful job extracting every last penny out of the iPhone money-printing machine that Steve Jobs created. A year ago, Apple reported a record $88.3 billion in quarterly sales, and it generated $20.1 billion in profit — the best quarterly earnings of any American company in history. Apple has $237 billion in cash, more than the annual economic output of many medium-sized European nations.

But after Jobs died, Apple failed to deliver a groundbreaking innovation that came close to matching the iPhone’s success. The Apple Watch is the most successful new product Cook’s team devised. It is selling relatively well, but it’s such a small business that Apple didn’t bother breaking out Watch sales (even in those heady days when Apple used to break out segment revenue). Data tracker IDC estimates Apple sold about 20 million watches last year.

Apple has been accused of lacking innovation for most of the Cook era. The company’s frustrated marketing chief Phil Schiller famously exclaimed, “Can’t innovate anymore, my ass!” when introducing the new Mac Pro in 2013. Ironically, Apple still sells the same, now-very-outdated Mac Pro five years later. The MacBook Air had gone four years without an update until October, and the iPhone 8 was essentially the same phone (with improved guts) as the iPhone 6, 6S and 7.

“You’re not going to pluck a Steve Jobs out of a genie jar,” said Laura DiDio, tech industry analyst at ITIC. “Apple needed to make some moves.”

Lacking a “next big thing,” Cook went with the next best thing: He banked on the iPhone’s continued success.

Trouble with the iPhone

Despite dozens of successful smartphone competitors, Apple’s iPhone remains a runaway hit.

But iPhone sales have stagnated — Apple sold fewer iPhones in each of the past three years than it sold in 2015, when Apple debuted the iPhone 6. If iPhone sales fell last quarter, they will have dropped in six of the past 12 quarters.

A spokesman for Apple declined to comment.

The problem isn’t unique to Apple. The entire smartphone market has shrunk in each of the past four quarters, according to IDC.

“China isn’t the full picture,” said Nigel Vaz, emerging markets and Asia-Pacific CEO of Publicis, a digital consultancy. “The mobile market is maturing, and customers can no longer be relied upon to upgrade every time a new iPhone is released.”

Apple has few places left from which it can extract growth. The Chinese market is shrinking because of a slowing economy, and other developed markets are reaching saturation.

“There’s some weakness outside of China as well,” Cook admitted in an interview with CNBC on Wednesday. “I would have liked to have done better in some of our developed markets.”

India is an obvious growth market, with 900 million people still without smartphones. That’s a lot of potential iPhone customers. Yet Apple refuses to price the iPhone for the Indian market, yielding market share — and mind share — to low-cost phone makers including Samsung, Oppo and Xiaomi.

To make up for flat sales, Apple has raised the price of the iPhone. Last year, Apple introduced the iPhone X, the first dramatic change to the iPhone since the iPhone 6. It came with a significantly heftier price tag: $999. That was $300 more expensive than the iPhone 8. The iPhone XS Max starts at $1,099.

The pricing experiment has been an astounding success: IPhone revenue was up 18% last year despite flat unit sales.

But Apple can’t hike prices forever. At some point, customers are going to reach their limit and will refuse to pony up so much money for iPhones. Alternatively, customers will keep their older iPhones longer or buy year-old or two-year-old iPhones that Apple sells at a discount.

That’s already happening in China, which Cook blamed on a souring macroeconomic environment. Evidence suggests it’s starting to happen in the United States, too. The average selling price of an iPhone soared 23% last year, turning off some potential customers, said Gene Munster, Apple analyst with Loop Ventures, in a blog post last week.

“The price hike did not take,” Munster said. “IPhone demand was not as price-elastic as Apple imagined.”

But in other markets, Cook blamed “Apple-specific” problems that the company can control. “We’re not going to sit around waiting for the macro to change,” Cook told CNBC. “We’re going to focus really deeply on the things we can control.”

The items Apple can control, Cook said, were services — part two of his master plan to grow without a big new product.

The services solution … and problem

To make up for the innovation stagnation, Cook & Co. went all-in on the company’s services business, which includes the App Store, Apple Music, Apple Pay and iCloud. It started selling Apple Care insurance as a part of a package that let people buy new iPhones every year. And Apple opened its own studio, developing exclusive content for its products, including “Carpool Karaoke” and a “Shark Tank”-like show called “Planet of the Apps” starring Gwyneth Paltrow.

In his interview with CNBC Wednesday, Cook pointed out that Apple hit sales records for each of its various services. He also said Apple started a trade-in program, which helps people reduce the purchase price of new iPhones.

Services and Apple’s products-not-named-the-iPhone, Mac or iPad are the company’s fastest-growing businesses. Services grew 24% last year, and “other” products, including the Apple Watch, Apple TV and HomePod, grew 35%. But those two business units combined only made up one fifth of Apple’s total sales.

Apple is famous for its “walled garden” approach to software, for the most part limiting its software and services to customers who buy its hardware. To maintain its services momentum, Apple is loosening up its restrictions on who can use them. Apple announced in November that Apple Music would become available on Amazon’s Echo speakers. And Sunday, Samsung said it will put an iTunes app on its smart TVs.

