Editorial: As Apple plays the telephone game, analysts hear something else entirely

When Apple entered the smartphone market in 2007, it didn't do so to lose money making most of the world's smartphones as a public service. All these years later, a shocking number of analysts and reporters still seem to be confused about this.

Jobs depiction of potential iPhone market share

In introducing the original iPhone at the beginning of 2007, Steve Jobs noted that the market for mobile phones was "just about a billion last year," and that "we're going to go for it and see if we can get 1 percent market share, 10 million units in 2008, and go from there."

Note that Jobs didn't aim to get a 1% share of "smartphones," but rather all mobile phones. At the time, these were mostly basic Nokia models that did little more than make calls. Jobs ambitiously intended to sell 10 million iPhones in its first full year, but it's curious why he described this as such a small fragment of the mobile market rather than being a pretty significant slice of comparable smartphones priced anywhere close to the original $499 price of iPhone. Apple had just sold around 40 million iPods in 2006, but iPods were far cheaper on average than the new iPhone.

Jobs was defining first-year success in two ways: both with a milestone number of 10 million units, and as a very tiny slice of the very large, total addressable market for global mobile phones. Ten million iPhones at $499 more or more would generate over $5 billion in its first-year revenues at a substantial profit margin. It didn't matter that this number was "only" 1% of all the phones sold in the world. That should tell you something about market share numbers today.

At the same time, Jobs was also making it clear how much growth potential Apple had in mobile phones: 10 million units would be only a tiny fragment of the overall mobile market. And at the same time, he was also making it clear that Apple didn't need to dominate share numbers for "all phones sold" to create a massive and very successful business for iPhone.

