What to expect from Apple's Q3 2019 earnings report on Tuesday

Apple's June-quarter financial results will be published on Tuesday, and the iPhone maker's performance will be discussed at length by analysts. Here's what industry observers currently expect Apple will reveal in the filing and the ensuing analyst conference call.

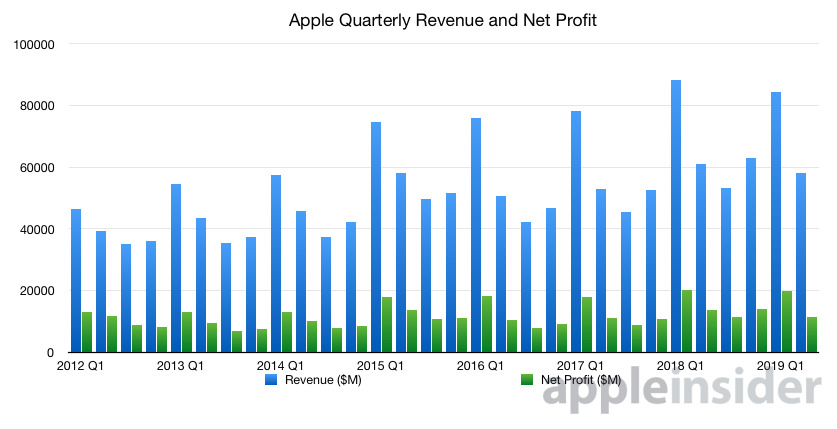

Going into the third quarter results, Apple's forecast for the three month period ending in June, as provided in its second quarter results, is that it will achieve revenue of between $52.5 billion and $54.5 billion. The gross margin is expected to be between 37% and 38% in the period, while operating expenses are tipped to be somewhere between $8.7 billion and $8.8 billion.

These expectations are relatively similar to the results seen one year previously, where the Q3 2018 results revealed revenue of $53.3 billion, operating expenses of $7.8 billion, and a gross margin percentage of 38.34%. It remains to be seen if the upcoming results will again reveal a record-setting June quarter, but it looks like it could be a close race.

Apple launched quite a few products in the quarter which may make an impact on revenue. In March, it launched new models of the iPad Air and iPad Mini, followed by updated iMacs and second-generation AirPods, with all potentially having an effect across the entire period.

Less of an effect will be felt by the updated MacBook Pro and iPod Touch, which were revealed in the second half of May.

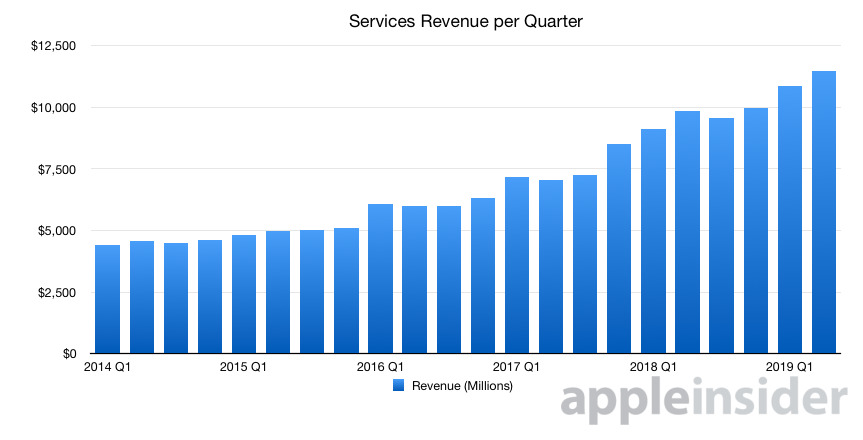

There is also the question of how much of an impact Apple News+ will make. While the subscription option launched in March to a US audience, meaning it was available for the entire quarter, the limited launch may mean it will help enable the Services business to continue growth, but without making a major splash.

AppleInsider will offer full coverage of the earnings call on Tuesday July 30, starting at 2 p.m. Pacific, 5 p.m. Eastern.

Macquarie

Apple's remainder of 2019 won't be one of hardware changes, but more one of services, analysts at Macquarie suggest, with an anticipated "lacklustre year for iPhone" meaning investors will be more focused on the 5G-equipped 2020 iPhone than the 2019 refresh. For Services, the firm is concerned about the criticism Apple has over its 30% App Store commission, while the introduction of subscriptions like Apple Music and Apple News+, as well as upcoming launches of Apple Arcade and Apple TV+, will not "have the impact to outweigh" more established revenue drivers.

We think any of the more near-term hardware trends may be outweighed by the focus on the 2020 iPhone, similar to the anticipation leading up to the iPhone 10 in 2017," the firm wrote

Macquarie's latest investor note put Apple's revenue at $54.2 billion, the higher end of estimates, with an earnings per share of $2.08. At the time, the analysts reiterated their "Neutral" rating for Apple's stock, as well as the 12-month price target of $190.