But services can’t keep growing in a straight line forever. Apple is dealing with some high-profile defections, including Netflix (NFLX), which recently dealt Apple a blow by refusing to allow new customers to sign up for the service on the App Store, preventing Apple from collecting those lucrative commissions. And China’s crackdown on video games is a huge threat to Apple. China represents 40% of Apple’s App Store revenue — 90% of which is from video game sales, according to Macquarie Capital.

Even if those challenges weren’t present, services just isn’t a big enough business to offset the slowdown in iPhone sales.

“Just as investors hang on to services as Apple’s life preserver in the choppy seas, it is going to float away,” said Benjamin Schachter, analyst at Macquarie Capital.

Without a “next big thing,” Apple will continue to rely on the iPhone as its cash cow. But when your cash cow stops growing, you’re in trouble.

The Microsoft answer

Apple’s iPhone dilemma is similar to the situation Microsoft found itself in earlier in the decade.

Generating the bulk of its sales from Windows and Office, Microsoft was loathe to disrupt its money-making machine. Microsoft notoriously killed off a tablet device that would have beaten Apple’s iPad to the market by years. The reason: It didn’t run Windows.

CEO Steve Ballmer wanted to protect the legacy of his predecessor, the legendary Bill Gates. But the handwriting was on the wall: The PC boom was over, and customers weren’t buying new computers every few years the way they had in the past.

Ballmer, a career salesman and — much like Cook — an operations expert, had a decision to make: Continue focusing most of Microsoft’s resources on a slowly sinking ship or invest in growth areas to change the company’s direction.

Ballmer chose neither. He directed Microsoft to buy Nokia’s cell phone business for nearly $8 billion in 2013, hoping to leverage Nokia’s huge customer base to make Windows as prevalent on smartphones as it was on PCs. The bet was a tremendous failure.

Microsoft was super late to the smartphone game. App makers didn’t want to develop for Windows Phone. Android and iPhone customers weren’t interested in switching. Microsoft wrote down virtually the entire value of its purchase two years later.

Frustrated with a stock price that had languished for more than a decade, Microsoft asked Ballmer to step aside. In 2014, it promoted Satya Nadella, head of Microsoft’s nascent cloud division, to run the company.

Nadella took Microsoft in a different direction. He started giving Windows away for free, providing customers with smartphone-like updates twice a year. He made Office available — also for free — on the iPad. And he shifted Microsoft’s focus to the cloud.

Five years later, Microsoft passed Apple to become the most valuable company on the stock market. It is neck-and-neck with Amazon for cloud superiority, powering everything from corporate email servers to Pixar movies.

The next big thing

The key difference between Microsoft and Apple is Microsoft was a diverse business even when it was focused mainly on its consumer products. It took a decade, but Microsoft’s bet on the cloud fully materialized.

Apple, on the other hand, is almost exclusively a consumer business. Its three main products — iPhones, Macs and iPads — make up 80% of Apple’s sales. So what product can Apple develop to snap it out of its growth funk?

Apple has taken some big swings at self-driving cars. It swiped talent from Tesla (TSLA) and put a few dozen test cars on the roads in California. While Apple lags behind Alphabet’s Waymo, Uber and some carmakers, there is plenty of room for competition to develop a promising technology that could revolutionize transportation for the world.

Notably, Apple wasn’t the first company to develop smartphones, tablets or music players — it just made them better than anyone else. It could try to replicate that feat in the self-driving car space.

It also has an opportunity to expand its push into the enterprise space. Corporate computing remains a Windows-based world, but iPads, iPhones and Macs are slowly becoming welcomed by IT departments as Apple enhances its security and IT protocols.

Apple partnered with IBM (IBM) in 2014 to help Apple make headway selling to corporations. In May, the companies announced that the partnership will include machine learning technologies. IPhones installed with IBM’s Watson app will allow repair shops, for example, to point an iPhone camera at a broken piece of equipment, and the iPhone will determine what and how the item should be fixed. That kind of technology could open up Apple’s products to new customers.

So could price-cutting. Apple is wildly profitable, but it has resisted cutting its prices to go after cost-conscious customers. That’s a Steve Jobs legacy: Jobs wanted Apple’s products to scream luxury. If Apple products remained out of reach for some consumers, Jobs saw that as a good thing — iPhones became status symbols.

“It’s unrealistic to expect a new iPhone-like innovation every year,” said DiDio. “Apple may need to eat some humble pie for a while. I’m not saying they’ll turn into Dell, but they may have to cut prices.”

In the meantime, the next big thing for Apple could be the same thing — just at a lower price. If it’s seeking growth, one way to do that is address a new market.

Apple is obviously in no imminent danger of collapse. But the tech graveyard is filled with tombstones of former technology giants that failed to innovate: AOL, Yahoo, Gateway, Nokia…

Tim Cook could continue to successfully lead Apple for some time. He has done a phenomenal job leading the company. But unless he has a new plan to grow the company, his winning streak may be cut short.