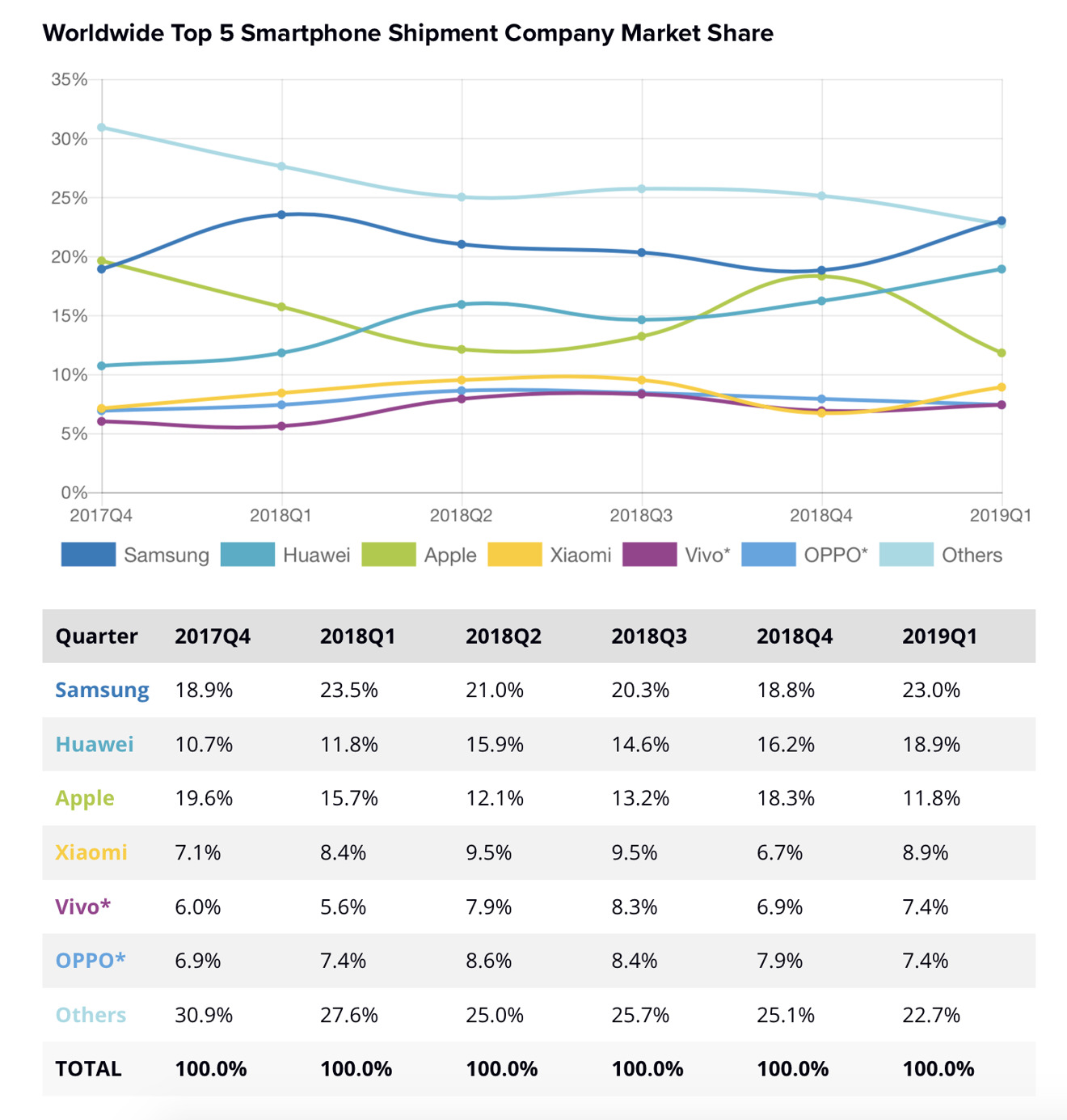

Now more than a decade later, Apple is selling around 30-40 million iPhones just in its relatively slow Q3. Market research companies like IDC have reported over the last couple years that Apple has captured somewhere between 10 and 20 percent of all smartphone units shipped per quarter. These numbers swing around so wildly that they are nearly meaningless.

IDC's number factory of billowing noxious smoke

What are iPhones being compared to by IDC? Not "all mobile phones" sold, as Jobs did back in 2007. IDC compares its estimates of how many smartphones each major vendor dumps into the global market per quarter. Yet these statistics are so meaningless that they provide no real insight into what is actually happening.

And quite clearly, IDC's guestimate numbers are often embarrassingly incorrect — stupefyingly wrong figures that get crammed into precisely calculated percentages of "change" and "market share" that mean really absolutely nothing. IDC's chart below doesn't provide any clarity into the individual or relative performance of the world's top smartphone makers over the past couple years. You'd need to read the caption to know that these rollercoaster lines depict nearly random fractions of an industry that declined overall by 5.6 percent across the period of the chart.

They are not informative figures. They are distractions from reality. What did it mean when IDC said Apple sold the greatest segment of smartphone market share (19.6%) during the last quarter of 2017, beating out Samsung and nearly doubling the volumes sold by Huawei, but then six months later was in third place with a sales unit figure close to half that of Samsung?

Does it mean Apple is suddenly in trouble? No, it doesn't say anything about Apple's performance as a company, or the relative ability of Apple to compete or innovate or attract buyers compared to Samsung and Huawei. Apple's highly cyclical sales of high-end iPhones were being compared against much more consistent volumes of low-end Androids being sold to completely different audiences. It's like comparing holiday spirits sales to the price of tea in China.

Using its own numbers, IDC couldn't even predict a wining platform for smartphones. IDC concluded that Windows Mobile would quickly come out ahead, then predicted Windows would win in tablets. Its numbers, time and again, are just low-value noise that blind insight and confuse future trends, and not something that helps anyone understand what's going on in the industry.

IDC's smartphone numbers as absolutely brain-fogging as when IDC claimed Xiaomi was "about tied" with Apple in wearables because it was producing volumes of $12 bands that were being sold at clearance sales during the same quarter that Apple was selling $350 and up watches that built up an installed base capable of attracting mobile app developers and enterprise development.

