Earlier this week, I managed to do something that’s generally been impossible in New York City: I didn’t take my wallet out for two days straight, and still managed to pay for food, get around, and live my life. I didn’t even have to try.

New York has traditionally been a city that runs on cash. I live in Brooklyn, and many of the local bodegas and cafés have long been cash-only. That’s been changing with the advent of companies like Square, which provide simple ways for even the smallest vendors to accept cards and contactless payments. The owner of the breakfast cart down the block from my apartment now has a Square reader on his phone: No more visits to an overpriced ATM just to get a bagel.

Recently, the city has been experimenting with contactless payment for the subway system, which, when it’s fully live, will catapult itself into the brave new world of… 2012. It’s currently available on a few lines and buses, none of which I usually take, but one day, I had a few meetings on that line, and paid for my fares with my wrist. It was magical.

I also used Apple Pay, Apple’s contactless payment technology, to pay for a few things at the pharmacy, and bought lunch through the Safari web browser on my phone. I hadn’t had to use a card, let alone cash, all day.

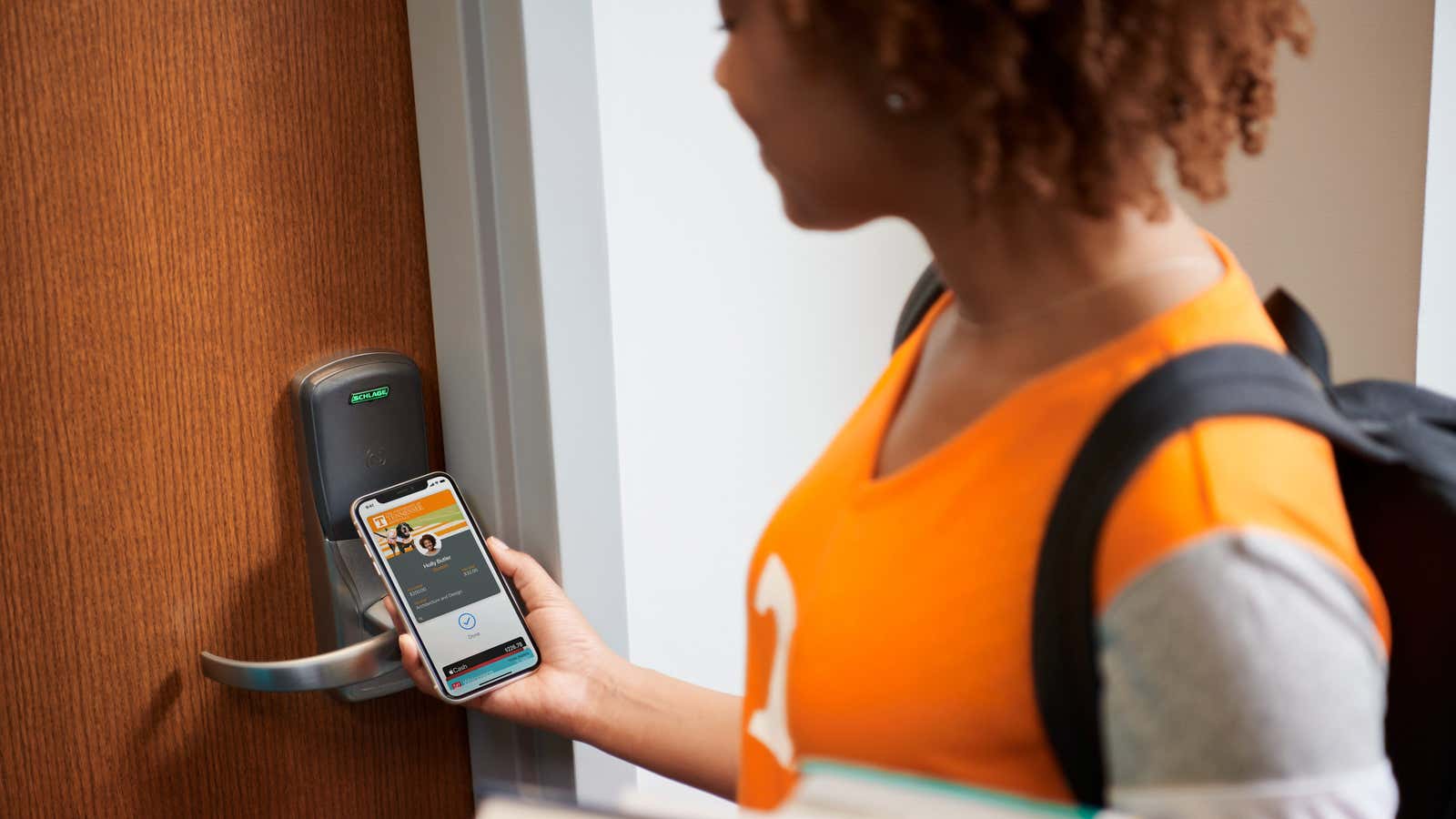

My experiences seem to be part of a growing trend led by Apple. The company recently announced a partnership with several US universities to bring student IDs to the iPhone. In the same way I can pay for a burrito or a subway ride by tapping my phone on a pad, students at universities including Duke (CEO Tim Cook’s alma mater), Clemson, Temple, and Johns Hopkins will now be able to enter dorms, school gyms, libraries, and buildings. They can also load up their ID cards with school meal plans. Theoretically, a student at one of these schools could get around for days without needing anything other than their iPhone.

