Apple Makes Yet Another High-Profile Artificial Intelligence Hire

Perhaps the hottest term in all of technology is "artificial intelligence," or AI. It seems that just about every tech company is looking to both leverage and heavily market their moves in the space in a bid to build better products and excitement among consumers. Apple (NASDAQ: AAPL) is one company that seems to be doubling down on its efforts in AI.

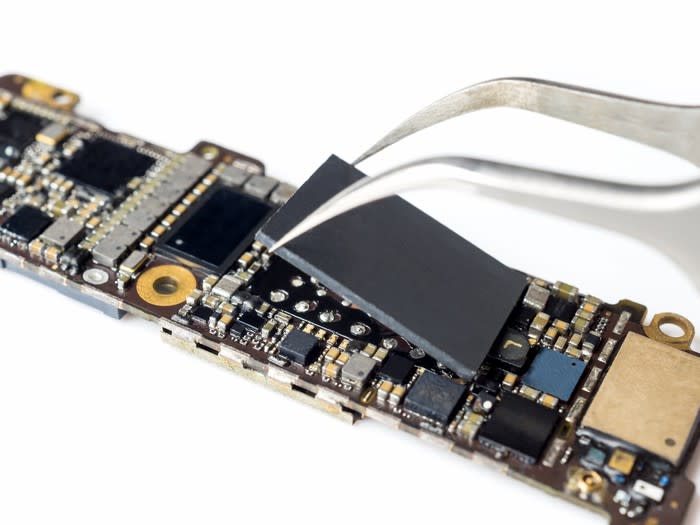

Apple's products are already being increasingly infused with AI smarts. With the A11 Bionic chip that it introduced in late 2017, the company integrated a dedicated piece of hardware known as the Apple Neural Engine to accelerate some machine learning computations. Arguably the biggest generation-over-generation improvement in the subsequent A12 Bionic chip was the more than eightfold boost in the performance of the Neural Engine.

Image source: Getty Images.

But the Apple AI story isn't just about hardware -- it's about the people that the company is bringing aboard to strengthen its AI efforts. Apple hired John Giannandrea, a top AI expert from Alphabet, to serve as VP of the company's machine learning and AI strategy last year (and, to underscore his importance, he was recently promoted to senior vice president).

And now, Apple seems to have made yet another high-profile AI hire, scooping up Ian Goodfellow, previously a senior staff researcher at Alphabet's Google, to serve as "Director of Machine Learning in the Special Projects Group."

Here's why this is a positive sign for Apple's artificial intelligence efforts.

It's all about the people

It might be tempting to think that Apple simply lured someone like Goodfellow away by offering him a significant pay raise. That may well have been the case, but the reality is that Alphabet is known for compensating its software engineers extremely well. On top of that, if you look at the reviews of Google on, say, indeed.com, it becomes clear that the company is generally regarded as a great place to work, receiving an average of 4.3 stars out of 5 across 2,902 reviews.

What Apple's ability to lure top AI talent tells me is that the company is working on projects that are sufficiently interesting to excite that talent. Apple's hiring of Giannandrea and putting him in a significant position of power within the company is also a clear signal to prospective employees that Apple isn't just dabbling in AI -- it's making a serious long-term commitment to the field.

You might also have noticed that Apple has even been regularly publishing articles related to its machine learning research on its website, known as the Apple Machine Learning Journal. The company is even making itself known at major AI conferences, announcing on its Apple Machine Learning Journal web page that it planned to attend the 32nd Conference on Neural Information Processing Systems, and even going so far as to say that it would "have a booth staffed with Machine Learning experts from across Apple who would love to chat with you ."

Apple is a notoriously secretive company, so the fact that it's publishing research and hosting booths at major AI conferences tells you just how far it's willing to go to attract and retain top AI researchers and engineers.

What this means for Apple investors

Ultimately, Apple is going to need to be at the forefront of AI technology to ensure that its products and technologies are competitive, as AI will be used for everything from enhancing its current iOS products to making a serious push into the smart-home market. The fact that Apple continues to grab some of the best talent in AI is an encouraging sign that, in the years ahead, should translate into a strong position with respect to AI-infused hardware, software, and services.

More From The Motley Fool

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), and Apple. The Motley Fool has the following options: short January 2020 $155 calls on Apple and long January 2020 $150 calls on Apple. The Motley Fool has a disclosure policy.