US stocks edge up to new highs on earnings beats, consumer spending

US stocks advanced to new highs Monday as Wall Street investors digested better-than-expected first quarter earnings and a rise in consumer spending.

The benchmark S&P 500 and Nasdaq indexes both hit new records Monday, but the Dow remained the laggard. Financial stocks led the gains in the S&P 500, climbing 1.2 percent with Citigroup and Bank of America among the best performers.

Alphabet, the parent of Google, reports after the closing bell on Monday. Five Dow Jones Industrial Average components and 164 companies or about a third of the S&P 500 index companies issue results this week. Through the end of last week, 46 percent of S&P500 companies have reported for the quarter and 77 percent have beaten estimates that were revised down late last year.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 38239.66 | +153.86 | +0.40% |

| SP500 | S&P 500 | 5099.96 | +51.54 | +1.02% |

| I:COMP | NASDAQ COMPOSITE INDEX | 15927.900321 | +316.14 | +2.03% |

Dow component Disney rallied to a new all-time high during the session after record ticket sales for “Avengers: Endgame”. The latest Marvel super-hero movie broke box office records with a $350 million opening weekend in North America and $1.2 billion worldwide.

Andarko Petroleum was up Monday after it said it intends to resume talks with Occidental Petroleum after its bid for the company topped a deal with Chevron announced last week.

Boeing remains an investor concern also after reports that the planemaker failed to tell Southwest Airlines when the company began flying 737 Max jets in 2017 that a safety feature designed to warn pilots about malfunctioning sensors had been deactivated. Boeing's Max fleet remains grounded worldwide after two fatal crashes earlier this year.

Tesla stock firmed after the electric automaker on Monday said it could decide to explore new financing sources, according to a filing with the Securities and Exchange Commission (SEC).

Spotify reported revenue and subscriber growth that beat Wall Street estimates with its premium service netting 100 million subscribers.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GOOGL | ALPHABET INC. | 171.95 | +15.95 | +10.22% |

| DIS | THE WALT DISNEY CO. | 112.73 | -0.04 | -0.04% |

| BA | THE BOEING CO. | 167.22 | +0.41 | +0.25% |

| APC | n.a. | n.a. | n.a. | n.a. |

| TSLA | TESLA INC. | 168.29 | -1.89 | -1.11% |

U.S. consumer spending recovered in March, the Commerce Department reported early Monday, while the Federal Reserve’s preferred underlying inflation gauge slipped to a one-year low.

Consumer spending rose 0.9 percent for the month, up from a gain of only 0.1 percent in February. Personal income rose 0.1 percent in March, less than forecast.

The Federal Reserve meets this week but with inflation below 2.0 percent policy makers on Wednesday are expected to hold interest rates steady.

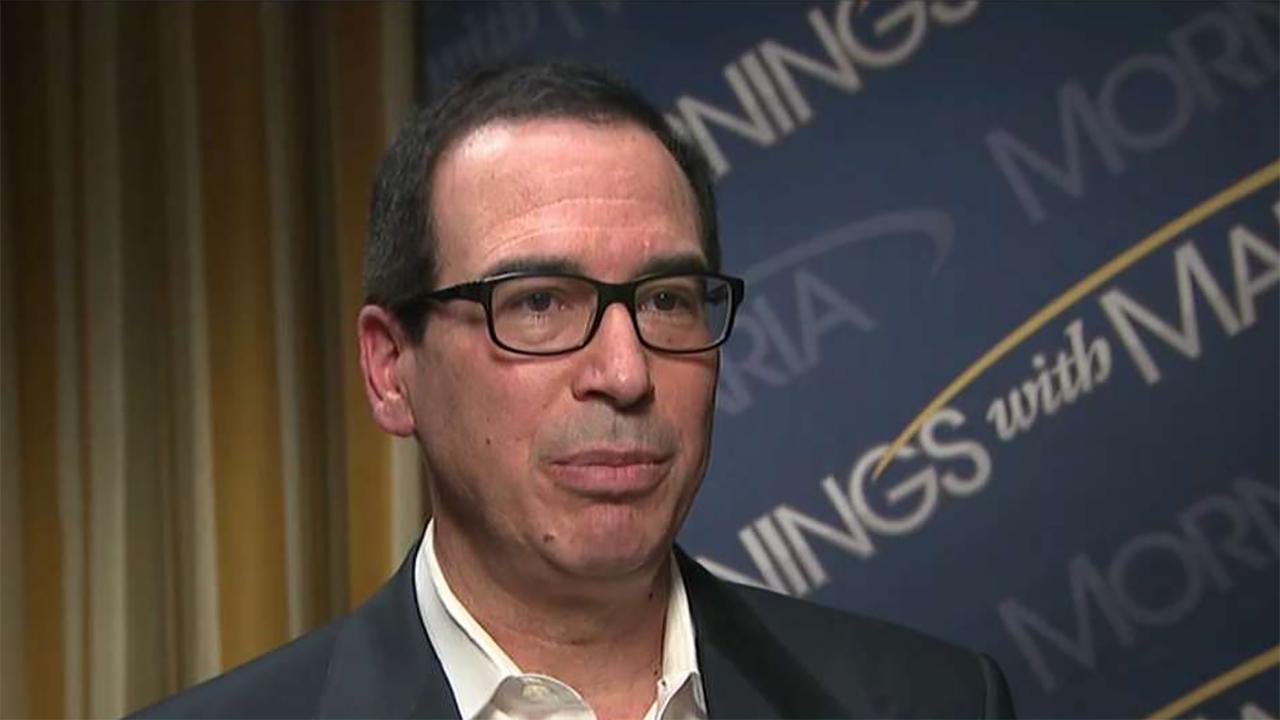

Investors are also watching for developments in trade talks between the U.S. and China. U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin are expected to meet Chinese Vice Premier Liu He on Tuesday.

Meanwhile, President Donald Trump’s attempt to revamp North America’s trade rules is hitting a roadblock in Washington, with Democrats and labor groups demanding changes that dim the chances of ratifying a new agreement with Canada and Mexico before next year’s presidential election.

Treasury yields rose supporting the U.S. dollar against major currencies after it hit a 22 month high last week.

Crude oil prices steadied after falling back from six month highs seen last week. President Trump had called for lower prices, even though the administration moved last week to restrict Iran's oil exports further. Exxon and Chevron both reported higher oil production figures last week.

CLICK HERE TO GET THE FOX BUSINESS APP