Stocks pop on Cisco, Walmart earnings as trade fears fade

U.S. stocks rallied on Thursday, for the third straight session, after solid quarterly results from Walmart, Cisco and amid an easing of fears that ongoing trade wars won’t be as severe as investors had feared.

All three of the major market averages rising just under 1 percent as the Dow Jones Industrials gained 214 points, the S&P 500 25 points and the Nasdaq Composite over 75 points.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 38675.68 | +450.02 | +1.18% |

| SP500 | S&P 500 | 5127.79 | +63.59 | +1.26% |

| I:COMP | NASDAQ COMPOSITE INDEX | 16156.328018 | +315.37 | +1.99% |

The world’s largest retailer topped profit estimates for the first quarter as same-store sales grew at a pace not seen in nearly a decade and the retail giant's e-commerce business continued to expand at a double-digit percentage rate.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WMT | WALMART INC. | 59.82 | +0.11 | +0.18% |

However what pleased Wall Street was comments from the retail giant on tariffs, signaling any costs will be passed along to consumers.

“Increased tariffs will lead to increased prices for our customers,” Walmart CFO Brett Biggs said during a conference call, noting that the company is “going to continue to do everything we can to keep prices low.”

In the world of tech, networking giant Cisco also rallied after profits and sales beat analyst expectations. As for the company's exposure to China, CFO Kelly Kramer, on the company's earnings call, said that while the company still has exposure to the region, it has "greatly reduced our exposure working with our supply chain and our suppliers."

On trade, President Trump signed an executive order on Wednesday that allows the Commerce Department to ban foreign telecom gear that poses a national security risk to the technology infrastructure of the U.S. The Commerce Department specifically named Huawei as a company that potentially undermines U.S. national security.

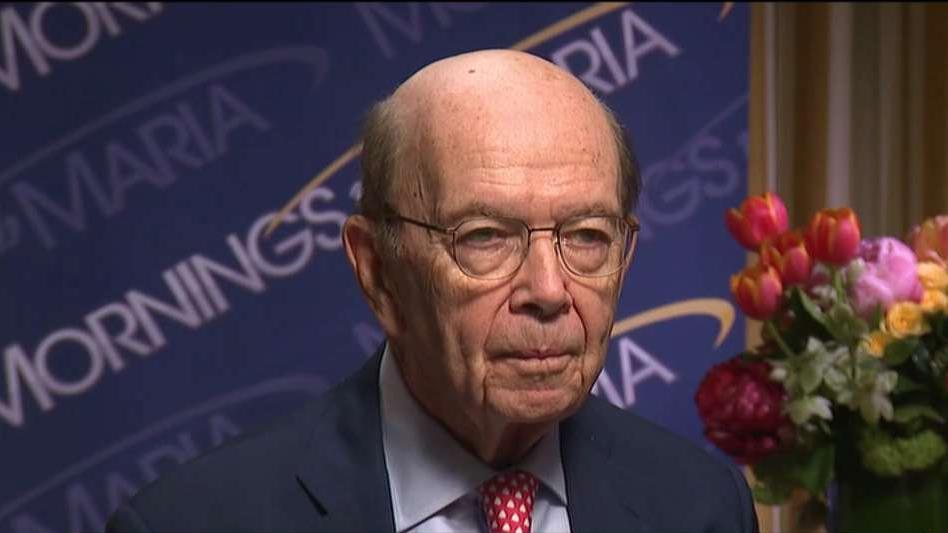

Thursday, Commerce Secretary Wilbur Ross told FOX Business, “U.S. technology will not be used in a way that’s adverse,” he said during an interview with Maria Bartiromo. Ross said Huawei's technology also poses a risk to the development of 5G.

CLICK HERE TO GET THE FOX BUSINESS APP

Chipmakers reversed early losses.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| INTC | INTEL CORP. | 30.90 | +0.39 | +1.28% |

| NVDA | NVIDIA CORP. | 887.83 | +29.66 | +3.46% |

Ross also indicated that the White House is still deciding whether to move forward with tariffs on European automakers and a final decision could come by May 18.

In other investor news, Berkshire Hathaway revealed the size of its stake in Amazon in a regulatory filing on Wednesday, weeks after Warren Buffett touted the e-commerce giant and its CEO, Jeff Bezos. Buffett’s firm held 483,300 shares in Amazon worth $860.6 million as of the end of its most recent quarter on March 31, according to the 13F filing. At current stock prices, the stake is worth more than $900 million.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 186.24 | +1.51 | +0.82% |

In commodities, oil prices nudged higher for both Brent, the worldwide benchmark, now trading around $72 per barrel and WTI, which tracks domestic prices, hovering around $62 and change.