Should Apple Investors Believe Tim Cook's Promise of Innovation?

Apple (NASDAQ: AAPL) recently hosted its annual stockholder meeting, during which Tim Cook, who has served as the company's CEO since 2011, offered some encouraging words about the company's future product and services pipeline.

Here's the relevant excerpt from Bloomberg's report of the shareholder meeting:

Apple Inc. Chief Executive Officer Tim Cook said he has "never been more optimistic" about where the company is today and where it's heading. In a pep talk to investors, Cook said the iPhone maker is "planting seeds" and "rolling the dice" on future products that will just "blow you away."

So if you're an Apple shareholder or you're thinking of becoming one, you might ask yourself the following: Should I believe Tim Cook's claims?

Image source: Apple.

There's strong evidence to suggest that you should.

Apple's massive investments

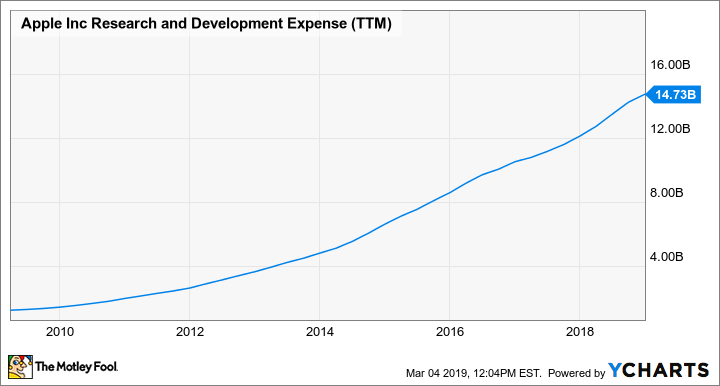

Apple is one of the biggest spenders on research and development (R&D) in the world of technology. Over the last 12 months, the company's R&D spending came in at nearly $15 billion.

AAPL Research and Development Expense (TTM) data by YCharts.

For the current quarter, Apple guided to operating expenses of between $8.5 billion and $8.6 billion, up from $7.53 billion in the same quarter a year earlier. Operating expenses incorporate R&D as well as sales, marketing, and administrative costs, but it's a safe bet that R&D spending will be up.

Now, the sheer magnitude of R&D investments might not necessarily be enough to conclude that Apple has stuff cooking that will "blow you away" -- after all, a pessimist might simply chalk that up to inefficiencies within the organization -- but Apple has shown that this spending yields new products and technologies.

As an example, Apple's in-house chip prowess has grown dramatically over the years, with the company not only building its own best-in-class mobile applications processors but also venturing into other components like power-management chips and wireless chips.

We also saw Apple acquire 3D-sensing specialist PrimeSense many years back and make the requisite investments to transform that technology into the TrueDepth camera that's found on Apple's latest iPhones. Apple is also likely investing heavily to evolve that technology for many generations to come.

Bloomberg also reported a while back that Apple is working to eliminate its dependence on third-party display technology manufacturers and is exploring cutting-edge display technologies, like microLEDs.

Beyond the iPhone, Apple has released multiple successful new product lines including the Apple Watch -- which dominates the smartwatch market -- as well as its AirPods wireless earbuds, which continue to grow at an impressive clip.

Investor takeaway

The point of this discussion is to make clear that while Apple is by no means perfect, the company has been dutifully boosting its investments in R&D -- it's very clearly not resting on its laurels. That commitment to increased R&D spending, coupled with the fact that we've seen a lot of interesting stuff come out of Apple's R&D pipeline over the years, makes me inclined to take Tim Cook at his word.

More From The Motley Fool

Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.