It's not informative how many low end knockoffs Androids ship

For iPhone— as was the case with Macs, iPods, and iPads— what's important is whether Apple can continue to find a sufficiently large audience of buyers willing to pay enough to drive the continued development of new features, new operating system advancement, and the development of new software content and related ecosystems.

In the 1990s, there was a period where it wasn't clear whether Apple could continue to sell enough Macs to maintain all of those things. Yet over the last two decades, Apple has been able to increase its Mac shipments to support the continued development of competitive Mac notebooks; it has remained competitive in macOS development, and it has attracted new software development to the Mac.

That success helped to launch generations of iPod and the iTunes Music store. Macs and iPods enabled the launch of iPhone and the App Store, and that in turn enabled the launch of iPad and tablet-optimized App Store titles. That success has set up Apple to launch Apple Watch and then AirPods. Apple is now cross-pollinating with initiatives including Sidecar for using iPad along with new Macs, developments like SwiftUI for reusing code across Apple's platforms, and Project Catalyst for migrating iPad apps to a native form optimized for the macOS Catalina desktop.

These developments have been steadily progressing across two decades now, with mobile and tablet devices erupting mostly over the last ten years. No figures about the high volumes of Nokia, Blackberry, Motorola, Xaiomi, Samsung, or Huawei devices have ever had any real impact on Apple's ability to execute in building out new form factors, new development platforms, and new accessory and app ecosystems. What really mattered was the critical mass of sales driving Apple's development engines.

Apple is a high volume innovator in and beyond phones. Google and Microsoft are not.

The comparative percentage of the $700+ iPhones Apple sells at the same time that Android producers are cranking out sub-$300 phones for developing markets is not material. What is material is the scale that Apple is operating at, and how that changes what the company can accomplish as a high volume innovator.

This important reality was highlighted in Apple's last earnings call, where Tim Cook noted that "Apple is alone in offering this kind of value and ecosystem to its customers. And these devices and their platforms are unmatched in their ease-of-use, their seamlessness and their privacy and security."

Specifically, Cook had been discussing Apple's expansion into wearables that required approval from government regulators. Like mobile phones in 2007 or tablets in 2010, this is a new business for Apple that requires developing new capabilities. The only thing more interesting than Apple's ability to successfully march into this field is the fact that nobody else is really trying to do this.

"In the June quarter," Cook noted, "we expanded the availability of the [Apple Watch] ECG app and a regular rhythm notifications to five additional European countries and added Canada and Singapore just last week, making them available in 31 countries and regions around the world, with more to come later this year. We're very proud of the muscle we've built in bringing regulated products like these to market. This is an important competency that creates exciting opportunities for us moving forward."

In particular, Apple is "alone in offering this kind of value and ecosystem" in comparison to the world's two other major platform vendors: Google and Microsoft. While media sycophants love to give Google the adoration of a beauty pageant queen for having given away its knockoff of iOS for free to China, Google has squandered its last decade of copycat work. Its efforts to sell tablets went nowhere, the Android Wear initiative is an absolute joke, its me-too effort at copying AirPods was pointless, and it has nothing comparable to Apple Watch helping it to gain important competencies in the approval of future health-related wearables.

What Google does have is a major investment in Pixel silicon related to camera imaging, a huge expenditure it has not recouped in its flaccid attempts to collect anything more than the applause of shills for its terrible-selling Pixel phones. Pixel is such an absolute shit-show that across three years, it has only sold about as many units as iPhone did it its first year. Yet rather than being incredibly profitable and paving the way for future advances in smartphones, Pixel has done nothing but burn Google's extra cash to ashes.

Google's Pixel also tried to launch web-based notebooks, netbooks, and tablets, all of which were total failures. And across all of its years, Google has learned very little about building sales partnerships, erecting successful retail ventures, or creating ecosystems supporting original software and accessories— despite vacuous promises that there was someday going to be a way to unlock the IA, ML, and advanced imaging potential of Pixel silicon.

