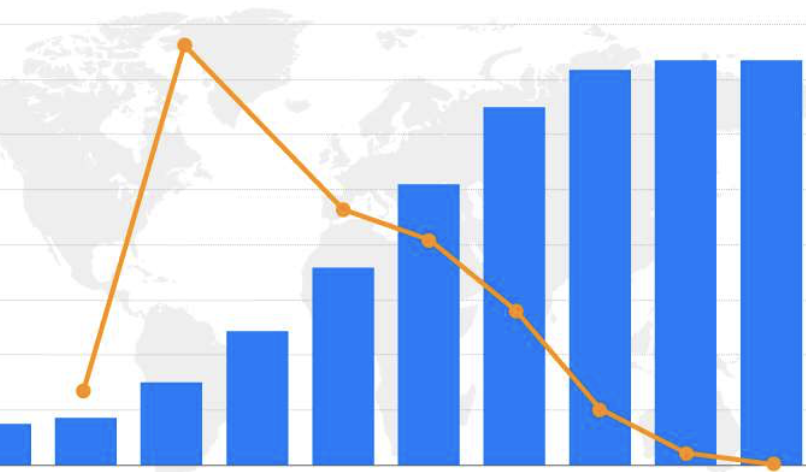

The smartphone market had a tough 2018, and my early discussions with IDC’s supply-side team suggest that in the first quarter of 2019 things went from bad to worse, especially for some of the market leaders. This data point adds some additional context as to why we’ve seen some industry-shaking decisions made by the two market-leaders—Samsung and Apple— in the space of the last few weeks.

More Shipment Declines

At IDC we’re still in the early stages of gathering shipment data for the first quarter, and we won’t announce the preliminary numbers for another week. That said, our initial discussions suggest that the market saw some rather dramatic volume declines year over year. It appears market leaders Samsung and Apple each took a major hit, while the Chinese vendors—lead by Huawei—fared notably better. I talked about the success of Huawei, OPPO, Vivo, and Xiaomi earlier this year.

Despite its own set of well-documented challenges, Huawei continues its aggressive push to grab market share around the world. If the company’s momentum holds, it should easily move into the number two spot worldwide ahead of Apple this year, and there’s a very strong chance it could challenge Samsung at number one. In addition to increasing its overall number of smartphone shipments, Huawei has also methodically increased its volume of higher-priced, more profitable smartphones.

While Huawei remains locked out of the all-important U.S. carrier market, protecting market leaders Apple and Samsung from its incursion here, its ascension everywhere else should be keeping those companies’ executives up at night. I think this threat, combined with the rapid deceleration of the smartphone market due to extending lifecycles, forced both Samsung and Apple into making some tough choices that could significantly impact the long-term prospects for both.

Samsung’s Galaxy Fold Debacle

I’ve not had the opportunity to test the new Samsung Galaxy Fold, so I’ll withhold any comments on the viability of the product for now (although people whose opinion I trust were surely impressed by it). However, the fact that a few tech reviewers ran into serious hardware issues with early versions of the device (some self-inflicted, others not), makes it hard to see this as anything but a serious misstep from Samsung.

The question is, did the company rush the product into production? Did it do so simply to be first to market, or was it something else? There have been smart; pragmatic takes on how Samsung ended up where it did with the Fold. My take: Even though the company spent many years developing the display technology that makes the Fold possible, it did rush the final product out. If it wasn’t rushed, the implications are even more dire for the company’s product creation process. After all, it had already experienced the public relations disaster associated with exploding batteries in the Samsung Galaxy Note, and one would expect it not to repeat a similar mistake. In the end, I believe Samsung was desperate to get the Fold into the market to bolster its reputation as an innovative company and to create a strong counter-narrative to its slumping smartphone shipments.

Unfortunately, these screen issues have likely damaged the company’s ability to sell this first-generation product. It has been suggested the launch delay won’t be a long one, but if that’s the case, any fix would seem to be stop-gap at best. A design that was years in the making, that is fundamentally flawed, can’t be corrected in weeks. Samsung’s saving grace may turn out to be that it never intended to ship high volumes of the product. Samsung has shown in the past the ability to bounce back from issues such as this, but one wonders how many strikes the company will get. The bigger question is whether these issues will have a long-lasting impact on the broader category of foldables.

Apple and Qualcomm

There’s already been a great deal written about Apple and Qualcomm settling their dispute over royalties and licensing and the end of litigation between the companies. This move has already had industry-shaking ramifications, not the least of which was Intel’s decision to exit the 5G smartphone modem space (although it is up for debate which decision came first). I’d suggest, however, that Apple’s ultimate decision to settle with Qualcomm was also driven by the challenging place it finds itself in with regards to 2019 iPhone volumes. Early indications suggest Apple had a bad first quarter, and the outlook for the rest of the year isn’t great, either.

Apple won’t have a 5G iPhone ready in 2019, as up until a few weeks ago it was depending exclusively on Intel’s 2020 launch of a 5G modem. Worse yet, it seemed Intel was in real danger of failing to bring that product to market on time. Looking down the barrel of a very tough 2019 and faced with real possibility it wouldn’t be able to field a 5G product on time next year Apple made the only decision it could and settled with Qualcomm. It is hard to imagine Apple making that deal if iPhone shipments were still growing (or even if they were flat). Difficult times require tough decisions.

Bottom line, both Samsung and Apple’s decisions will have wide-ranging impacts on not just the companies themselves, but the broader smartphone industry as well. Has Samsung mortally wounded the foldable category, or only delayed its inevitability? Has Apple’s Qualcomm settlement cemented the latter’s dominant position in the industry, at least for the next few years? It will be interesting to see how both decisions, and their ultimate ramifications, play out over the course of the next few years.

Pretty! This has been a really wonderful post. Many thanks for providing these details.

For the reason that the admin of this site is working no uncertainty very quickly it will be renowned due to its quality contents.