Analysts impressed with Services & iPhone 11 pricing, less on iPhone 11 Pro

Analysts are weighing in on Tuesday's "It's Innovation Only" iPhone 11 launch event, with positive sentiment from industry watchers over the pricing of Apple TV+ and Apple Arcade accompanying the largely-expected iPhone upgrades.

JP Morgan - "Positive Surprises through Competitive Pricing"

It was a "largely positive" event for JP Morgan, led by Apple's lowering of pricing of the iPhone 11 relative to the iPhone XR, which "could act as [a] positive driver for volumes in [the] entry level premium smartphone segment," while maintaining the price of the Pro models. Specifications were "largely in-line" with expectations.

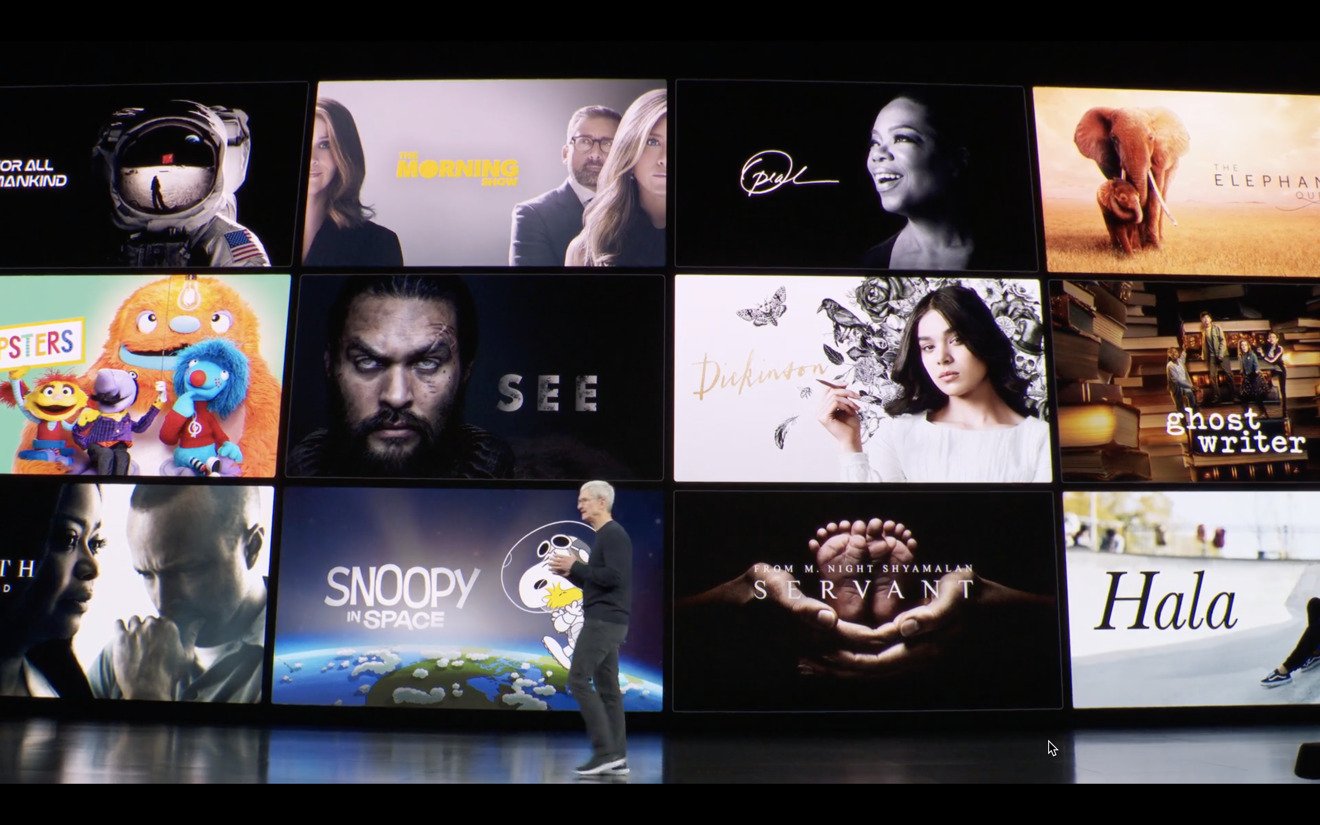

The other big point for the analysts was the favorable pricing for Apple TV+ and Apple Arcade. The Apple TV+ announcement "potentially surprised relative to expectations," as the $4.99 monthly fee is "quite attractive" compared to competing services, along with the offer of a free one-year subscription to new Apple device purchasers.

The Apple Watch Series 5 was a "mild disappointment," due to upgrades largely centering on the casing and display outside of software features previously announced at WWDC. The lowering of the Apple Watch Series 3 to a new starting price of $199 was seen as a better move, as "a strategic step to tap into the value segment."

Cowen - "One more thing, we like the pricing for TV+/Arcade"

The biggest elements of the event were not the iPhone launches, but those of Apple's services, according to Cowen. Heading up the investor note over what is supposed to be an iPhone event, Cowen suggests the $4.99 pricing for Apple TV+ and Apple Arcade is a "positive for driving incremental EPS growth in Services," with the Apple TV+ pricing "more attractive than expected" while the free year for hardware purchases introducing "new paradigms for catalyzing product demand."

The $4.99 price and 100 launch titles could make Apple Arcade "a more compelling offering than most (casual) gamers expect."

For the iPhones, the refresh was "largely in line with our expectations," with the lower iPhone 11 pricing a "positive for driving incremental demand." However, a $100 reduction for older models may cause consumers to "gravitate" towards earlier releases and away from the new launches.

The extra cameras on the back are actually a sign Apple is focusing more on "software refinement to improve photography," complete with a better user experience, low-light imaging, and the "future enablement of Deep Fusion."

Rosenblatt Securities - Cautious on iPhone 11, but iPhone XR still attractive

The launch of three new models at the same time, rather than splitting the group as in 2018, will "make Q3 shipments to Apple slightly stronger than seasonally normal," Rosenblatt suggests, though also believes this is already reflected in Apple's existing quarterly guidance. Estimates for shipments remain unchanged at 60 to 65 million units for the second half of 2019, but current production "may need to be trimmed after the initial launch."

Rosenblatt maintains its "cautious view on new iPhone sales," expecting challenges paired with "already low expectations." While the iPhone 11's price is lower than the iPhone XR's initial retail price, the XR is thought to continue to be more attractive based on its current retail price.

The Apple TV+ pricing is "competitive," but Rosenblatt doesn't have much faith it will make an impact immediately. "We believe this service will not bring meaningful upside in the near term," the analysts suggest.

On the subject of the September 1 tariffs, where there is a 15% fee on imports of AirPods, the Apple Watch, and iPads, this is thought to have led to Apple producing more of the products. "So far, there has been no impact on retail prices in the US," the firm observes, but warns to "expect AirPods, [Apple Watch], and tablet shipments to slow in Q4 from Q3."

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

Wesley Hilliard

Wesley Hilliard

Amber Neely

Amber Neely

William Gallagher

William Gallagher