Microsoft similarly invested major efforts in launching new Surface RT netbooks running a touch-version of Windows to audiences who soundly rejected that concept. It then tried to salvage a decade of work in Windows Mobile phones, even stooping to pay developers to write apps for its mobile platform. It casually tossed out an exercise Band, and then designed a series of Surface computer form factors that don't matter in any commercial respect whatsoever, apart from titillating bloggers who seem to think the tech industry exists to entertain them, rather than being a commercial enterprise that needs to generate a return on investment.

Apple vs the Conglomerates

That naturally leaves Apple "pitted" against two vast, nationalist conglomerates that have sought to enter the advanced, premium smartphone market Apple created: South Korea's Samsung and China's Huawei. Yet despite copying Apple's hardware designs and software behaviors and images right down to the icons, both companies have failed to duplicate Apple's model of high-end products that sell in high volumes.

Huawei has maintained that it is not run by China's communist party and doesn't get subsidized by state aid. But its executives also claimed to have an operating system that it could drop in to replace Android, a claim it later walked back as a made-up story so casually that even its fan sites were left with their jaws on the floor.

Huawei so flagrantly and casually lies about materially important things that it's hard to take anything the company claims as being factual and genuinely honest.

Over the past year, Huawei was making significant progress in Europe. But having lost its ability to obtain a license for Google's Android, it's now in a precarious position to launch its next flagship phone this summer. And since being put on the US Entity List in May, Huawei's sales have ended their growth spurt.

In Q2, Huawei sales remained flat despite the imposition of the trading ban only occurring half-way through the quarter. Increased sales within China were not enough to mitigate losses outside. Further, the sales ban that affects Android, ARM and many other critical components was not applied to currently shipping phones. Huawei's next phone will be directly hit by the restrictions.

Huawei smartphones Q2 sales were traditionally much more stronger than on Q1 (32.5% more on average).

— Alex B (@somospostpc) July 30, 2019

This year after Trump's veto it is 0%. That's quite the effect pic.twitter.com/x3dQlOePDA

Samsung spent most of the last decade working to build its Galaxy S brand into an iPhone alternative, but after hitting its peak in 2014, Samsung has increasingly flopped around with an increasingly lower end target of competing against emerging Chinese producers to reach high volume sales of low to middling mobile devices. While Samsung essentially invented the ultra-expensive oversize phone, it rapidly lost that market to Apple.

