Alphabet tops Q4 estimates but declines to give Google Cloud run rate

Alphabet published its fourth quarter fiscal 2018 financial results on Monday, beating market expectations. Google Cloud continues to be "one of the fastest growing businesses across Alphabet," Alphabet and Google CFO Ruth Porat said on a conference call Monday. However, Google executives declined to share figures that could shed more light on Google Cloud's run rate.

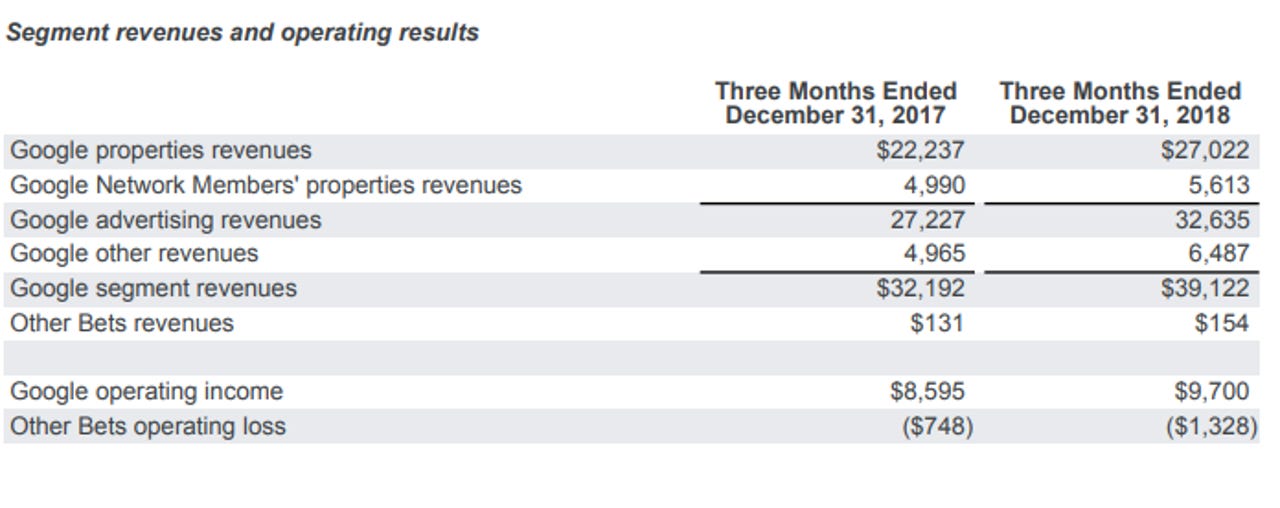

For Q4 2018, Alphabet earnings came to $12.77 per diluted share on revenue of $39.3 billion, up 22 percent.

Wall Street was looking for earnings of $10.86 per share on revenue of $38.98 billion. Despite the beat, shares fell in after-hours trading when the tech giant reported growing losses in its "other bets" category. The category includes Waymo, Alphabet's self-driving car company.

For the full fiscal year, Alphabet reported an EPS of $43.70 on revenue of $136.8 billion, up 23 percent year-over-year.

The vast majority of Alphabet's revenues came from Google. Specifically, Google revenue from advertising came to $32.64 billion in the fourth quarter. Google's "Other" revenues -- which includes non-advertising sales in areas like cloud services and hardware -- totaled $6.49 billion. Alphabet's moonshot "Other bets" category brought in $154 million in sales. Yet the "Other bets" operating losses increased from $748 million in Q4 2017 to $1.33 billion in Q4 2018.

Within the "Other" category of Google, "Cloud does continue to deliver sizable revenue growth driven by GCP," Porat said on Monday's call.

While declining to give a run rate, Porat and Google CEO Sundar Pichai shared other financial milestones Google Cloud reached in fiscal 2018. For intance, in 2018, Google doubled the number of Google Cloud Platform contracts greater than $1 million.

"Were also seeing a nice uptick in the number of deals that are greater than $100 million and really pleased with the success and penetration there," Porat said.

Google in 2018 also more than doubled the number of multi-year GCP contracts signed. The company also ended the year with more than 5 million paying G Suite customers.

"Our focus on helping customers digitally transform their businesses is paying off," Google CEO Sundar Pichai said on the call. "We continue to see strong growth in all our major geographies and industries this quarter."

While Google shared several Cloud milestones, it's unclear how the cloud computing business stacks up against competitors. Last week, Chinese e-commerce giant Alibaba said its cloud computing business saw revenue jump 84 percent in its December quarter to $962 million. That gives it a revenue run rate approaching $4 billion.

Still, Pichai stressed that after three years under the leadership of former Google Cloud chief Diane Greene, Google Cloud's product offerings are now "ready and differentiated." Greene was recently replaced by longtime Oracle executive Thomas Kurian, and the two executives worked closely together to ensure a smooth transition and plot out the year ahead.

"On Cloud, one of the things that was evident towards end of last year is now our ability to win very large customers, Global 5000 companies with multi-year contracts," Pichai said. "And so that's definitely something we want to focus on."

Google Cloud plans to invest in and scale its go-to-market, both in terms of direct sales and channel partnerships, he said. From a go-to-market standpoint, Google Cloud plans to focus on key areas in which Google has a clearly defined product with differentiated features, Pichai said. That includes infrastructure, data management and smart analytics, and productivity and collaboration.

These areas of investment are reflected in Alphabet's headcount, which was 98,771 at the end of the quarter. In Q4, Porat said, the most sizable headcount increases were in Google Cloud, for both technical and sales roles.