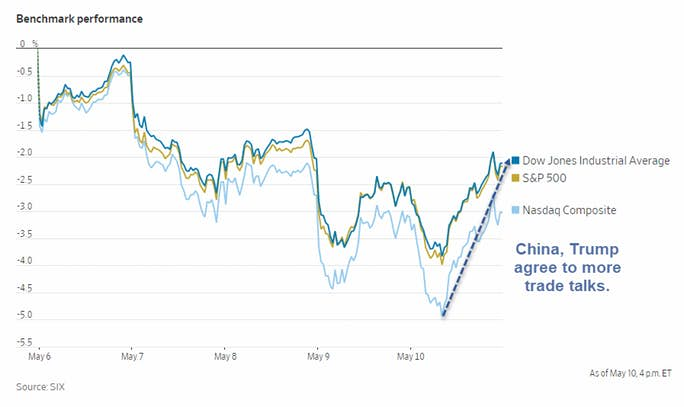

Stocks staged an afternoon rally reversing early losses after China and Trump agreed to more talks.

Stocks reversed course on Friday but are down for the week following a series of absurd Tweets by president Trump on trade policy.

The Wall Street Journal reports Stocks Bounce Back, Close Higher as Investors Weigh New Tariffs.

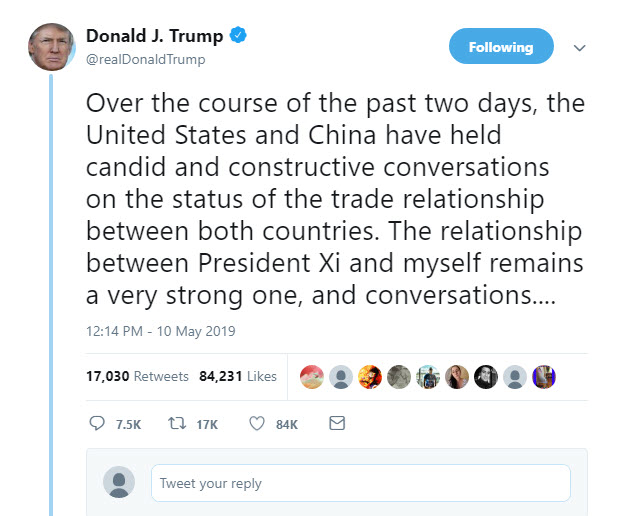

Stocks slid to start the day, sending the Dow Jones Industrial Average down nearly 360 points, before rebounding in the afternoon. The rally came after Treasury Secretary Steven Mnuchin told CNBC the most recent trade talks were “constructive” and President Trump tweeted that tariffs “may or may not be removed” depending on future negotiations.

Blowing With the Stock Market

Trump's position on trade talks blows with the performance of the stock market. By Friday, Trump had had enough of the stock market declines, so the message of the Tweets was less aggressive.

Apple (AAPL) In Trade Crosshairs Again

With Trump's latest threats Apple (NASDAQ:AAPL) and the iPhone Near Trade Crosshairs Again.

The round of tariff increases that hit Friday don’t directly affect iPhones, iPads, Macs or Apple Watches. But President Trump this week threatened a tariff of 25% on $325 billion in Chinese imports that haven’t previously been targeted by duties. Those would cover virtually all Chinese exports to the U.S., including Apple’s most important devices.

“Build your products in the United States and there are NO TARIFFS!” Mr. Trump said Friday on Twitter.

Apple has faced minimal impact from previous tariffs on about $200 billion in Chinese goods, which covered electronic circuit boards, computer chips, chemicals and other parts. However, the iPhone maker is among the companies most exposed to future tariffs because it assembles almost all of its products in China. Tariffs could add to gadget prices or cut into profits by forcing Apple to absorb the additional costs.

“If Trump actually goes the last round, they’re in big trouble,” Mary Lovely, an economist at Syracuse University, said of the iPhone maker. She said a host of other consumer-facing products would face the same fate, including apparel and electronics.

Shares of Apple fell 7% this week, as trade concerns mounted. They finished Friday at $197.18

iPhone sales sank 16% in the first half of its fiscal year. Many iPhone owners are holding on to existing devices, turned off by higher prices and less interested in new features.

In the U.S., a tariff of 25% on a Chinese-made iPhone XS could exacerbate that problem by adding about $160 in costs to the $999 device, according to Morgan Stanley (NYSE:MS). Apple could either pass that cost on to consumers—potentially causing people to hold off on buying new iPhones—or absorb it, reducing its per-share earnings by 23% in fiscal year 2020, the firm estimates.

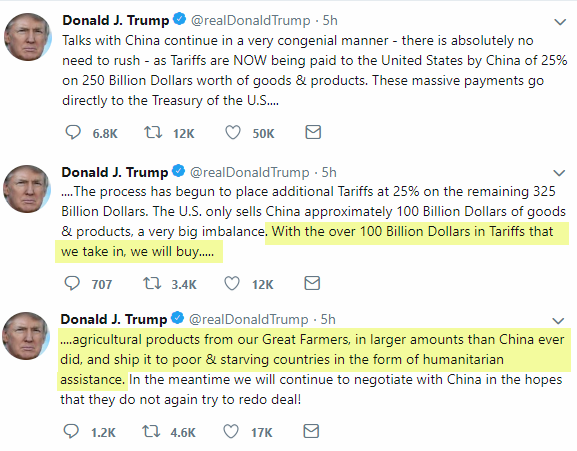

Money Left Over

Beyond Idiotic

Trump says he will use those tariffs to buy more soybeans and feed the world's poor with money left over.