Morgan Stanley

Prior to the earnings report, Apple is viewed as an attractive purchase due to low Wall Street estimates, Morgan Stanley believes. "Unusually negative" investor sentiment for the upcoming September quarter, as well as a persistent undervaluing of Apple's Services, suggest investors may be lowballing Apple's stock, resulting in results potentially looking far better than shareholders may expect.

The forecast suggests Apple has shipped 37 million iPhones in the quarter, down 10% year-on-year, resulting in a 11% decrease in iPhone revenue to $26.2 billion.

Even so, the "positive bias" by the analysts has led to Morgan Stanley raising their price target from $231 to $247, but it still rates the shares as "Overweight." The firm's forecast rose up to $53.8 billion for the June quarter, up 1% year-on-year.

Cowen and Company

Cowen also detected the poor investor sentiment, describing talks with investors over the last few as being "overwhelmingly skewed towards the bearish side" due to a lack of iPhone innovation, as well as smartphone sales starting to taper out and Services being a longer-term story. "The concerns are absolutely fair, but nothing new," analysts suggest.

This has also led Cowen to be bullish on the stock, as Apple "needs to convince investors on the Services opportunity as it transforms its business." The "all-in" nature of original content production for Apple TV+ means Cowen hopes Apple will offer more insight into its strategy, as well as that of pricing for both Apple TV+ and Apple Arcade.

For the June quarter, Cowen thinks Apple will report "broadly in line" with its forecast, with revenue estimated at $53.5 billion and an earnings per share of $2.10.

Raymond James

The 2019 iPhone cycle will be the "weakest in years," predicts Raymond James, with the 2020 iPhone likely to be a far bigger revenue driver than this year's crop of devices. The analysts suggest it may not necessarily be the right time for investors to buy ahead of a quarter with such a perceived "weakness."

This didn't stop Raymond James from setting a price target of $250.

Alliance Bernstein

Apple's outlook for 2020 is "arguably more uncertain than in prior years, given that Apple will be launching several major new Services, questions about the trajectory of replacement cycles remain, and rumors about next year's iPhones appear less than definitive," suggest Alliance. There is worry that the "consensus estimates in Q3 and Q4 may be aggressive," given a deceleration of installed base growth and "tough comps in Licensing and AppleCare."

On the iPhone upgrade cycle itself, the 2019 lineup is said to be "largely identical" to the 2018 versions. The similarities "suggest to us the risk of another relatively muted product cycle."

While Alliance has a "Market Perform" rating for Apple, the price target for the company's shares is set at $190.

JP Morgan

There is a "higher level of investor interest" relative to the recent history for this earnings report, claims JP Morgan, but with it is a "low bar for expectations." There is however a "potential upside" for investors for the fourth quarter, based on the firm's own supply chain checking and analysis of supplier revenue trends, which both point to "abating headwinds" relative to iPhone shipments.

Services will see "tough growth" this quarter of 13% year-on-year, but with a reacceleration incoming for the launch of Apple's other services.

JP Morgan believes Apple will earn $53.5 billion in revenue, slightly higher than the firm's own consensus calculation of $53.3 billion, with earnings per share of $2.13. For iPhone sales, it is estimated Apple has shipped 37.5 million, while the analysts' consensus puts it at 41.3 million for the quarter.

Rated as "Overweight," JP Morgan has a price target for AAPL of $239 by December 2019.

Loup Ventures

The quarter will be "representative of the balance of 2019," with overall business flat to down 2% year-on-year, with iPhone revenue down 12% and Services up 15% or more, writes Loup Ventures' Gene Munster. Investors are thought to have "written off" the 2019 iPhone, with Greater China revenue also declining 11%.

The firm continues its belief that Wall Street undervalues the Apple ecosystem by focusing on hardware sales instead of revenue and earnings growth by other means. "We believe Apple has become a staple in about a billion peoples' lives and expect over time Apple should receive more credit for the durable and sticky ecosystem it has built," Munster suggests.

For the quarter, Loup Ventures expects revenue in line with consensus of $53.4 billion and an EPS of $2.10. For guidance the high end of the September quarter outlook "should be in line with the Street's $61.0 billion estimate," with Apple expected to hit the high end of its guidance range.

Thomson Reuters

Rather than being an estimate by the company's own analysts, Thomson Reuters is a calculated average based on the estimates of multiple analysts. While it does temper the opinions of those going high or low, there is usually a sufficient enough number to give a decent view of what "Wall Street" is expecting.

For the quarter ending June 2019, a collection of 32 analysts provide a mean average of $53.7 billion, with the range going from a high of $54.2 billion to a low of $52 billion. This is down from the estimate of last year, which had a mean of $55.1 billion.

On the earnings per share, the group of 36 analysts' mean average figure is $2.10, with a high of $2.20 and a low of $1.79. This is also down from last year, which was estimated at $2.43.

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

Amber Neely

Amber Neely

13 Comments

I'm hoping for the upside. Says a stockholder.

The fact there’s estimates ranging from $190 to 250 is all the evidence needed to understand that the analyst community should be simply ignored. Buy for the long term and ignore the fluctuations. Pay attention to the long-term business prospects and fundamentals. With Apple as with any business.