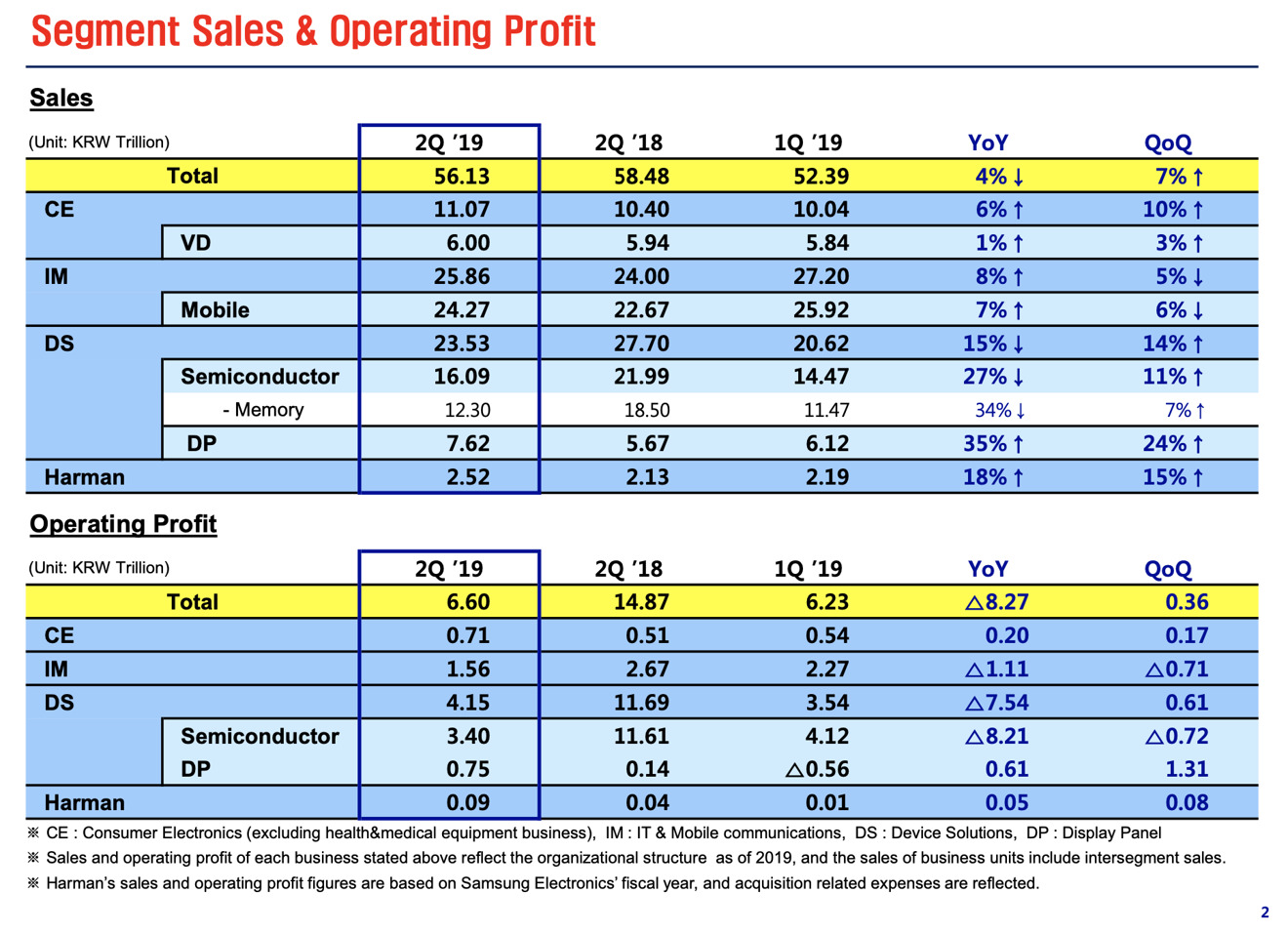

Samsung's Galaxy S9 and S10 have been selling so poorly that the company has been forced to refocus its strategy around A-series affordable phones priced around $300. This quarter, Apple's critics were desperately trying to make hay about a 13% drop in iPhone revenues and a nearly 8.5% drop in profits over the year-ago quarter to reach $11.5 billion in operating income. Yet Samsung's equivalent Mobile segment, despite an 8% increase in revenues reported a precipitous 41.6% collapse in operating profits in sales of its phones, tablets, and PCs. And Samsung Mobile only collectively earned $1.3 billion, just 11.3% of the profits Apple generated in the quarter.

Samsung explained its performance by stating that "overall smartphone shipments increased thanks to strong sales in the mid-range-and-below segment, but flagship sales were slow amid waning launch effects of a new model and sluggish demand in the premium market," adding that "profitability declined due to intensifying competition in the low-end to mid-range market and an increase in expenses aimed at clearing the inventory of older models."

Samsung has already found it impossibly difficult to keep pace with Apple in high-end silicon, software, and in proprietary innovations such as Face ID and the TrueDepth camera. Now that it is focusing on low to middle tier phones, keeping up with Apple will be all that much harder. Yet market research data factories ignore all of this to present Samsung as "winning" solely base on the number of phones it ships in a quarter.

Either they don't really know what's going on, or they don't want you to.

Daniel Eran Dilger

Daniel Eran Dilger

Malcolm Owen

Malcolm Owen

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Marko Zivkovic

Marko Zivkovic