Earlier this year, Apple also said it would be working with the MTA, New York’s transit authority, to bring contactless payments to the subway system. The early tests have reportedly been a success, recording the millionth payment way before the MTA expected. Although contactless payments have been around for years (the first Android device with contactless technology was released in 2010), it wasn’t until Apple took it seriously that one of the most outdated transit systems in the country took notice.

It’s a trend that seems to have replicated itself year after year with Apple. MP3 players had been around for many years before the iPod, but that device upended the music industry (along with iTunes); Apple didn’t produce the first touchscreen smartphone, but the iPhone spurred a mobile revolution. Even wireless charging, which has been standard on major Android devices for years, seemed to increase in prominence after Apple introduced compatible phones.

There’s something about Apple entering a market—which it is rarely the first to do—that tends to cause a tectonic shift. It could be, at least in the US, that Apple has around 40% of the smartphone market share, far more than any single smartphone producer. It could also be that Apple is such a massive, profit-generating company that others want to be in any industry it’s entering.

Which is why Apple seems uniquely positioned to kill off the wallet. It’s trying to kill off the credit card with Apple Pay and its own digital card. It’s already brought tickets, boarding passes, loyalty cards, and cash cards out of the wallet and into the phone. How much is left?

Outside of college in the real world, there are a few hurdles keeping the physical wallet in place. Most restaurants and businesses still prefer cash: Credit card companies charge transaction fees, and there’s obviously no records of cash payments, which some businesses may prefer. But if credit card companies and payment providers like Square can demonstrate how they improve the buying experience, perhaps even bringing in new customers, perhaps we’ll start to see more businesses jump on the contactless train.

Most people also still need to bring their IDs in the wallets when driving (or going out). Government-issued identification will probably be the most difficult thing in the wallet to digitize: In the US, states tend to move slowly, and they rely on generally archaic technology and data-management systems. As The Wall Street Journal’s Joanna Stern recently reported, there are a few states, such as Delaware and Louisiana, that are experimenting with digital ID cards. But it’ll likely be a few years before this technology is more widely accepted and understood by bouncers, store owners, and the average state trooper.

Which means Apple might actually be closer to killing off a different pocket pal: The keyring. Though most people don’t have wireless keycard access on their front doors or keyless entry on their cars, consumer preference could drive adoption of digital technologies a lot faster than governments adapt to them.

And the technology to digitize locks is becoming more commonplace. August, the smart-lock startup, was purchased by Assa Abloy, the largest lock maker in the world, in late 2017, and the company has slowly been seeding its technology into all of its parent company’s other subsidiaries. It likely won’t be long before August’s technology will be in many new doors, in both the home and the office, and increasingly retrofitted into existing structures when people realize they can forget their keys at home and still get in. Similarly, more and more car companies are offering keyless cars, where the driver just needs to have a key fob on them to open car doors and start the engine. Companies like Tesla, Ford, and GM are also experimenting with apps that communicate with their cars and unlock them.

Is this a good idea?

There really aren’t too many things holding back the digital wallet, and there are probably few other companies that would be able to pull off this change than Apple. But there are also a slew of ethical and security concerns to killing the physical wallet and keys.

Much of the technology in Apple’s ecosystem is not cheap. The lowest-cost Apple Watch starts at $279, and the cheapest iPhone (which is three years old) starts at $449. It’s great if students have the option to replace their cards with their iPhones, but not everyone attending college can afford these devices. These technologies are often available in lower-cost Android phones as well, but they’re still expensive devices.

There’s also the issue of what replacing cash with digital credit systems does to our society. It’s a lot easier for companies to skim tips away from workers accepting digital payments instead of cash. It’s considerably harder to help out marginalized members of society without cash. It’s also essentially a barrier to entry for anyone who doesn’t have or can’t get a bank account, and a tracking tool for governments, banks, and credit agencies for anyone who does.

On top of that, digital technologies like RFID (radio-frequency identification) and NFC (near-field communication), which enable many contactless systems, aren’t immune from hackers. There are literal step-by-step guides on how to copy keycards and key fobs online, and the contactless terminals the phones interact with are also susceptible.

Then there’s the very obvious problem: What happens to you if you need to pay for something, show someone your ID, or get into your building if your phone is dead?

It’s nice, on some level, to envision a future where all you need to remember when you go out of the house is your phone or watch, and Apple certainly seems to be ushering us into that vision. But whether we’ve thought through every possible outcome of that world, other whether we really need it (just put your keys in your bag, maybe?), is still up for debate.